- China

- /

- Electronic Equipment and Components

- /

- SHSE:688622

Market Participants Recognise Guangzhou Hexin Instrument Co.,Ltd.'s (SHSE:688622) Revenues Pushing Shares 51% Higher

Guangzhou Hexin Instrument Co.,Ltd. (SHSE:688622) shares have continued their recent momentum with a 51% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 20% over that time.

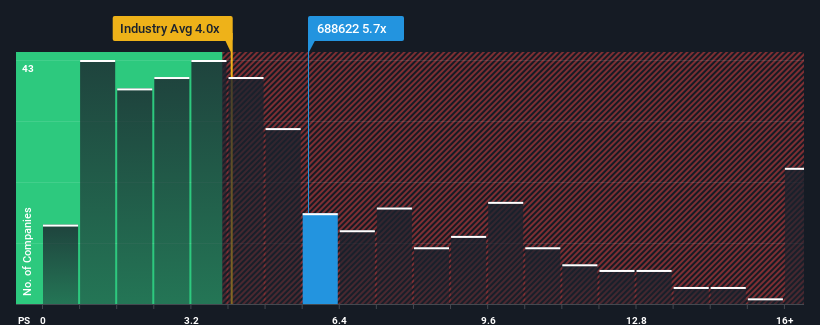

Following the firm bounce in price, Guangzhou Hexin InstrumentLtd's price-to-sales (or "P/S") ratio of 5.7x might make it look like a sell right now compared to the wider Electronic industry in China, where around half of the companies have P/S ratios below 4x and even P/S below 2x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Guangzhou Hexin InstrumentLtd

How Guangzhou Hexin InstrumentLtd Has Been Performing

While the industry has experienced revenue growth lately, Guangzhou Hexin InstrumentLtd's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Guangzhou Hexin InstrumentLtd's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Guangzhou Hexin InstrumentLtd?

Guangzhou Hexin InstrumentLtd's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.2%. As a result, revenue from three years ago have also fallen 21% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 113% during the coming year according to the one analyst following the company. That's shaping up to be materially higher than the 26% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Guangzhou Hexin InstrumentLtd's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Guangzhou Hexin InstrumentLtd's P/S?

Guangzhou Hexin InstrumentLtd's P/S is on the rise since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Guangzhou Hexin InstrumentLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electronic industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Guangzhou Hexin InstrumentLtd with six simple checks.

If these risks are making you reconsider your opinion on Guangzhou Hexin InstrumentLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688622

Guangzhou Hexin InstrumentLtd

Provides mass spectrometers (MS) and related technical services in China.

Adequate balance sheet with limited growth.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion