- China

- /

- Electronic Equipment and Components

- /

- SHSE:688400

LUSTER LightTech Co., LTD. (SHSE:688400) Shares Slammed 26% But Getting In Cheap Might Be Difficult Regardless

LUSTER LightTech Co., LTD. (SHSE:688400) shares have had a horrible month, losing 26% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 48% in that time.

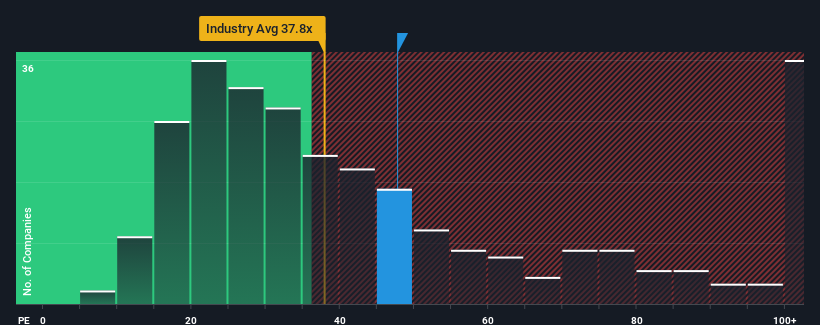

Even after such a large drop in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may still consider LUSTER LightTech as a stock to avoid entirely with its 47.7x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, LUSTER LightTech's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for LUSTER LightTech

How Is LUSTER LightTech's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like LUSTER LightTech's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 20%. This means it has also seen a slide in earnings over the longer-term as EPS is down 2.5% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 70% during the coming year according to the three analysts following the company. With the market only predicted to deliver 35%, the company is positioned for a stronger earnings result.

With this information, we can see why LUSTER LightTech is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

LUSTER LightTech's shares may have retreated, but its P/E is still flying high. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that LUSTER LightTech maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for LUSTER LightTech that you need to be mindful of.

If you're unsure about the strength of LUSTER LightTech's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688400

LUSTER LightTech

Researches, develops, and sales of configurable visual systems, intelligent visual equipment, and optical communication products in China.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success