- China

- /

- Electronic Equipment and Components

- /

- SZSE:301556

Undiscovered Gems To Explore This February 2025

Reviewed by Simply Wall St

As global markets navigate a period of volatility marked by fluctuating interest rates and geopolitical tensions, small-cap stocks have shown resilience amid broader market shifts. Despite recent challenges, such as AI competition fears impacting tech-heavy indices, the search for promising opportunities continues to draw investors towards lesser-known companies that demonstrate strong fundamentals and growth potential. In this dynamic environment, identifying stocks with solid financial health and innovative capabilities can be key to uncovering undiscovered gems worth exploring.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Kenturn Nano. Tec | 45.38% | 9.73% | 28.94% | ★★★★★☆ |

| Co-Tech Development | 26.81% | 3.29% | 6.53% | ★★★★★☆ |

| Feedback Technology | 23.09% | 11.19% | 19.33% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Dong Feng Electronic TechnologyLtd (SHSE:600081)

Simply Wall St Value Rating: ★★★★★★

Overview: Dong Feng Electronic Technology Co., Ltd. is involved in the manufacture and sale of automotive parts and accessories in China, with a market cap of CN¥5.70 billion.

Operations: Dong Feng Electronic Technology Co., Ltd. generates revenue primarily from the sale of automotive parts and accessories in China. The company's market capitalization stands at approximately CN¥5.70 billion.

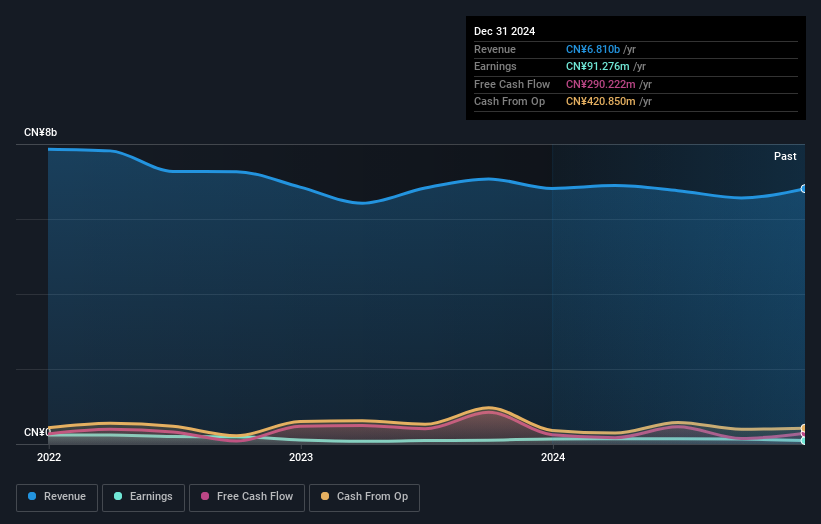

Dong Feng Electronic Technology Ltd. has been making waves with its recent performance, showing a 27% earnings growth over the past year, outpacing the Auto Components industry average of 10%. This growth is partly influenced by a significant one-off gain of CN¥75M, which highlights its ability to capitalize on unique opportunities. Over the last five years, it has managed to reduce its debt-to-equity ratio from 13.6% to 8.1%, indicating prudent financial management. The company also boasts more cash than total debt and generates positive free cash flow, painting a promising picture for potential investors in this niche sector.

Jilin OLED Material Tech (SHSE:688378)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jilin OLED Material Tech Co., Ltd. focuses on the research, development, production, and sale of organic electroluminescent materials and equipment for China's new display industry with a market cap of CN¥4.79 billion.

Operations: Jilin OLED Material Tech derives its revenue from the sale of organic electroluminescent materials and equipment. The company has a market cap of CN¥4.79 billion and focuses on serving China's new display industry.

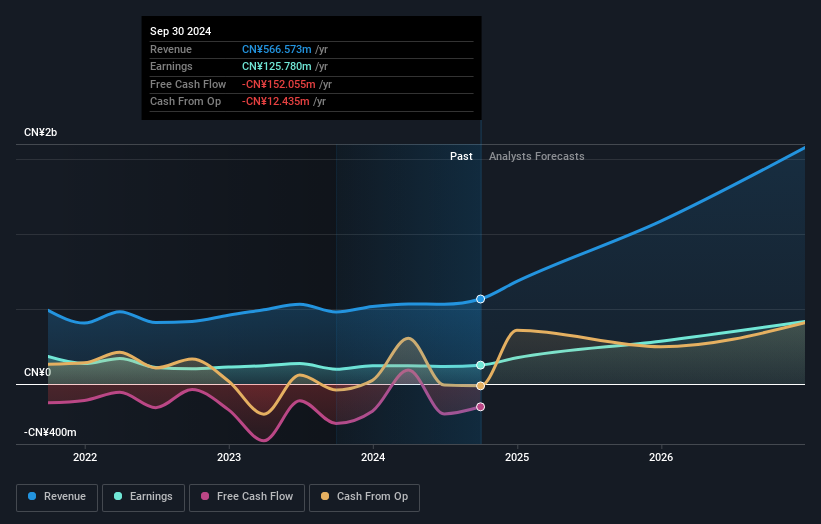

Jilin OLED Material Tech, a notable player in the electronics sector, has shown promising growth with earnings increasing by 27.2% over the past year, outpacing the industry's 3%. The company's debt-to-equity ratio improved significantly from 12.4% to 3.3% over five years, indicating better financial health. A one-off gain of CN¥75.7M impacted recent results, highlighting some volatility in earnings quality. Despite not being free cash flow positive and trading at a price-to-earnings ratio of 39.7x below industry average (49.9x), Jilin plans to repurchase up to CN¥100M worth of shares for employee incentives and equity plans using its own funds and a special loan facility.

- Get an in-depth perspective on Jilin OLED Material Tech's performance by reading our health report here.

Gain insights into Jilin OLED Material Tech's past trends and performance with our Past report.

Zhejiang Top Cloud-agri TechnologyLtd (SZSE:301556)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Top Cloud-agri Technology Co., Ltd. operates in the agricultural technology sector and has a market cap of CN¥8.24 billion.

Operations: The company generates revenue primarily from its agricultural technology solutions. It has a market cap of CN¥8.24 billion, indicating significant valuation in the sector.

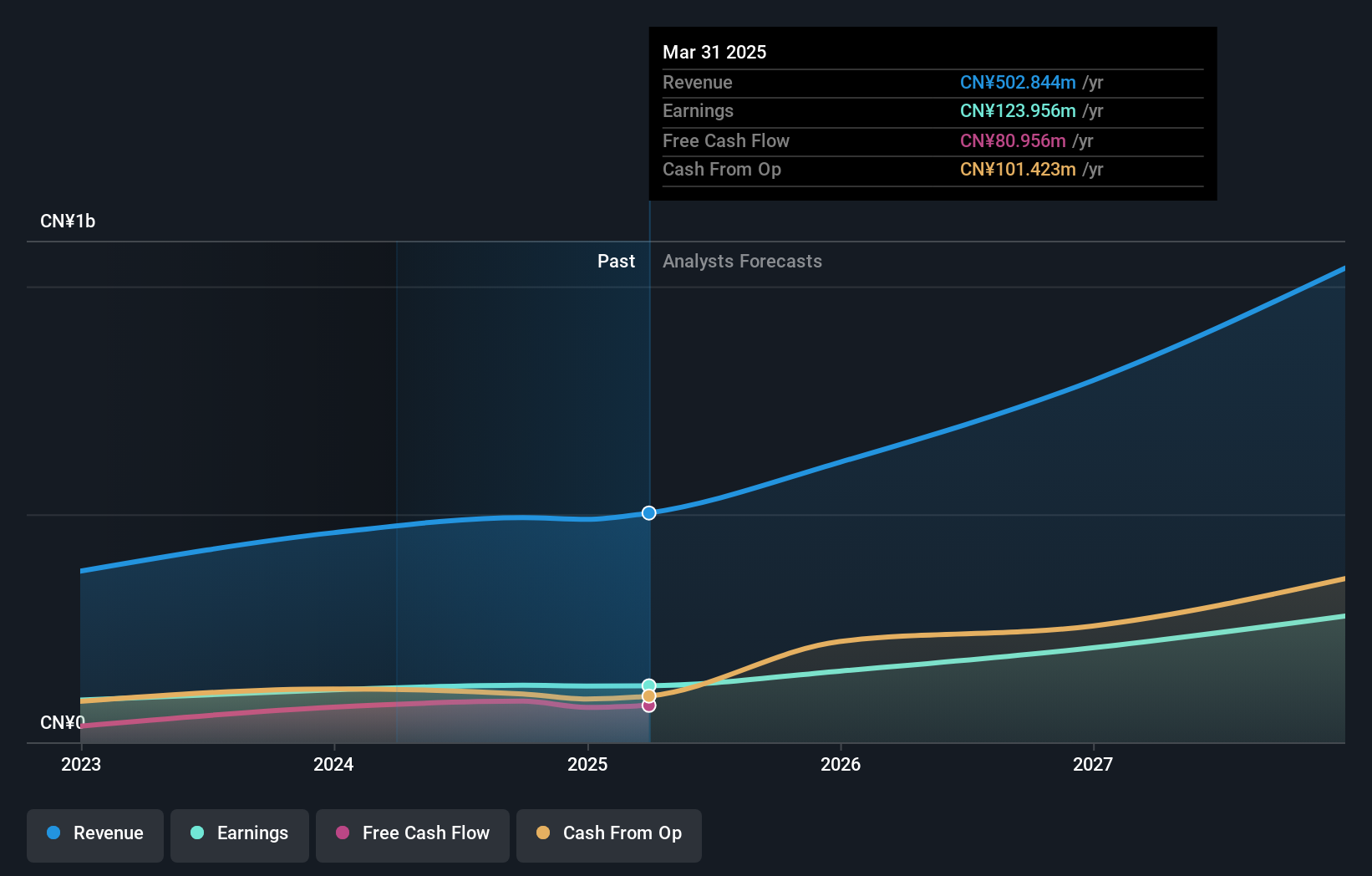

Zhejiang Top Cloud-agri Technology, an intriguing player in the tech space, showcases robust financial health with a 14% earnings growth over the past year, outpacing the broader electronic industry by 11%. The company is debt-free now compared to a 5.1% debt-to-equity ratio five years ago, highlighting its improved financial discipline. Despite recent share price volatility, it remains free cash flow positive with US$90 million in levered free cash flow as of September 2024. Looking ahead, earnings are projected to grow at an impressive rate of over 31% annually.

Turning Ideas Into Actions

- Dive into all 4719 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Top Cloud-agri TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301556

Zhejiang Top Cloud-agri TechnologyLtd

Zhejiang Top Cloud-agri Technology Co.,Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives