Global markets have recently reached record highs, buoyed by favorable trade deals involving the U.S., Japan, and the EU, alongside strong performance in key indices such as the S&P 500 and Nasdaq Composite. As business activity growth is propelled by demand for services despite challenges in manufacturing and housing sectors, investors are keenly observing high-growth tech stocks that can capitalize on these dynamic market conditions.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.05% | 23.29% | ★★★★★★ |

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| Gold Circuit Electronics | 20.97% | 26.54% | ★★★★★★ |

| Fositek | 30.51% | 37.34% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| KebNi | 20.56% | 65.02% | ★★★★★★ |

| Bonesupport Holding | 23.98% | 62.26% | ★★★★★★ |

| Nayax | 22.26% | 57.43% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Genew TechnologiesLtd (SHSE:688418)

Simply Wall St Growth Rating: ★★★★★☆

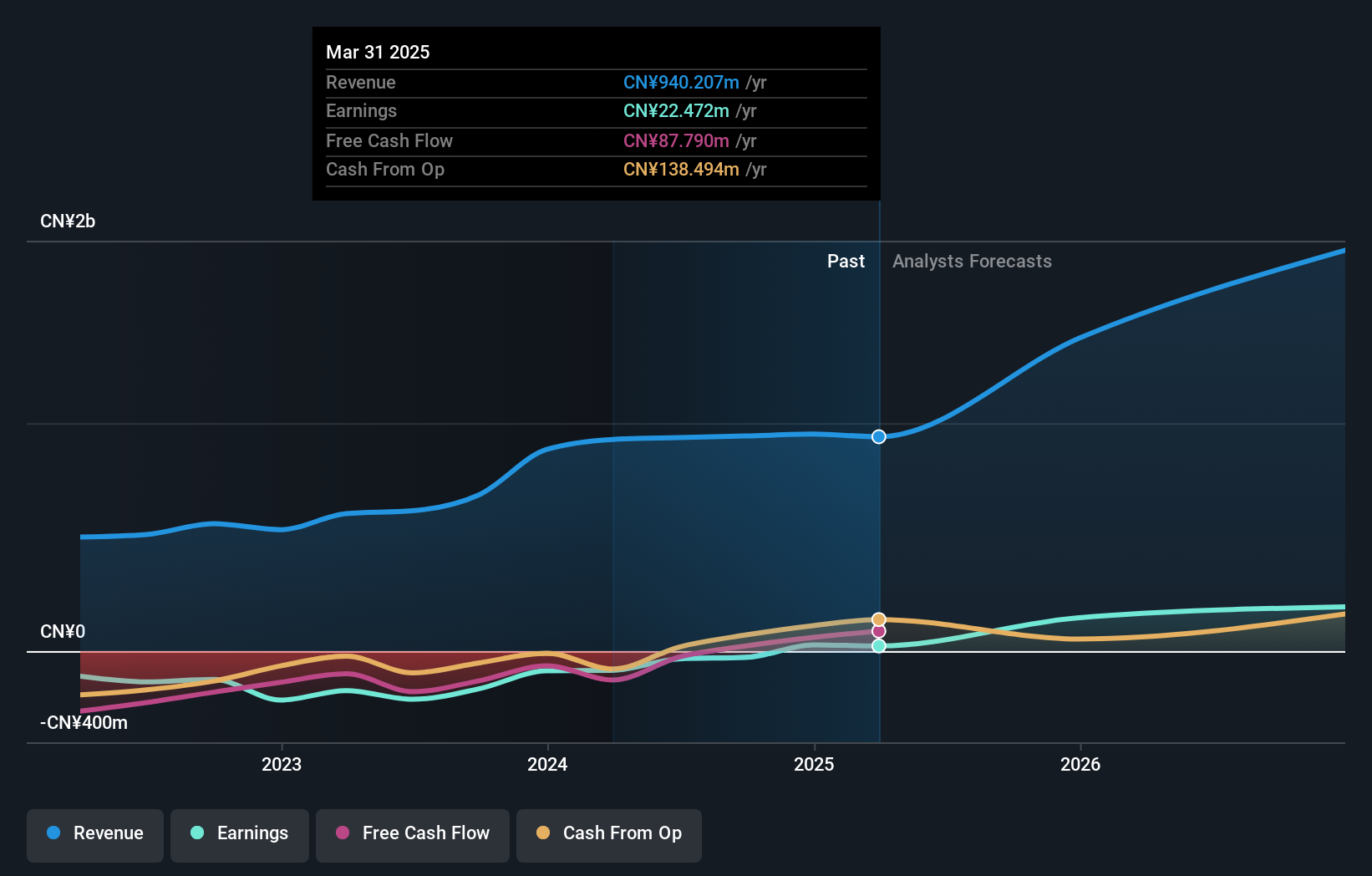

Overview: Genew Technologies Co., Ltd. focuses on the research, development, production, and sale of communication and network products globally, with a market cap of CN¥5.33 billion.

Operations: Genew Technologies Co., Ltd. specializes in developing and selling communication and network products internationally. The company generates revenue from its comprehensive product offerings, with a focus on innovation in the telecommunications sector.

Genew Technologies has recently demonstrated a robust trajectory in the tech sector, with an annual revenue growth rate of 34.2%, significantly outpacing the broader Chinese market's growth of 12.6%. This surge is complemented by an impressive forecast for earnings growth at 79.3% per year, highlighting its potential in a competitive landscape. Furthermore, the company's recent strategic moves, including a CNY 1.07 billion private placement and shareholder approvals for expansion initiatives, underscore its aggressive pursuit of innovation and market share expansion. These factors collectively suggest that Genew is not only capturing but also setting industry trends through substantial investments in technology and strategic market maneuvers.

- Get an in-depth perspective on Genew TechnologiesLtd's performance by reading our health report here.

Gain insights into Genew TechnologiesLtd's past trends and performance with our Past report.

Venustech Group (SZSE:002439)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Venustech Group Inc. specializes in offering network security products, trusted security management platforms, and specialized security services globally, with a market cap of approximately CN¥19.19 billion.

Operations: The company generates revenue primarily from information network security, contributing CN¥3.01 billion to its overall financial performance.

Venustech Group is navigating the competitive tech landscape with a projected annual revenue growth of 17.7%, outperforming the broader Chinese market's average of 12.6%. Despite current unprofitability, the company's earnings are expected to surge by 43.1% annually, signaling robust future potential. This growth trajectory is supported by strategic initiatives such as the recent extraordinary shareholders meeting aimed at bolstering corporate governance and expansion strategies. With R&D expenses tailored to foster innovation, Venustech is positioning itself to capitalize on emerging tech trends, although it faces challenges in achieving positive cash flow and a modest forecasted return on equity of 3.3%.

- Click here and access our complete health analysis report to understand the dynamics of Venustech Group.

Explore historical data to track Venustech Group's performance over time in our Past section.

ASROCK Incorporation (TWSE:3515)

Simply Wall St Growth Rating: ★★★★★☆

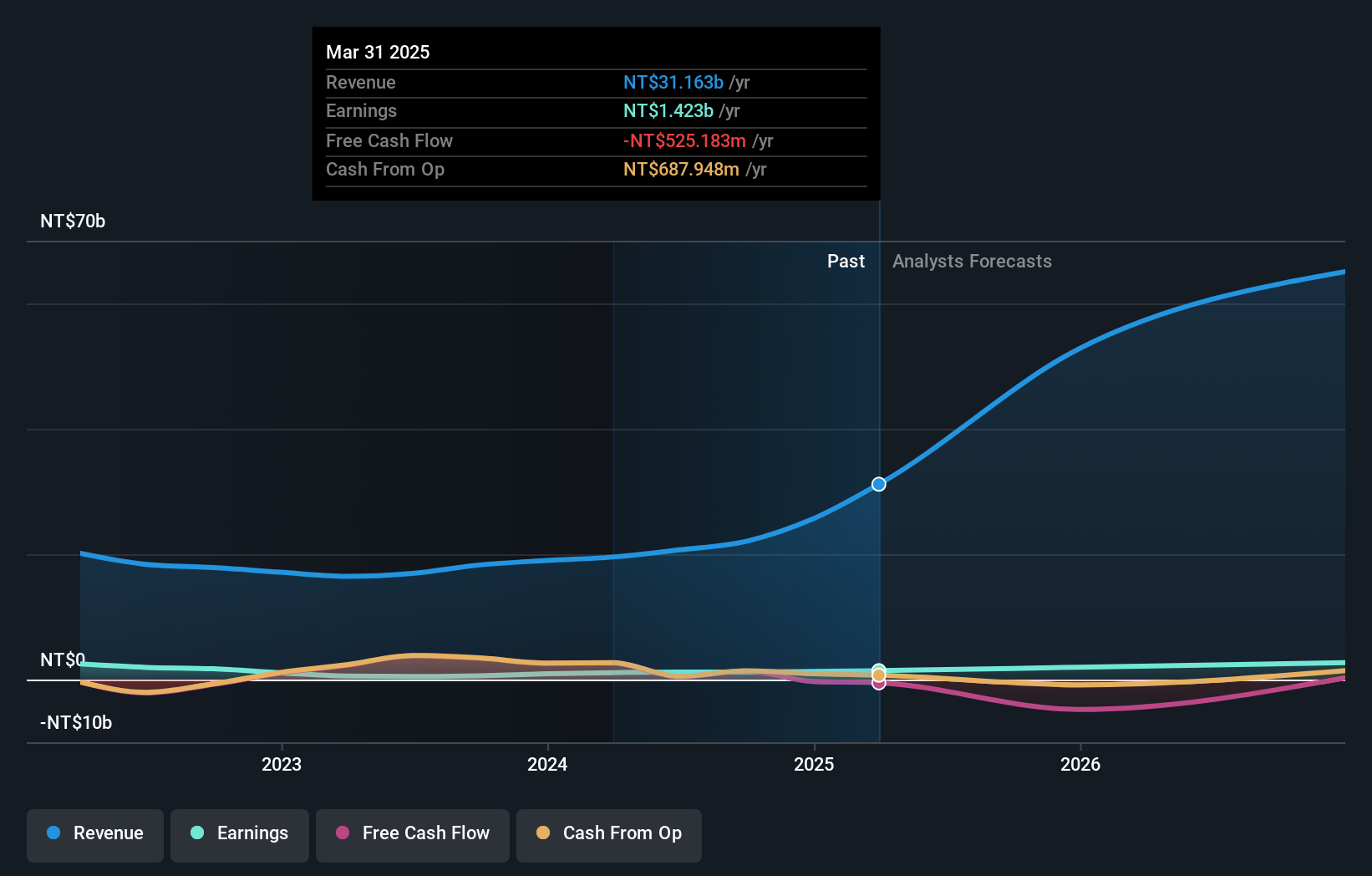

Overview: ASROCK Incorporation is a Taiwanese company that designs, develops, and sells motherboards, with a market capitalization of NT$32.93 billion.

Operations: The company's primary revenue stream comes from its motherboard sales, totaling NT$37.96 billion.

ASROCK Incorporation stands out in the tech sector with its robust annual revenue growth of 33.2%, significantly outpacing the Taiwan market average of 10%. This growth is complemented by an impressive earnings increase, forecasted at 36.2% annually, which notably exceeds the industry's past year performance of 12.3%. The company's commitment to innovation is evident from its strategic R&D investments, directly contributing to these financial achievements and positioning ASROCK as a dynamic player in technology advancements. Recent corporate developments, including amendments to its Articles of Incorporation and presentations at major investment forums, underscore a proactive approach in governance and market engagement that could further bolster its competitive edge and future prospects.

- Unlock comprehensive insights into our analysis of ASROCK Incorporation stock in this health report.

Seize The Opportunity

- Unlock more gems! Our Global High Growth Tech and AI Stocks screener has unearthed 223 more companies for you to explore.Click here to unveil our expertly curated list of 226 Global High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002439

Venustech Group

Provides network security products, trusted security management platforms, and specialized security services and solutions worldwide.

Flawless balance sheet and good value.

Market Insights

Community Narratives