- China

- /

- Electronic Equipment and Components

- /

- SHSE:688100

Exploring Three High Growth Tech Stocks in Asia

Reviewed by Simply Wall St

As global markets experience a mix of economic signals, with the S&P 500 and Nasdaq Composite hitting all-time highs amidst easing trade tensions between the U.S. and China, Asian tech stocks are gaining attention for their potential in this dynamic environment. In light of these developments, a good stock in the high-growth tech sector may be characterized by its ability to adapt to shifting trade landscapes and capitalize on technological advancements that align with evolving consumer demands.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.78% | 30.32% | ★★★★★★ |

| Fositek | 28.54% | 35.14% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 24.91% | 26.60% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.05% | 87.21% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

TianJin 712 Communication & Broadcasting (SHSE:603712)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TianJin 712 Communication & Broadcasting Co., Ltd. operates in the communication and broadcasting sector, with a market capitalization of CN¥16.22 billion.

Operations: TianJin 712 focuses on communication and broadcasting, generating revenue primarily from its specialized products and services in this sector. The company's financial performance is highlighted by a net profit margin of 12.5%, reflecting its efficiency in converting revenue into actual profit.

TianJin 712 Communication & Broadcasting is navigating a transformative phase, with revenue growth forecasted at an impressive 32.7% annually, significantly outpacing the Chinese market's average of 12.4%. Despite current unprofitability, the company is poised for a robust turnaround with earnings expected to surge by approximately 80.92% per year over the next three years. Recent strategic meetings and an earnings call underscore efforts to recalibrate operations and address a substantial net loss reported in Q1 2025, where revenues plummeted to CNY 216.13 million from CNY 489.82 million year-over-year. This backdrop of aggressive growth targets and operational restructuring highlights TianJin's potential pivot towards profitability and sector leadership in high-growth tech within Asia.

Willfar Information Technology (SHSE:688100)

Simply Wall St Growth Rating: ★★★★★☆

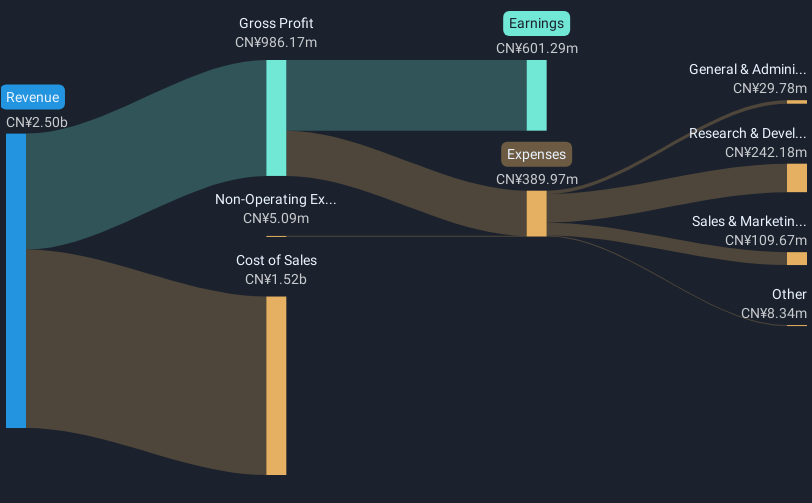

Overview: Willfar Information Technology Co., Ltd. offers smart utility services and IoT solutions both in China and internationally, with a market cap of CN¥17.73 billion.

Operations: Willfar Information Technology focuses on smart utility services and IoT solutions, generating revenue primarily from these sectors. The company operates both domestically in China and internationally.

Willfar Information Technology has demonstrated robust growth, with a 21.4% increase in annual revenue and a 21.9% rise in earnings, outpacing the broader Chinese market's averages of 12.4% and 23.4%, respectively. The company's strategic focus on R&D is evident from its substantial investment, which aligns with its recent expansion into Indonesia through PT Willfar, aiming to cater to Southeast Asia's growing demand for smart energy solutions. This expansion not only diversifies Willfar’s operational footprint but also enhances its product offerings in digital grid and smart city technologies, potentially positioning it as a regional leader in high-tech innovations.

Naruida Technology (SHSE:688522)

Simply Wall St Growth Rating: ★★★★★★

Overview: Naruida Technology Co., Ltd. specializes in the manufacturing and sale of polarized multifunctional active phased array radars in China, with a market capitalization of CN¥15.49 billion.

Operations: The company generates revenue primarily from its Scientific & Technical Instruments segment, which amounts to CN¥371.98 million.

Naruida Technology has demonstrated a remarkable growth trajectory, with earnings surging by 59.3% over the past year and projected annual increases of 54.4%. This robust expansion is underpinned by a significant R&D commitment, which in turn fuels innovations critical for staying ahead in competitive tech landscapes. The company's recent strategic moves, including a stock split and enhanced shareholder meetings, suggest an agile approach to corporate governance and investor relations. With revenue also expected to climb by 47.7% annually, Naruida is positioning itself as a formidable player in Asia’s high-tech sector, leveraging both market trends and operational agility to enhance its industry standing.

- Unlock comprehensive insights into our analysis of Naruida Technology stock in this health report.

Evaluate Naruida Technology's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Dive into all 490 of the Asian High Growth Tech and AI Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willfar Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688100

Willfar Information Technology

Provides smart utility services and IoT solutions in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives