High Growth Tech Trio Featuring MLOptic And Two Promising Stocks

Reviewed by Simply Wall St

As global markets navigate a mixed landscape with the S&P 500 and Nasdaq Composite marking consecutive years of significant gains, investors are keeping a close eye on economic indicators like the Chicago PMI and GDP forecasts that signal potential headwinds. In this environment, identifying high-growth tech stocks becomes crucial, as these companies often demonstrate resilience and innovation in times of economic uncertainty.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.09% | 45.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

MLOptic (SHSE:688502)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MLOptic Corp. operates as a precision optical solutions company in China and internationally, with a market cap of CN¥9.62 billion.

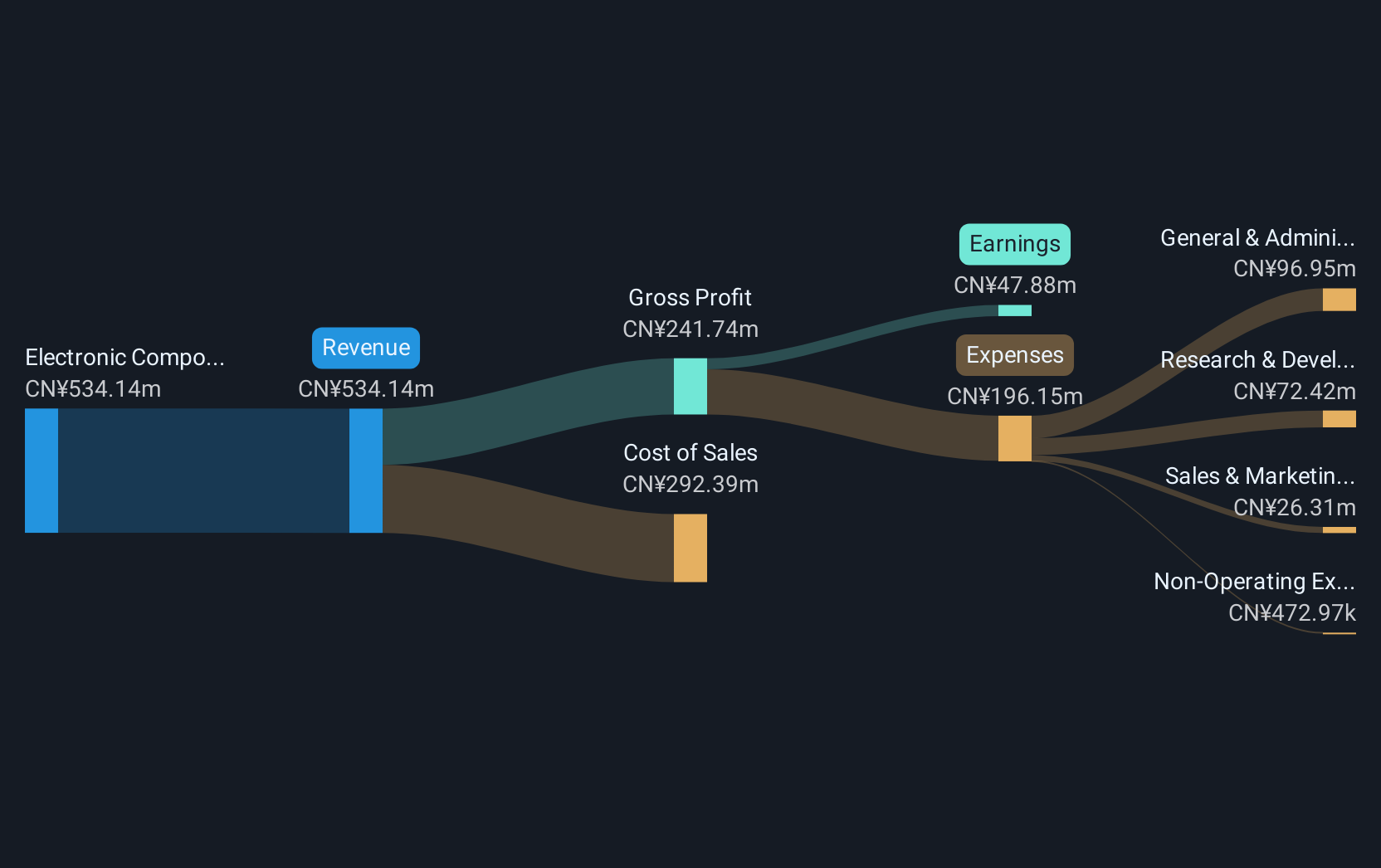

Operations: MLOptic generates revenue primarily from its Electronic Components & Parts segment, contributing CN¥473.59 million.

MLOptic, navigating through a challenging tech landscape, reported a revenue increase to CNY 375.36 million from CNY 359.8 million year-over-year, alongside a dip in net income to CNY 24.49 million from CNY 36.3 million previously. Despite the earnings contraction of -18.5% over the past year, forecasts remain optimistic with expected annual revenue and earnings growth rates of 22% and 34.5%, respectively, outpacing broader market projections. The firm's commitment to innovation is underscored by its recent share repurchases totaling CNY 26.92 million, reflecting confidence in its strategic direction amidst market volatility and ongoing R&D investments that are crucial for sustaining its competitive edge in high-tech optics solutions.

- Click to explore a detailed breakdown of our findings in MLOptic's health report.

Understand MLOptic's track record by examining our Past report.

Huayi Brothers Media (SZSE:300027)

Simply Wall St Growth Rating: ★★★★★★

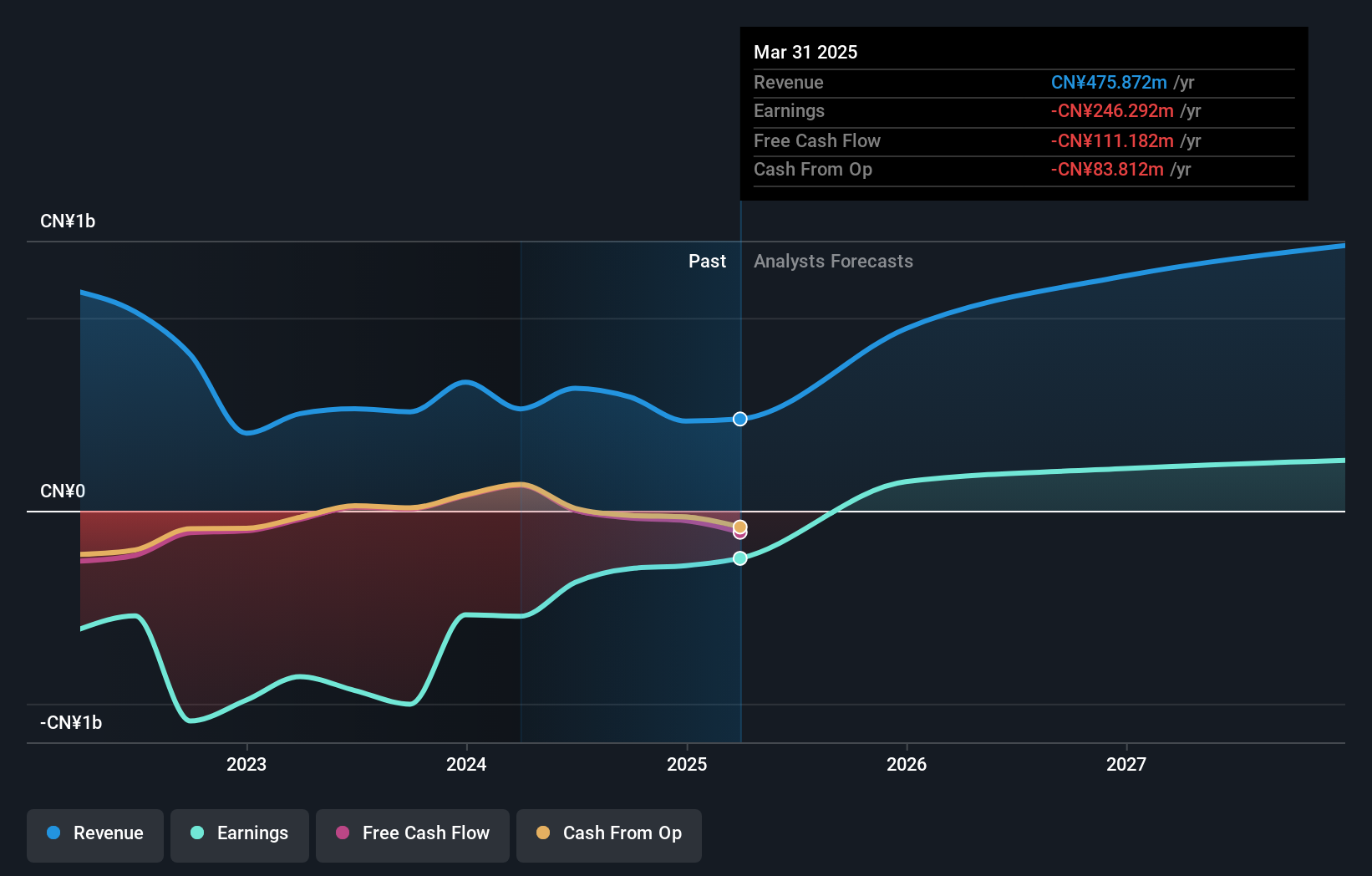

Overview: Huayi Brothers Media Corporation is an entertainment media company with operations in China and internationally, and it has a market cap of CN¥6.80 billion.

Operations: The company generates revenue primarily from film and television production, distribution, and related entertainment services. It also engages in talent management and operates theaters. The business model benefits from a diversified portfolio across various media segments, contributing to its overall financial performance.

Despite its recent unprofitability, Huayi Brothers Media is positioned for significant growth with earnings expected to surge by 110.47% annually. This anticipated turnaround is underpinned by a robust revenue forecast, growing at an impressive rate of 45.2% per year—outstripping the broader Chinese market's growth of 13.5%. The company's strategic moves, including a series of shareholder meetings aimed at enhancing corporate governance and financial strategies, reflect a proactive approach to capitalizing on these growth projections. Moreover, the firm's engagement in high-stakes decisions about share offerings and stock option plans underscores its commitment to long-term shareholder value amidst a volatile entertainment landscape.

- Dive into the specifics of Huayi Brothers Media here with our thorough health report.

Evaluate Huayi Brothers Media's historical performance by accessing our past performance report.

Jiangsu Zeyu Intelligent PowerLtd (SZSE:301179)

Simply Wall St Growth Rating: ★★★★★☆

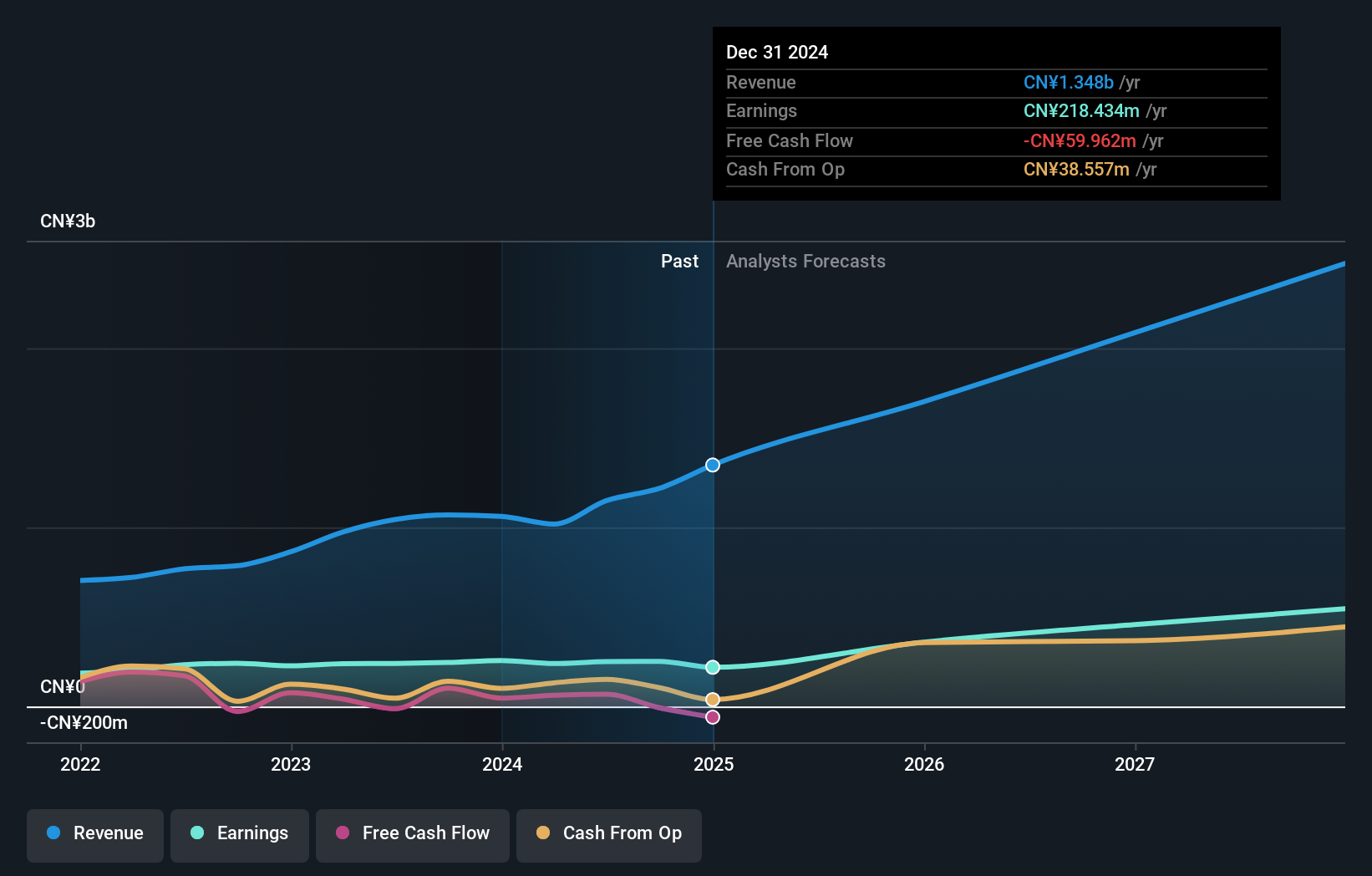

Overview: Jiangsu Zeyu Intelligent Power Co., Ltd. provides engineering construction, operation and maintenance, system integration, and design and consulting services for the power industry in China, with a market cap of CN¥5.64 billion.

Operations: The company generates revenue through its specialized services in engineering construction, operation and maintenance, system integration, and design and consulting within China's power sector. With a market cap of CN¥5.64 billion, it focuses on delivering comprehensive solutions to the power industry.

Jiangsu Zeyu Intelligent PowerLtd, amidst a competitive tech landscape, is making notable strides with a projected annual revenue growth of 26.1%, outpacing the broader Chinese market's 13.5%. This growth is complemented by an impressive forecast of earnings increasing at 30.4% annually. The firm recently reported a robust nine-month revenue jump to CNY 713.17 million from CNY 556.89 million year-over-year, although net income slightly dipped to CNY 131.59 million from CNY 136.25 million, reflecting strategic investments and adjustments in operations highlighted in their latest extraordinary shareholders meeting aimed at optimizing capital use and enhancing operational efficiency.

Summing It All Up

- Dive into all 1267 of the High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301179

Jiangsu Zeyu Intelligent PowerLtd

Engages in provision of engineering construction, operation and maintenance, system integration, and design and consulting services for the power industry in China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion