- China

- /

- Electronic Equipment and Components

- /

- SHSE:688661

Market Participants Recognise Suzhou UIGreen Micro&Nano Technologies Co.,Ltd's (SHSE:688661) Revenues Pushing Shares 26% Higher

Those holding Suzhou UIGreen Micro&Nano Technologies Co.,Ltd (SHSE:688661) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 44% over that time.

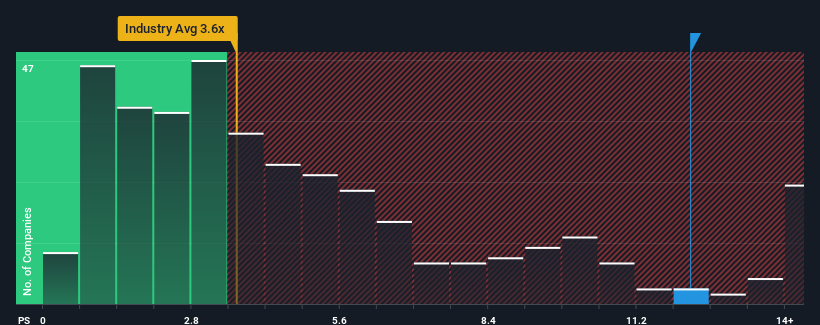

Since its price has surged higher, when almost half of the companies in China's Electronic industry have price-to-sales ratios (or "P/S") below 3.6x, you may consider Suzhou UIGreen Micro&Nano TechnologiesLtd as a stock not worth researching with its 12.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Suzhou UIGreen Micro&Nano TechnologiesLtd

What Does Suzhou UIGreen Micro&Nano TechnologiesLtd's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Suzhou UIGreen Micro&Nano TechnologiesLtd's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Suzhou UIGreen Micro&Nano TechnologiesLtd's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Suzhou UIGreen Micro&Nano TechnologiesLtd?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Suzhou UIGreen Micro&Nano TechnologiesLtd's to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period was better as it's delivered a decent 25% overall rise in revenue. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 138% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 26%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Suzhou UIGreen Micro&Nano TechnologiesLtd's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Suzhou UIGreen Micro&Nano TechnologiesLtd's P/S

Shares in Suzhou UIGreen Micro&Nano TechnologiesLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Suzhou UIGreen Micro&Nano TechnologiesLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electronic industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you settle on your opinion, we've discovered 1 warning sign for Suzhou UIGreen Micro&Nano TechnologiesLtd that you should be aware of.

If you're unsure about the strength of Suzhou UIGreen Micro&Nano TechnologiesLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688661

Suzhou UIGreen Micro&Nano TechnologiesLtd

Engages in the research and development, production, and sale of micro-electromechanical (MEMS) fine components and semiconductor test probe products in China and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.