- China

- /

- Entertainment

- /

- SZSE:300133

High Growth Tech Leads These 3 Top Stocks with Promising Potential

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape, characterized by declining consumer confidence and fluctuations in major indices, the technology sector continues to capture attention with its potential for high growth. In this environment, identifying promising stocks often involves looking at companies that demonstrate innovation and adaptability to changing market conditions, which are key factors in thriving amid economic uncertainties.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1265 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Willfar Information Technology (SHSE:688100)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Willfar Information Technology Co., Ltd. offers smart utility services and IoT solutions both in China and globally, with a market cap of CN¥17.23 billion.

Operations: Willfar Information Technology focuses on delivering smart utility services and IoT solutions across domestic and international markets. The company generates revenue through these technological offerings, catering to a diverse client base.

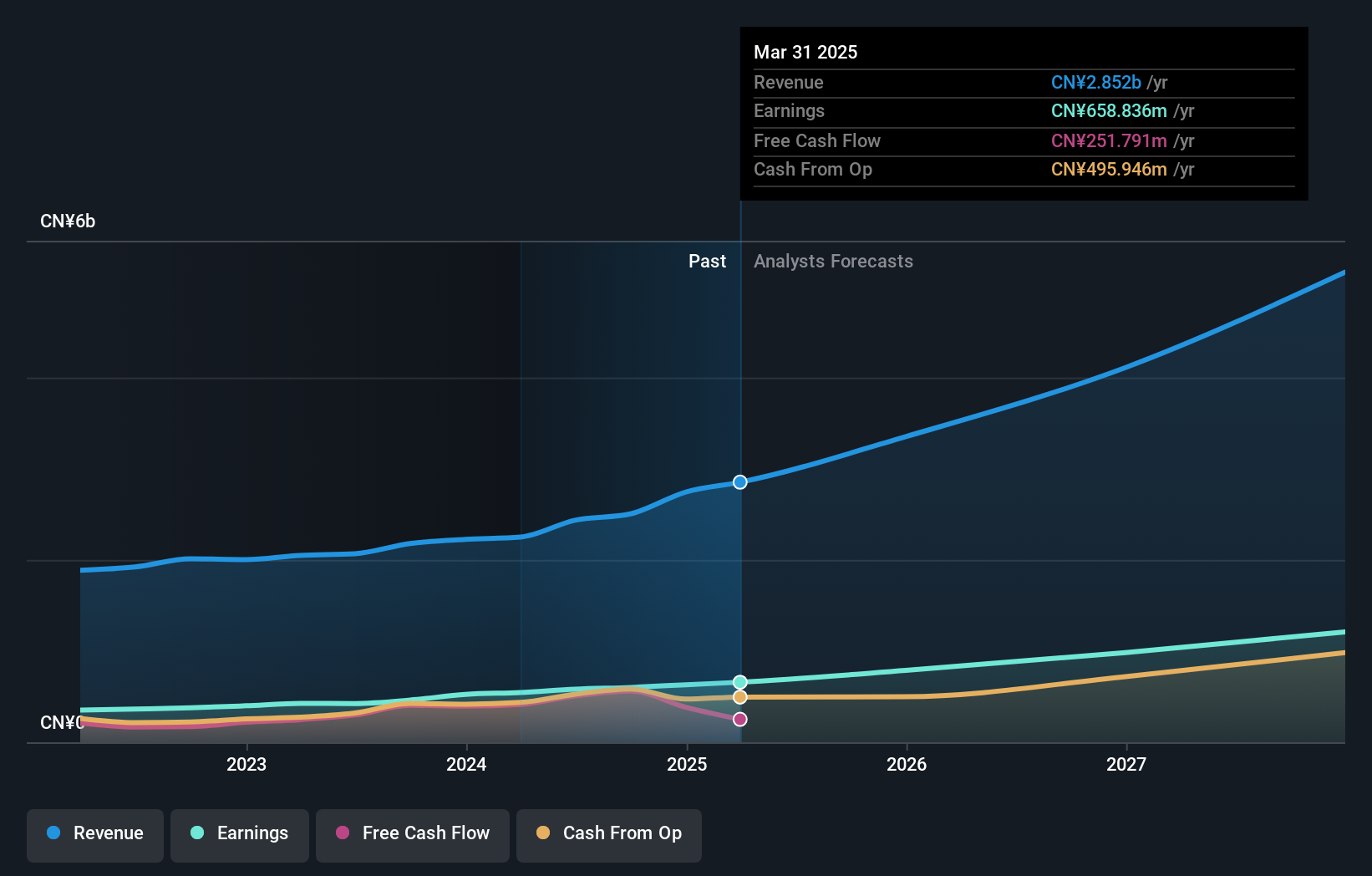

Willfar Information Technology has demonstrated robust financial performance with a 22% annual revenue growth, outpacing the Chinese market average of 13.6%. This growth is complemented by a significant 21.9% forecast in earnings growth over the next three years, highlighting its potential in an expanding sector. Recent earnings reports for the first nine months of 2024 show revenues reaching CNY 1.94 billion, up from CNY 1.66 billion year-over-year, with net income also rising to CNY 422.47 million from CNY 346.45 million. The company's strategic focus on innovation and market expansion is evident from these figures, positioning it well for sustained future growth despite slightly trailing the broader Chinese market's expected earnings increase of 25.1%.

Naruida Technology (SHSE:688522)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Naruida Technology Co., Ltd. specializes in the manufacture and sale of polarized multifunctional active phased array radars in China, with a market capitalization of CN¥11.69 billion.

Operations: Naruida Technology generates revenue primarily from its Scientific & Technical Instruments segment, amounting to CN¥235.19 million. The company's focus is on the production and sale of advanced radar systems within China.

Naruida Technology, amidst a challenging market, reported a revenue increase to CNY 136.2 million from CNY 113.51 million year-over-year for the first nine months of 2024, though net income dipped to CNY 26.01 million from CNY 33.24 million in the same period last year. The company's commitment to R&D is evident as it continues to allocate substantial resources despite fluctuating earnings; this strategic focus supports its rapid annual revenue growth of 60.8% and an even more impressive projected earnings surge of 72.3% annually over the next three years, significantly outpacing the broader Chinese market's growth expectations.

- Click to explore a detailed breakdown of our findings in Naruida Technology's health report.

Explore historical data to track Naruida Technology's performance over time in our Past section.

Zhejiang Huace Film & TV (SZSE:300133)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Huace Film & TV Co., Ltd. is involved in the production, distribution, and derivative of film and television dramas both in China and internationally, with a market capitalization of CN¥13.22 billion.

Operations: The company generates revenue primarily through the production and distribution of film and television dramas. It operates both domestically in China and internationally, leveraging its expertise in content creation to reach a broad audience.

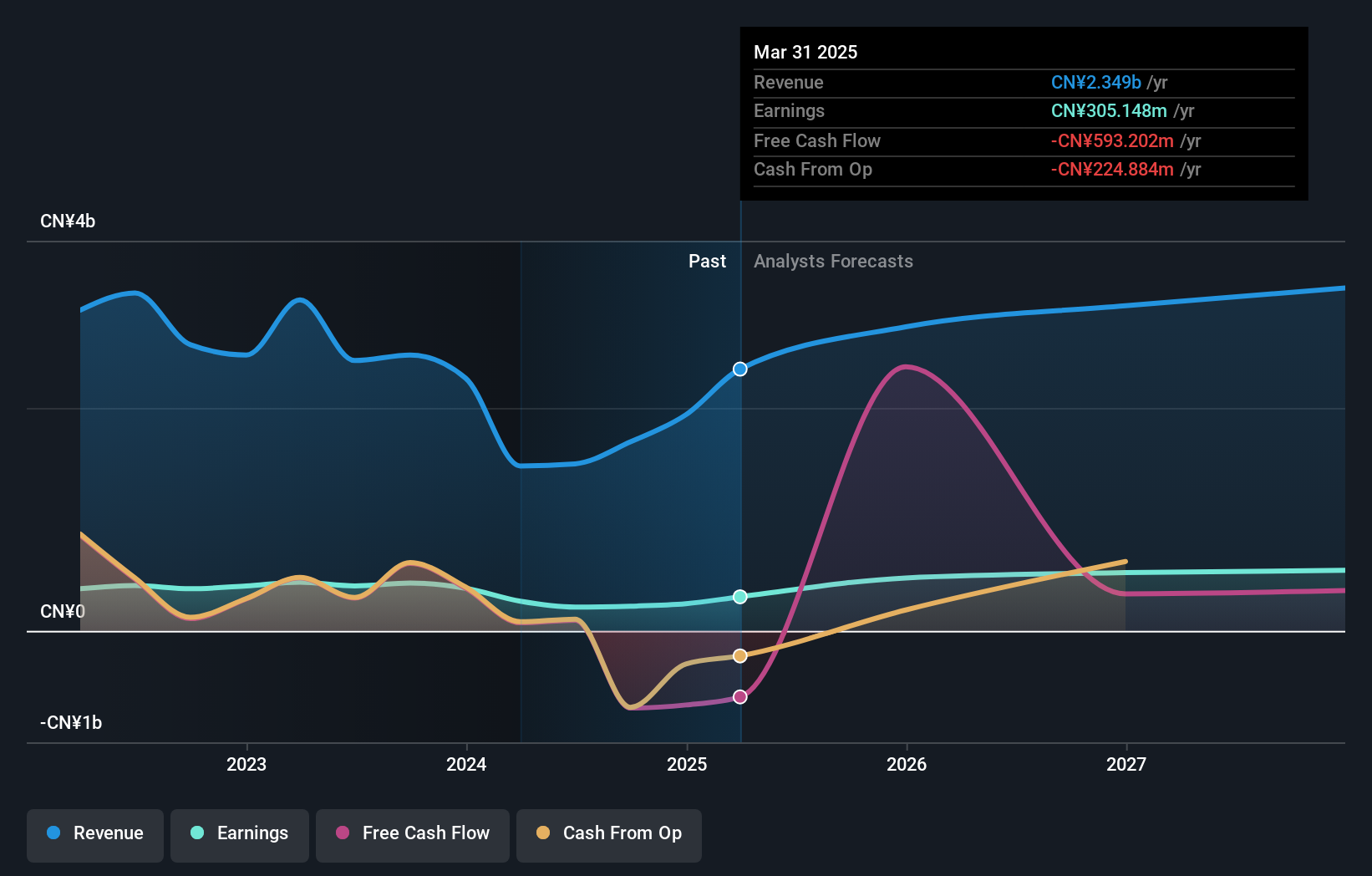

Zhejiang Huace Film & TV, navigating a challenging landscape, saw its revenue dip to CNY 892.54 million from CNY 1.464 billion year-over-year by September 2024, reflecting a significant market contraction. Despite this downturn, the company's net income remains robust at CNY 166.23 million, showcasing resilience in profitability with an earnings growth forecast of 35.7% per annum—outstripping the broader Chinese market's expectations of 25.1%. This performance is underpinned by strategic investments in innovative content production that aligns with shifting consumer preferences towards digital media consumption—a sector poised for rapid expansion due to evolving technology and viewer habits.

Seize The Opportunity

- Take a closer look at our High Growth Tech and AI Stocks list of 1265 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zhejiang Huace Film & TV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300133

Zhejiang Huace Film & TV

Engages in the production, distribution, and derivative of film and television dramas in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion