- China

- /

- Electronic Equipment and Components

- /

- SHSE:688401

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets continue to experience gains, with key indices like the S&P 500 and Russell 2000 reaching record highs, investor sentiment remains buoyant despite geopolitical uncertainties and domestic policy shifts. In this environment, identifying high-growth tech stocks that can capitalize on robust market conditions involves looking for companies with innovative solutions and strong adaptability to evolving economic landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.51% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1282 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Shenzhen Newway Photomask Making (SHSE:688401)

Simply Wall St Growth Rating: ★★★★★☆

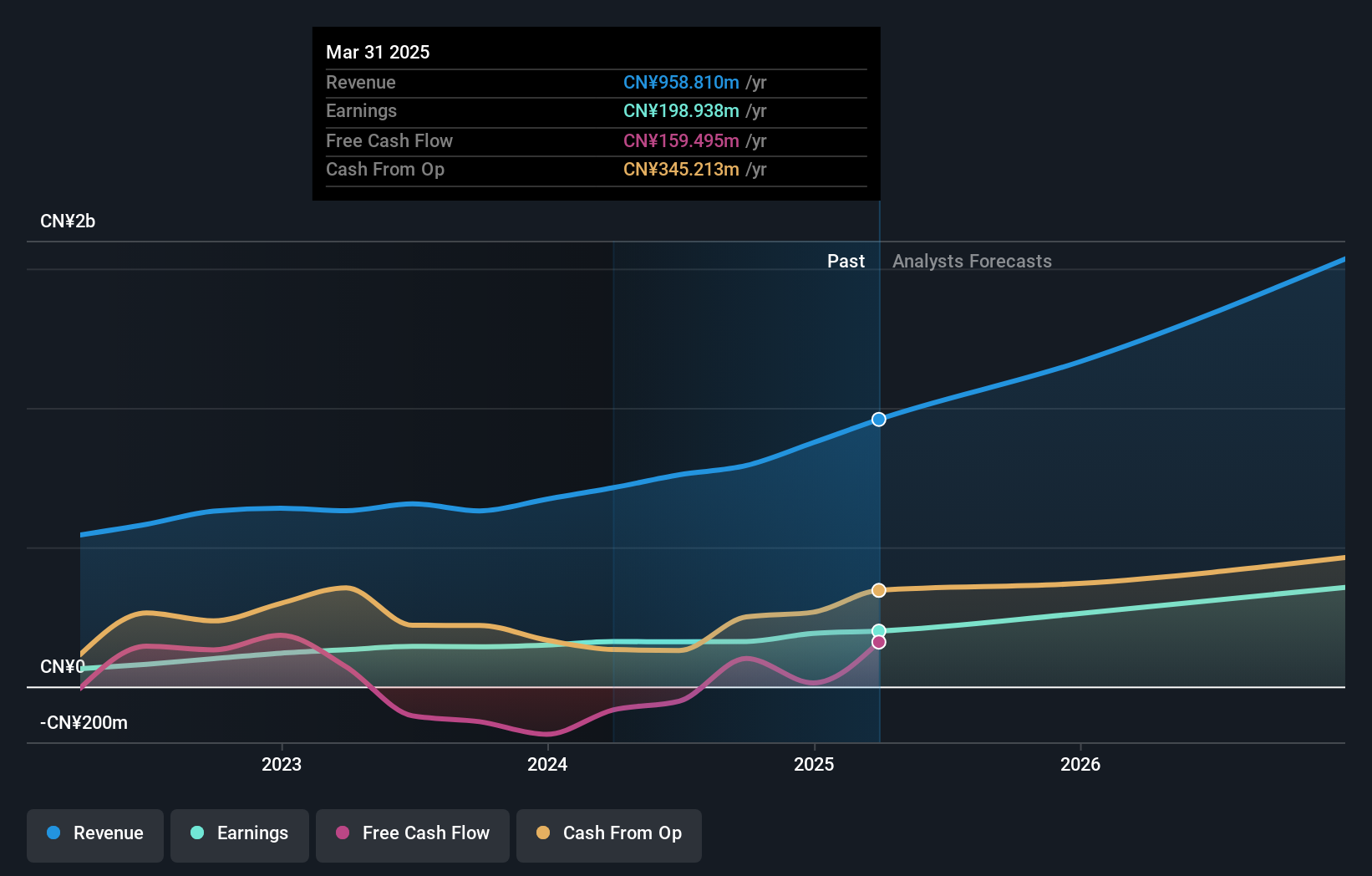

Overview: Shenzhen Newway Photomask Making Co., Ltd is a lithography company that focuses on the design, development, and production of mask products in China, with a market capitalization of approximately CN¥5.36 billion.

Operations: Newway Photomask generates revenue primarily from its electronic components and parts segment, amounting to CN¥793.19 million.

Shenzhen Newway Photomask Making has demonstrated robust financial performance with a 25% increase in sales to CNY 602.57 million and net income rising to CNY 121.06 million, reflecting solid operational efficiency. The company's commitment to innovation is underscored by its R&D investments, aligning with an expected annual revenue growth of 26.3% and earnings growth of 31.9%. Despite a volatile share price, these figures suggest strong underlying fundamentals and potential for sustained growth driven by strategic initiatives like the recent completion of a share buyback program totaling CNY 50.66 million, enhancing shareholder value.

Hefei Kewell Power SystemLtd (SHSE:688551)

Simply Wall St Growth Rating: ★★★★★☆

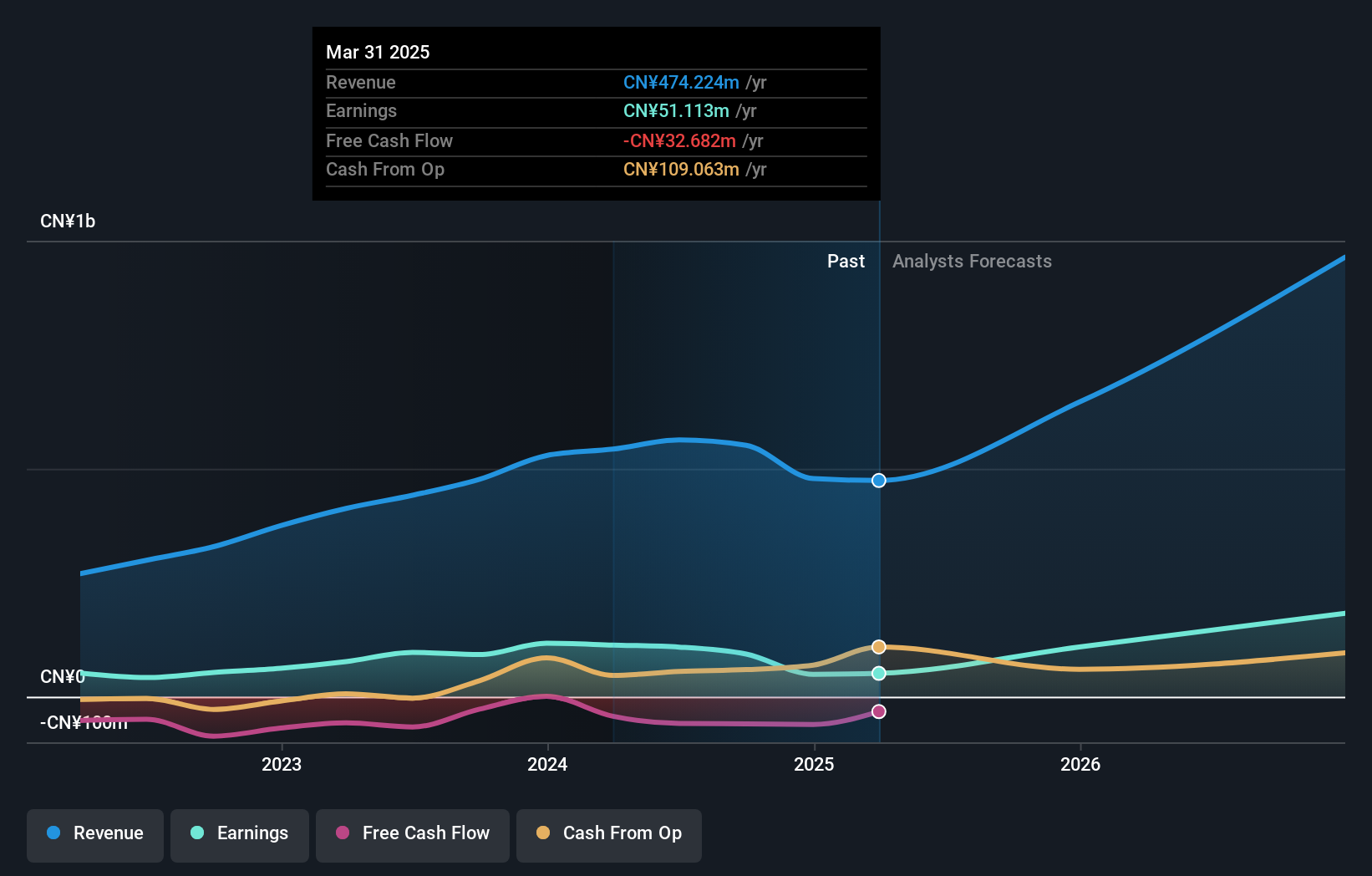

Overview: Hefei Kewell Power System Co., Ltd. is involved in the manufacture and sale of test power supplies and systems in China, with a market capitalization of CN¥2.61 billion.

Operations: Kewell Power System focuses on the production and distribution of test power supplies and systems in China. The company operates within a market valued at CN¥2.61 billion, reflecting its significant presence in this sector.

Hefei Kewell Power System Co., Ltd. is navigating a competitive landscape with notable strides in revenue and earnings growth, reporting an increase in sales to CNY 377.24 million from CNY 355 million year-over-year. The company's commitment to innovation is evident from its R&D focus, crucial for sustaining its forecasted revenue growth of 35.5% per year, outpacing the CN market's 13.8%. Despite a dip in net income to CNY 51.64 million from CNY 75.33 million, Hefei Kewell has actively enhanced shareholder value through strategic share repurchases totaling CNY 8.48 million recently, positioning it well within the tech sector's dynamic environment.

Cubic Sensor and InstrumentLtd (SHSE:688665)

Simply Wall St Growth Rating: ★★★★★★

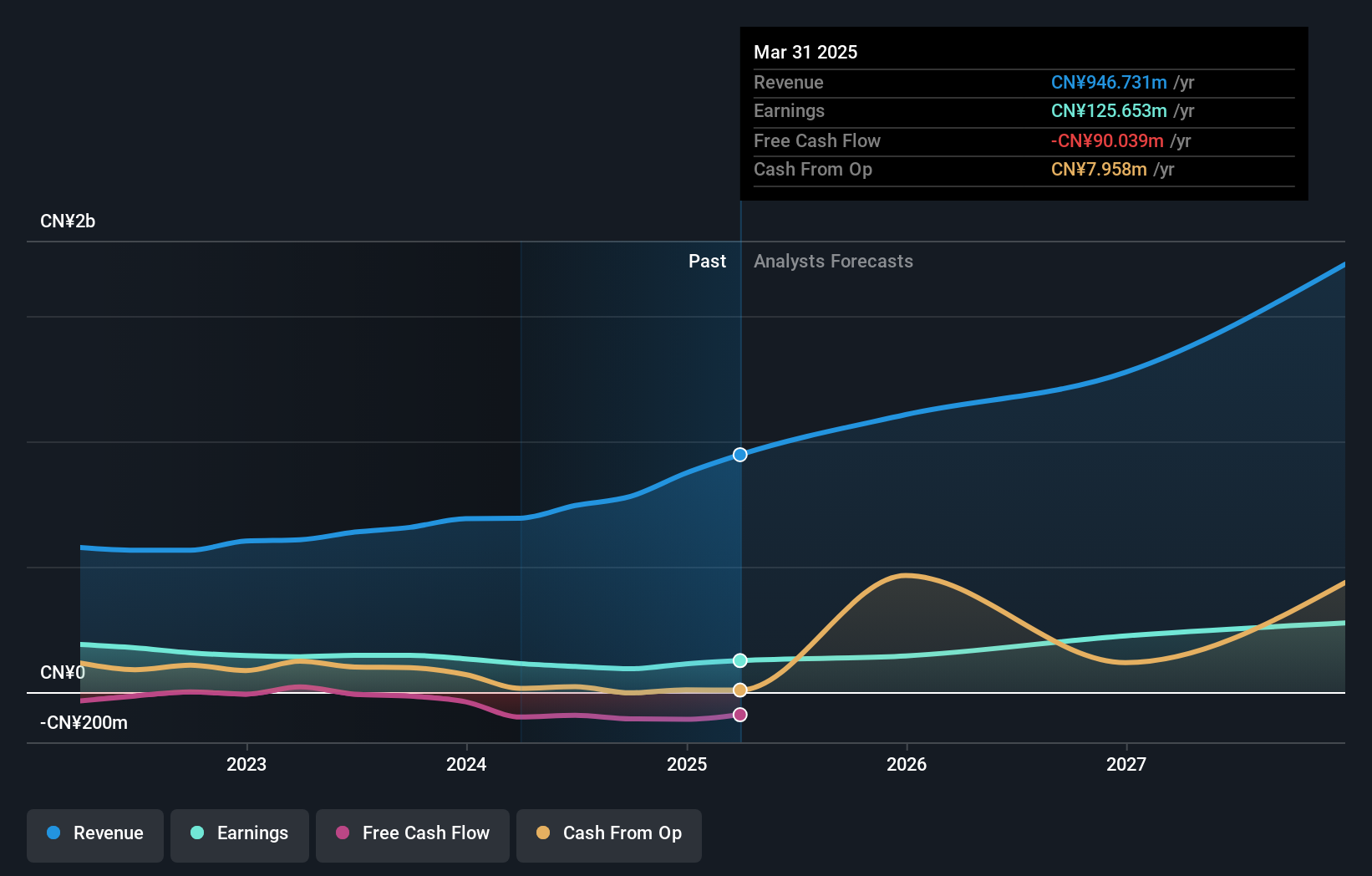

Overview: Cubic Sensor and Instrument Co., Ltd. is a Chinese company specializing in the manufacturing of gas sensors and sensor solutions, with a market capitalization of CN¥3.22 billion.

Operations: Cubic Sensor and Instrument Co., Ltd. focuses on producing gas sensors and sensor solutions in China. The company's business model revolves around these core products, contributing significantly to its revenue streams.

Cubic Sensor and Instrument Co., Ltd. has demonstrated a robust growth trajectory with its revenue surging by 19.6% year-over-year to CNY 540.44 million, outpacing the broader CN market's growth rate. Despite a decrease in net income to CNY 61.56 million from CNY 101.28 million, the firm is aggressively investing in R&D, dedicating substantial resources that underscore its commitment to innovation—critical for maintaining competitive advantage in high-tech industries. This strategic focus is evident as earnings are projected to climb by an impressive 44.4% annually, significantly above the market forecast of 26.2%, positioning Cubic Sensor and Instrument well for future technological advancements and market demands.

Key Takeaways

- Click this link to deep-dive into the 1282 companies within our High Growth Tech and AI Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688401

Shenzhen Newway Photomask Making

A lithography company, engages in the design, development, and production of mask products in China.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives