As global markets continue to reach new heights, with small-cap indices like the Russell 2000 hitting record intraday highs, investor sentiment is buoyed by domestic policy developments and strong consumer spending despite ongoing manufacturing slumps. In this dynamic environment, identifying high-growth tech stocks involves assessing their potential to capitalize on technological advancements and market trends while navigating geopolitical uncertainties and economic shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 28.04% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1285 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Bonesupport Holding (OM:BONEX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bonesupport Holding AB (publ) is an orthobiologics company that specializes in developing and commercializing injectable bio-ceramic bone graft substitutes across Europe, North America, and other international markets, with a market cap of SEK23.72 billion.

Operations: Bonesupport generates revenue primarily from its pharmaceuticals segment, amounting to SEK814.46 million. The company focuses on the development and commercialization of injectable bio-ceramic bone graft substitutes in various international markets.

Bonesupport Holding, a company operating within the high-growth sector of biotech, is demonstrating robust financial and operational performance. The firm's revenue is expected to increase by 34.9% annually, outpacing the Swedish market's growth of just 0.1%. This surge is underpinned by a significant forecast in earnings growth at 74.3% per year, which starkly contrasts with its past earnings decline of -57.6%. Such dynamics suggest a turnaround driven possibly by innovative strategies or market conditions favoring their offerings. Additionally, recent strategic moves like the notable acquisition by Erik Selin indicate active management and potential shifts in shareholder structure that could influence future governance and strategy directions.

- Click to explore a detailed breakdown of our findings in Bonesupport Holding's health report.

Explore historical data to track Bonesupport Holding's performance over time in our Past section.

Sinocelltech Group (SHSE:688520)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sinocelltech Group Limited is a biotech company focused on the research, development, and industrialization of recombinant proteins, monoclonal antibodies, and vaccines in China with a market cap of approximately CN¥17.28 billion.

Operations: The company primarily generates revenue from its Biological Drugs segment, which includes drugs and vaccines, amounting to CN¥2.45 billion.

Sinocelltech Group has demonstrated a remarkable turnaround, with its revenue soaring to CNY 1.94 billion, up from CNY 1.38 billion the previous year, and transitioning from a net loss of CNY 220 million to a net income of CNY 150 million. This financial recovery is underscored by an impressive forecasted annual earnings growth rate of 139.3%. The company's commitment to innovation is evident in its R&D investments, which are crucial for sustaining long-term growth in the competitive tech landscape. These strategic efforts are expected to keep Sinocelltech at the forefront of technological advancements and market expansion.

- Dive into the specifics of Sinocelltech Group here with our thorough health report.

Evaluate Sinocelltech Group's historical performance by accessing our past performance report.

Chengdu Zhimingda Electronics (SHSE:688636)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu Zhimingda Electronics Co., Ltd. focuses on the research, development, production, and sale of military embedded computer module products in China and has a market cap of CN¥3.30 billion.

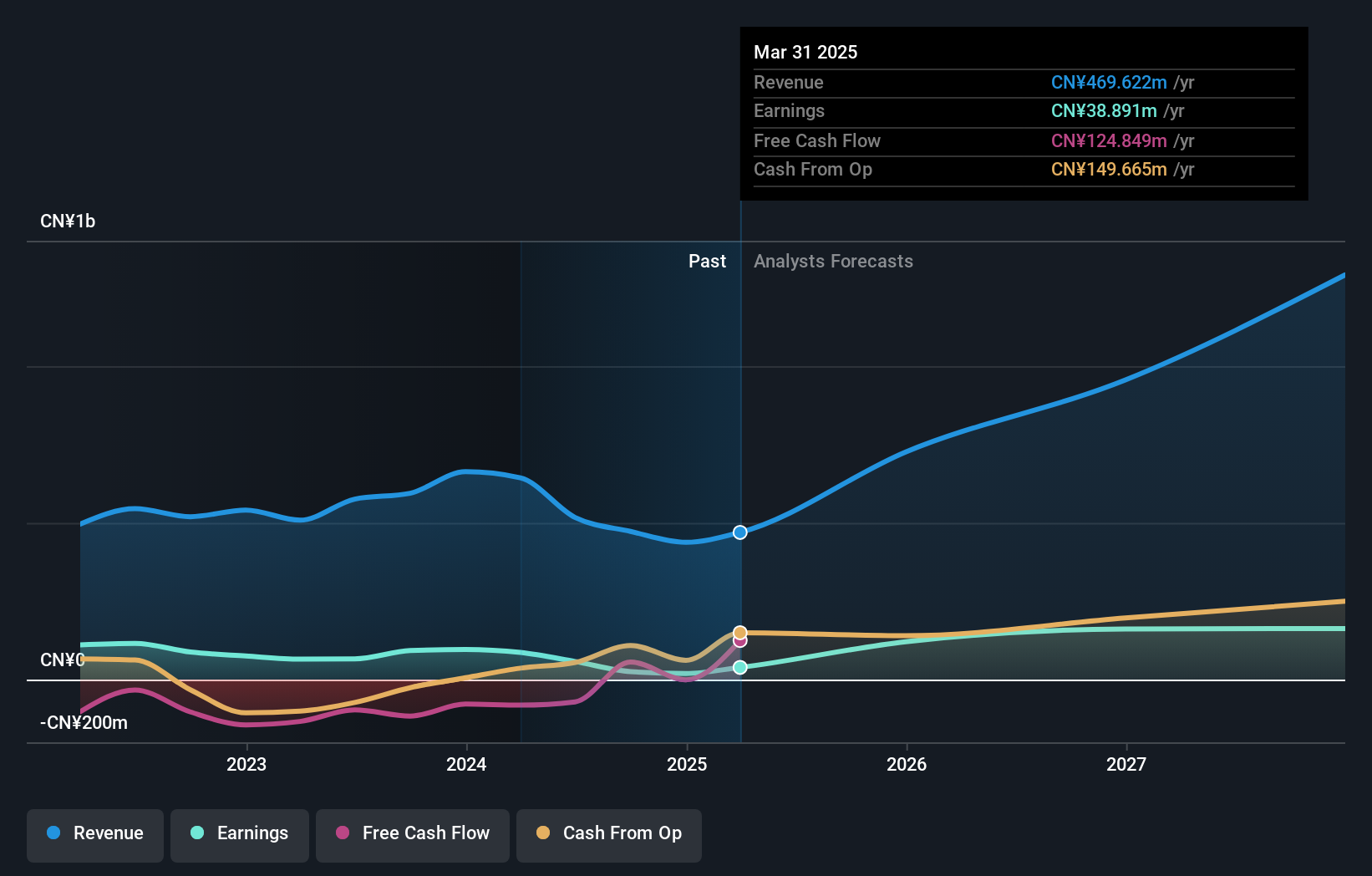

Operations: Zhimingda Electronics generates revenue primarily from the aerospace and defense sector, with sales amounting to CN¥472.61 million. The company's operations are centered on military embedded computer module products, contributing significantly to its financial performance.

Chengdu Zhimingda Electronics, amid a challenging fiscal period, reported a significant drop in sales to CNY 208.66 million from CNY 399.05 million year-over-year and shifted from a net profit of CNY 61.64 million to a net loss of CNY 9.16 million for the nine months ending September 2024. Despite these hurdles, the company is positioned for recovery with expected revenue growth at an impressive rate of 32.3% per year and earnings forecasted to surge by 57.4% annually. This potential turnaround is underpinned by strategic R&D investments aimed at fostering innovation and securing competitive advantages in rapidly evolving tech markets.

Summing It All Up

- Access the full spectrum of 1285 High Growth Tech and AI Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bonesupport Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BONEX

Bonesupport Holding

An orthobiologics company, develops and commercializes injectable bio-ceramic bone graft substitutes in Europe, North America, and internationally.

Exceptional growth potential with flawless balance sheet.