- China

- /

- Electronic Equipment and Components

- /

- SHSE:688661

After Leaping 25% Suzhou UIGreen Micro&Nano Technologies Co.,Ltd (SHSE:688661) Shares Are Not Flying Under The Radar

Despite an already strong run, Suzhou UIGreen Micro&Nano Technologies Co.,Ltd (SHSE:688661) shares have been powering on, with a gain of 25% in the last thirty days. The last 30 days bring the annual gain to a very sharp 82%.

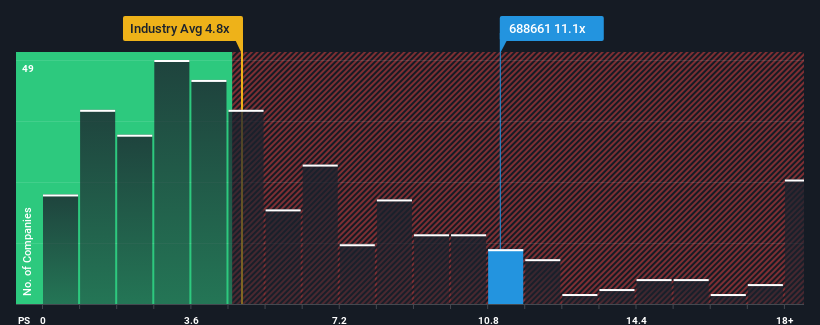

Since its price has surged higher, Suzhou UIGreen Micro&Nano TechnologiesLtd may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 11.1x, when you consider almost half of the companies in the Electronic industry in China have P/S ratios under 4.8x and even P/S lower than 2x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Suzhou UIGreen Micro&Nano TechnologiesLtd

What Does Suzhou UIGreen Micro&Nano TechnologiesLtd's P/S Mean For Shareholders?

Recent times have been advantageous for Suzhou UIGreen Micro&Nano TechnologiesLtd as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Suzhou UIGreen Micro&Nano TechnologiesLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Suzhou UIGreen Micro&Nano TechnologiesLtd would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 99% gain to the company's top line. The latest three year period has also seen an excellent 54% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 67% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 26%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Suzhou UIGreen Micro&Nano TechnologiesLtd's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Suzhou UIGreen Micro&Nano TechnologiesLtd's P/S?

Shares in Suzhou UIGreen Micro&Nano TechnologiesLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Suzhou UIGreen Micro&Nano TechnologiesLtd shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Suzhou UIGreen Micro&Nano TechnologiesLtd that you should be aware of.

If these risks are making you reconsider your opinion on Suzhou UIGreen Micro&Nano TechnologiesLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688661

Suzhou UIGreen Micro&Nano TechnologiesLtd

Engages in the research and development, production, and sale of micro-electromechanical (MEMS) fine components and semiconductor test probe products in China and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026