- China

- /

- Communications

- /

- SHSE:688418

Cautious Investors Not Rewarding Genew Technologies Co.,Ltd.'s (SHSE:688418) Performance Completely

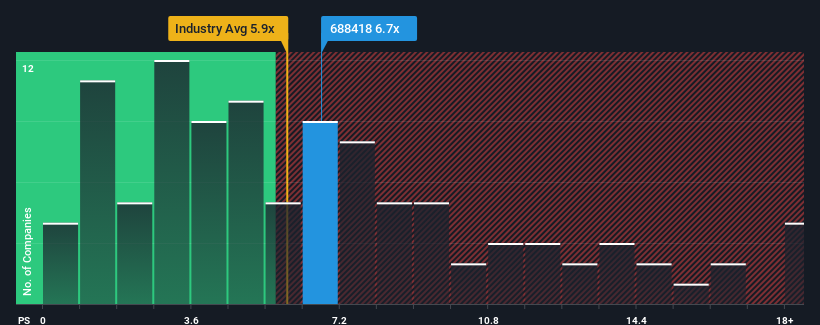

With a median price-to-sales (or "P/S") ratio of close to 5.9x in the Communications industry in China, you could be forgiven for feeling indifferent about Genew Technologies Co.,Ltd.'s (SHSE:688418) P/S ratio of 6.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Genew TechnologiesLtd

How Genew TechnologiesLtd Has Been Performing

Recent times have been advantageous for Genew TechnologiesLtd as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Genew TechnologiesLtd's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Genew TechnologiesLtd?

The only time you'd be comfortable seeing a P/S like Genew TechnologiesLtd's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 37%. The latest three year period has also seen an excellent 90% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 43% during the coming year according to the dual analysts following the company. That's shaping up to be materially higher than the 31% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Genew TechnologiesLtd's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Genew TechnologiesLtd's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Genew TechnologiesLtd that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688418

Genew TechnologiesLtd

Engages in the research and development, production, and sale of communication and network products worldwide.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026