- China

- /

- Electronic Equipment and Components

- /

- SHSE:688502

High Growth Tech Stocks In Asia To Watch December 2025

Reviewed by Simply Wall St

As the Asian tech market navigates a complex landscape marked by Japan's highest interest rates in three decades and China's mixed economic indicators, investors are keenly observing how these macroeconomic factors may influence the region's high-growth sectors. In such an environment, a good stock often exhibits resilience through robust fundamentals and adaptability to shifting economic conditions, making it well-positioned to capitalize on emerging technological trends.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi TechnologyLtd | 21.60% | 32.84% | ★★★★★★ |

| Suzhou TFC Optical Communication | 36.73% | 38.14% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Zhongji Innolight | 35.08% | 35.94% | ★★★★★★ |

| Fositek | 37.83% | 51.54% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

MLOptic (SHSE:688502)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MLOptic Corp. is a precision optical solutions company serving both domestic and international markets, with a market cap of CN¥19.89 billion.

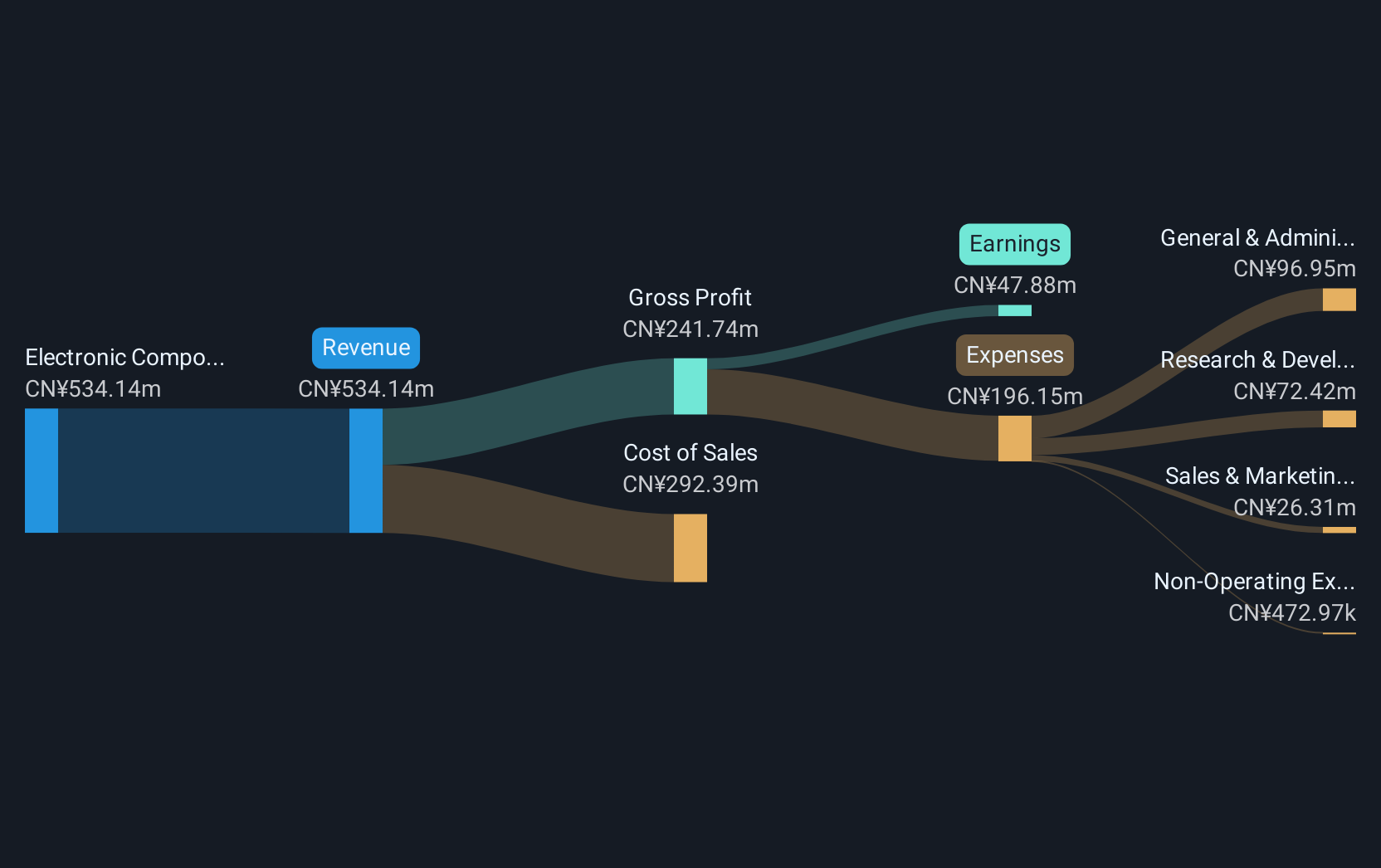

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, amounting to CN¥630.65 million.

MLOptic has demonstrated robust growth in a competitive tech landscape, with a notable 21% annual increase in revenue and an impressive 31.1% surge in earnings per year. This performance is significantly ahead of the broader Chinese market's growth rates of 14.4% for revenue and 27.2% for earnings, highlighting MLOptic's strong market position and operational efficiency. The company's recent financial results further underscore its upward trajectory; for the nine months ending September 2025, sales jumped to CNY 503.18 million from CNY 375.36 million year-over-year, with net income more than doubling to CNY 45.69 million from CNY 24.49 million, reflecting both strategic execution and market demand strength. Despite not leading the high-growth tech sector outright in Asia, MLOptic’s substantial investment in R&D—which remains undisclosed but is pivotal for sustaining innovation—coupled with its recent earnings momentum suggests it is well-positioned to capitalize on future technological advancements and customer needs expansion within the region’s bustling electronic industry landscape.

- Unlock comprehensive insights into our analysis of MLOptic stock in this health report.

Examine MLOptic's past performance report to understand how it has performed in the past.

Hefei Kewell Power SystemLtd (SHSE:688551)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hefei Kewell Power System Co., Ltd. specializes in providing testing equipment for test systems and intelligent manufacturing equipment in China, with a market capitalization of approximately CN¥3.04 billion.

Operations: The company focuses on developing and supplying advanced testing equipment and intelligent manufacturing solutions, primarily serving the Chinese market. It operates with a market capitalization of around CN¥3.04 billion, indicating its significant presence in the industry.

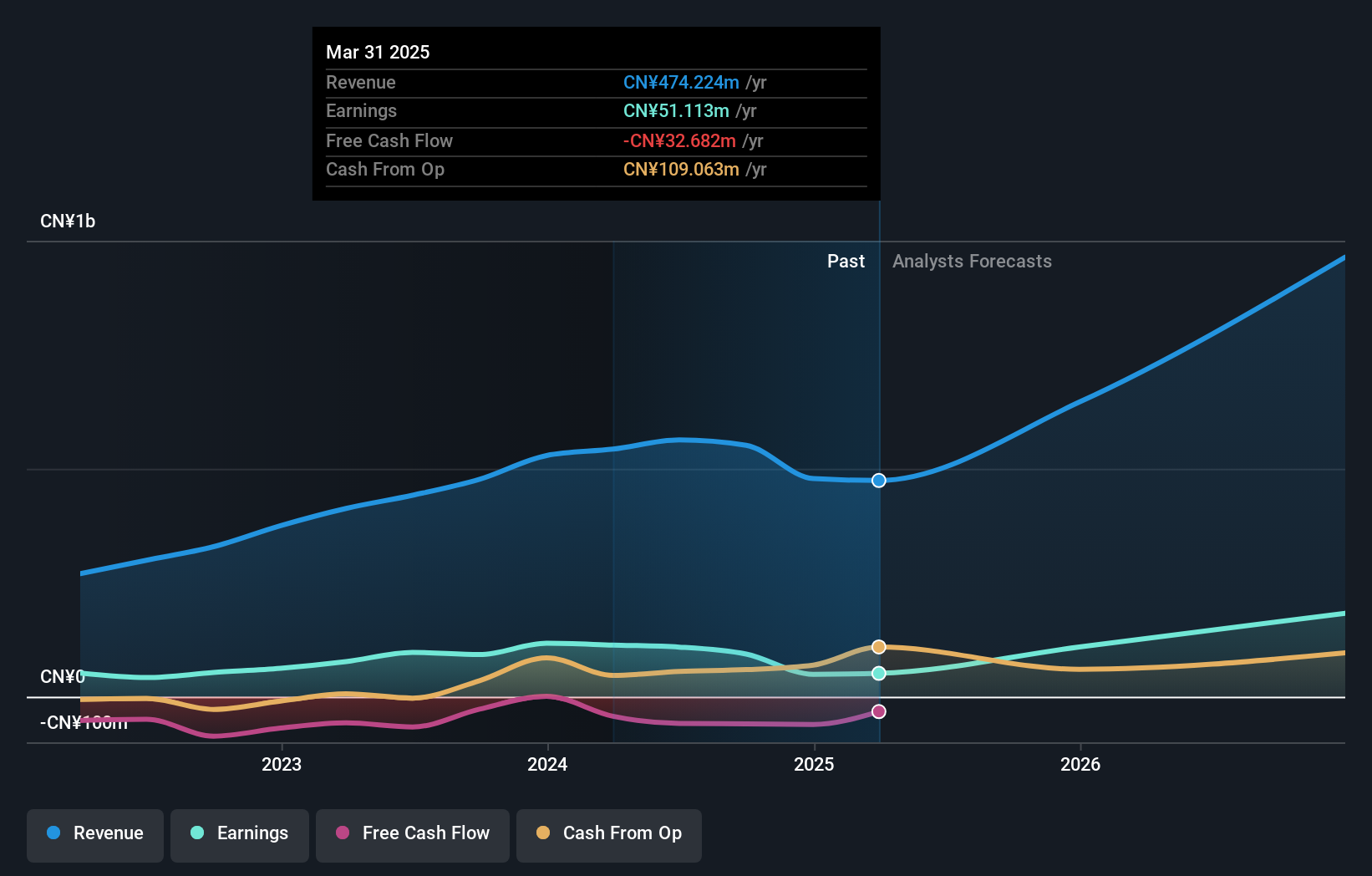

Hefei Kewell Power SystemLtd, amidst a challenging landscape, reported consistent earnings with a net income of CNY 51.6 million for the nine months ending September 2025, mirroring the previous year's figures. Despite a slight dip in revenue from CNY 377.24 million to CNY 369.79 million year-over-year, the company's commitment to innovation is evident with an expected annual revenue growth rate of 54.9% and earnings growth forecast at an impressive 89% per annum. This positions them well above the broader Chinese market expectations and underscores their potential in harnessing future tech advancements despite current volatility in earnings performance.

POCO Holding (SZSE:300811)

Simply Wall St Growth Rating: ★★★★★☆

Overview: POCO Holding Co., Ltd. focuses on the development, production, and sale of alloy soft magnetic powder and components for electronic equipment, with a market capitalization of CN¥20.81 billion.

Operations: POCO Holding Co., Ltd. specializes in producing alloy soft magnetic powder and core components primarily for electronic equipment manufacturers. The company generates revenue through the sale of these specialized materials, which are integral to the functionality of various electronic devices.

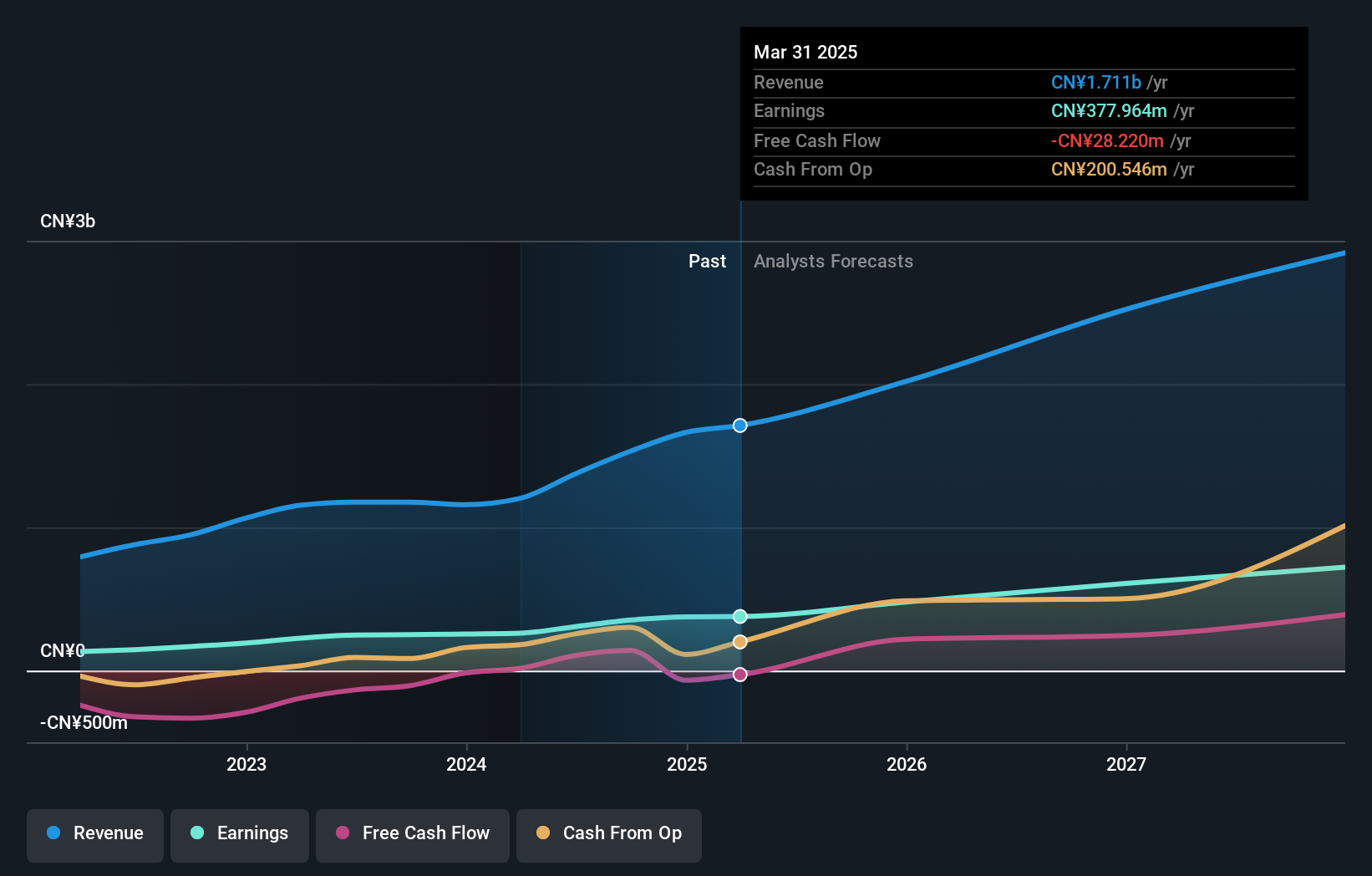

POCO Holding has demonstrated a robust financial trajectory, with revenues climbing to CNY 1.3 billion, up from CNY 1.23 billion year-over-year, and net income increasing slightly to CNY 293.58 million. This growth is underpinned by a notable annual revenue increase of 25.2% and an earnings surge of 30.7%. The company's commitment to innovation is reflected in its R&D investments, crucial for maintaining its competitive edge in the fast-evolving tech landscape of Asia. Despite some volatility in its share price over the past three months, POCO Holding's performance suggests a strong potential for sustained growth, aligning with broader market trends that favor high-tech development.

Turning Ideas Into Actions

- Reveal the 188 hidden gems among our Asian High Growth Tech and AI Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688502

MLOptic

Operates as a precision optical solutions company in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion