Discovering January 2025's Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets navigate a landscape shaped by easing core U.S. inflation and robust bank earnings, major indices like the S&P 500 and Russell 2000 have seen notable gains, reflecting a positive sentiment among investors. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial for those looking to capitalize on the momentum in small-cap sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 30.82% | 63.88% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

SiS Distribution (Thailand) (SET:SIS)

Simply Wall St Value Rating: ★★★★★☆

Overview: SiS Distribution (Thailand) Public Company Limited, along with its subsidiaries, is involved in the distribution of computer components, smartphones, and office automation equipment in Thailand and has a market cap of approximately THB9.19 billion.

Operations: SiS Distribution (Thailand) generates revenue primarily from consumer products, phones, commercial products, and value-added products, with consumer products contributing THB8.37 billion and phones THB5.25 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

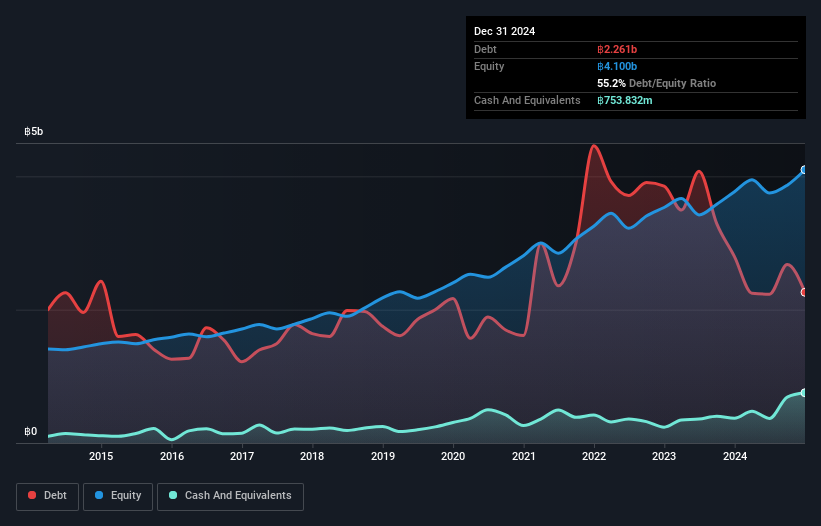

SiS Distribution, a notable player in the electronics sector, has shown resilience with its debt to equity ratio decreasing from 88% to 69.2% over five years. Trading at nearly 60% below estimated fair value, it appears undervalued. Despite high net debt to equity at 51.4%, interest payments are well covered by EBIT at a robust 15.7x coverage. The company reported THB 7,472 million in Q3 revenue for 2024 compared to THB 6,779 million last year; however, net income dipped from THB 160 million to THB 119 million. Earnings growth of nearly ten percent outpaced the industry average of seven percent.

- Delve into the full analysis health report here for a deeper understanding of SiS Distribution (Thailand).

Learn about SiS Distribution (Thailand)'s historical performance.

Hefei I-TEK OptoElectronics (SHSE:688610)

Simply Wall St Value Rating: ★★★★★★

Overview: Hefei I-TEK OptoElectronics Co., Ltd. is a Chinese company that designs, develops, manufactures, and markets industrial imaging, high precision optics, and opto-electrical equipment with a market cap of CN¥2.31 billion.

Operations: Hefei I-TEK OptoElectronics generates revenue primarily from its machine vision segment, which accounts for CN¥255.57 million. The company has a market capitalization of CN¥2.31 billion.

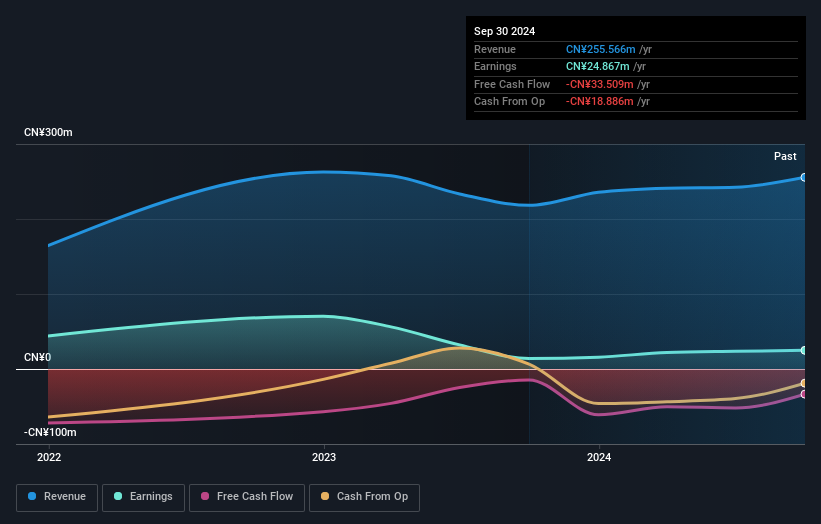

Hefei I-TEK OptoElectronics, a smaller player in the electronics sector, has shown impressive earnings growth of 78% over the past year, surpassing industry averages. The company is debt-free and boasts high-quality earnings. Recent financials reveal sales of CNY 183 million for nine months ending September 2024, up from CNY 163 million the previous year, with net income rising to CNY 16 million compared to CNY 7 million. Despite no share buybacks in late 2024, it completed repurchases earlier that year totaling over CNY 49 million. This suggests a solid footing in its market niche.

Shin-Etsu PolymerLtd (TSE:7970)

Simply Wall St Value Rating: ★★★★★★

Overview: Shin-Etsu Polymer Co., Ltd. is a global manufacturer and seller of polyvinyl chloride (PVC) products with a market capitalization of ¥1.31 billion.

Operations: Shin-Etsu Polymer Co., Ltd. generates its revenue primarily from three segments: Precision Molded Products, Electronic Devices, and Living Environment/Living Materials, with the Precision Molded Product segment contributing ¥50.10 billion. The company's cost structure and profitability are influenced by these segments' performance, which impacts its overall financial health.

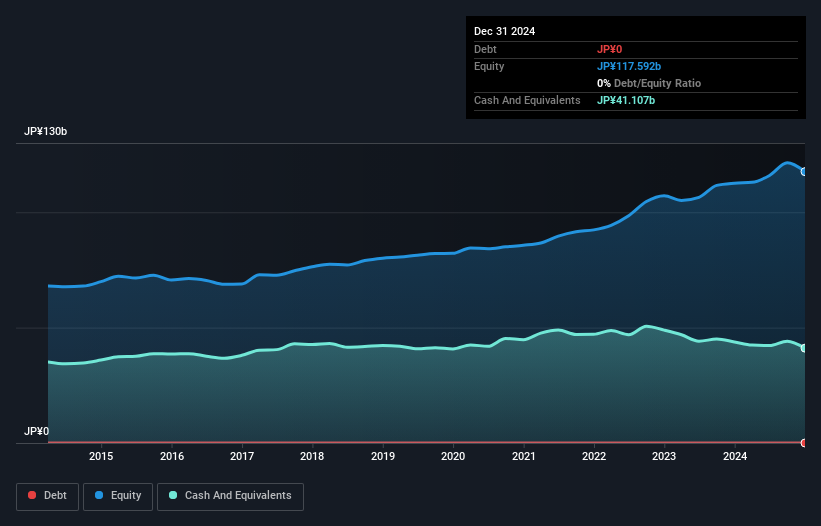

Shin-Etsu Polymer, a nimble player in the chemicals sector, boasts impressive financial health with no debt and high-quality earnings. Over the past five years, its earnings have grown 10.5% annually but lagged behind the industry’s 13.7% surge last year. Trading at 61.6% below its estimated fair value, it seems undervalued to some extent. Recently, the company completed a buyback of 500,000 shares for ¥809 million to support stock option rights exercises. With forecasted annual earnings growth of nearly 14%, Shin-Etsu Polymer might appeal to those seeking potential in an underappreciated market segment.

- Navigate through the intricacies of Shin-Etsu PolymerLtd with our comprehensive health report here.

Assess Shin-Etsu PolymerLtd's past performance with our detailed historical performance reports.

Key Takeaways

- Reveal the 4662 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:SIS

SiS Distribution (Thailand)

Engages in the distribution of computer components, smartphones, and office automation equipment in Thailand.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives