- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7613

Exploring High Growth Tech Stocks In The None Exchange

Reviewed by Simply Wall St

Amidst a backdrop of global market volatility, driven by competitive pressures in the AI sector and geopolitical tariff risks, the technology-oriented Nasdaq Composite has faced significant fluctuations. In this environment, identifying high-growth tech stocks requires careful consideration of factors such as innovation potential, market adaptability, and resilience to economic shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1222 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Hefei Kewell Power SystemLtd (SHSE:688551)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hefei Kewell Power System Co., Ltd. specializes in providing test systems and intelligent manufacturing equipment for various industries in China, with a market capitalization of CN¥2.38 billion.

Operations: Kewell Power System focuses on delivering test systems and intelligent manufacturing equipment across diverse sectors in China. The company generates revenue through these specialized solutions, catering to industry-specific needs.

Hefei Kewell Power SystemLtd's trajectory in the high-tech sector is underscored by a robust annual revenue growth rate of 35.5%, significantly outpacing the Chinese market average of 13.5%. This performance is complemented by an impressive earnings growth forecast of 39.2% per year, dwarfing the broader market's expectation of 25.3%. Despite these strong growth metrics, challenges such as a forecasted low return on equity at 12.5% in three years and a lack of positive free cash flow highlight areas for potential concern. The company has actively engaged in share repurchase initiatives, completing significant buybacks totaling CNY 11.82 million recently, which may reflect confidence in its financial health and future prospects.

- Get an in-depth perspective on Hefei Kewell Power SystemLtd's performance by reading our health report here.

Learn about Hefei Kewell Power SystemLtd's historical performance.

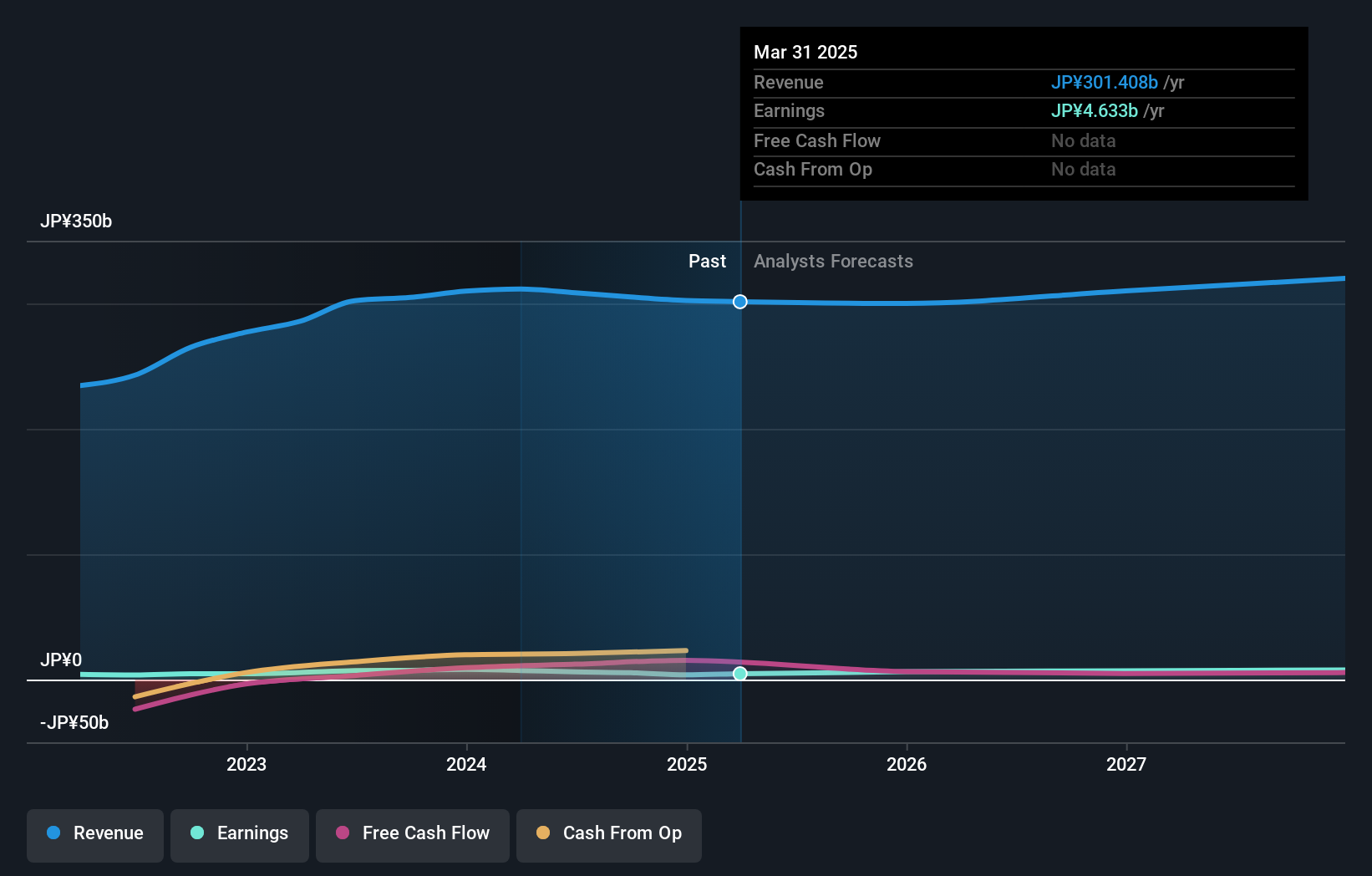

Macbee Planet (TSE:7095)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Macbee Planet, Inc. is a Japanese company specializing in analytics consulting and marketing technology, with a market capitalization of ¥46.63 billion.

Operations: The company focuses on analytics consulting and marketing technology within Japan. It generates revenue through providing data-driven insights and marketing solutions, leveraging advanced technology to enhance client performance.

Amidst a dynamic tech landscape, Macbee Planet stands out with its strategic focus on innovation and market expansion. The company recently declared an increase in dividends to JPY 18.00 per share, signaling robust financial health and confidence in sustained profitability. This move coincides with an aggressive share repurchase program where Macbee Planet bought back shares worth ¥1.62 billion, underscoring its commitment to shareholder value amidst a 20.94% forecasted annual earnings growth rate. Despite challenges like a lower profit margin of 5.1% compared to last year's 7.7%, the firm's revenue is expected to climb by 17.1% annually, outpacing the Japanese market average of 4.3%. These financial maneuvers and growth metrics reflect Macbee Planet’s potential resilience and adaptability in the high-tech sector.

- Dive into the specifics of Macbee Planet here with our thorough health report.

Evaluate Macbee Planet's historical performance by accessing our past performance report.

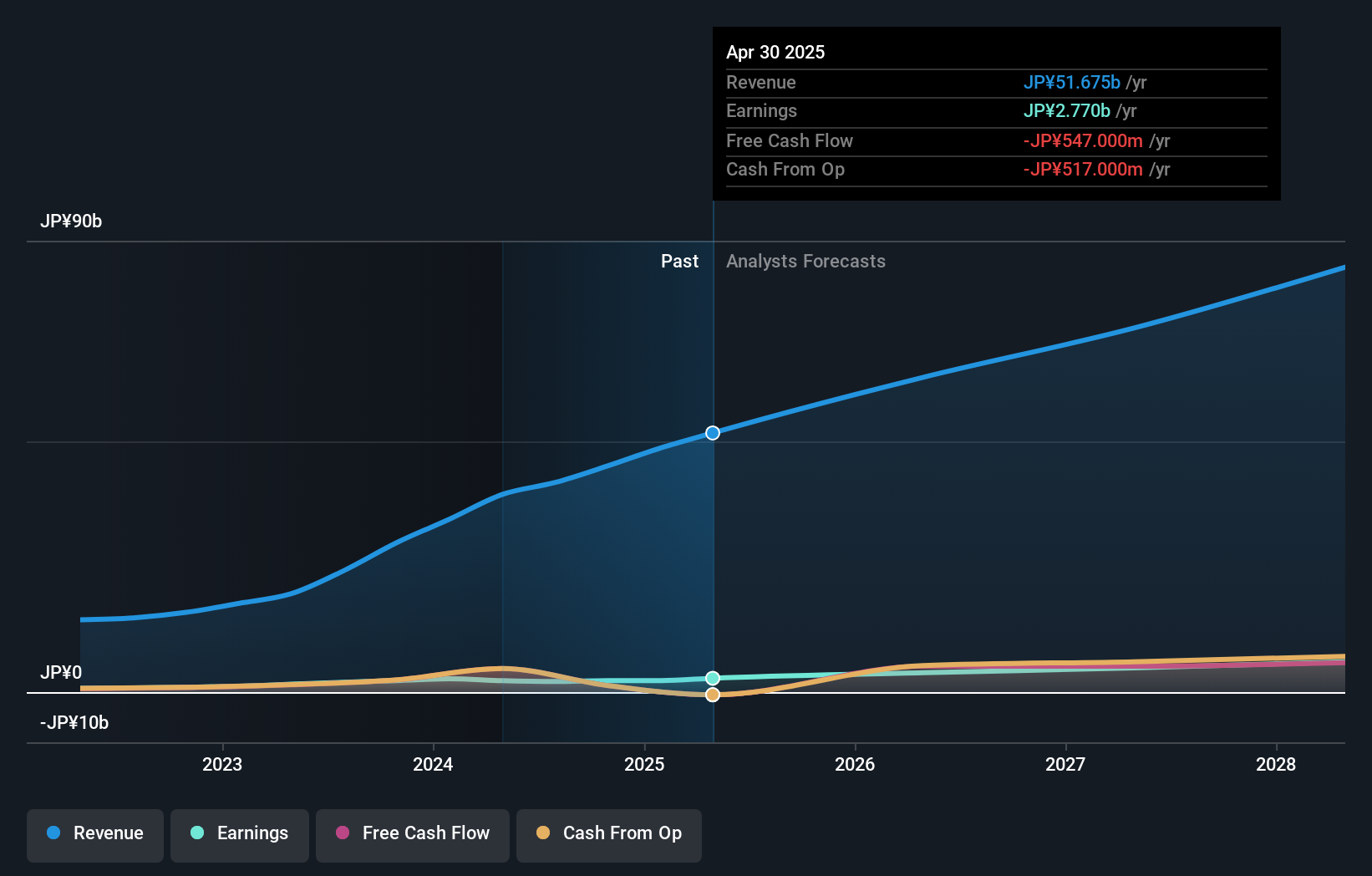

SIIX (TSE:7613)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SIIX Corporation primarily sells and distributes electronic components in Japan and internationally, with a market capitalization of ¥53.54 billion.

Operations: The company generates revenue through the sale and distribution of electronic components across various regions, with Southeast Asia contributing ¥115.45 billion and Japan ¥103.89 billion. Its operations extend to Europe, the Americas, and Greater China, reflecting a diverse geographical presence in its business model.

SIIX is navigating the competitive tech landscape with a focus on strategic growth and financial agility. Despite a challenging year with earnings declining by 25.8%, the company's commitment to innovation is evident in its R&D spending, which remains robust in support of long-term growth. With revenue expected to grow at 4.4% annually, slightly outpacing the Japanese market average of 4.3%, SIIX is positioning itself as a resilient player in technology. The firm also demonstrates strong financial management strategies, underscored by positive free cash flow and an aggressive share repurchase program, enhancing shareholder value amidst forecasts of significant earnings growth at 22.6% per year over the next three years.

- Delve into the full analysis health report here for a deeper understanding of SIIX.

Gain insights into SIIX's past trends and performance with our Past report.

Next Steps

- Explore the 1222 names from our High Growth Tech and AI Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7613

SIIX

Primarily sells and distributes electronic components in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion