- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A078600

Daejoo Electronic Materials And 2 More Insider-Favored Growth Leaders

Reviewed by Simply Wall St

In a week marked by tariff uncertainties and mixed economic data, global markets have experienced fluctuations, with U.S. stocks ending lower despite some recovery after initial losses. Amidst these market dynamics, companies with high insider ownership can often be seen as having strong growth potential due to the confidence insiders demonstrate through their substantial stakes.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.9% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.1% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Brightstar Resources (ASX:BTR) | 9.8% | 86% |

We'll examine a selection from our screener results.

Daejoo Electronic Materials (KOSDAQ:A078600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Daejoo Electronic Materials Co., Ltd. develops and sells electronic materials across various regions including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia with a market cap of ₩1.49 trillion.

Operations: The company generates revenue of ₩208.25 billion from the development, production, and sale of electrical and electronic components.

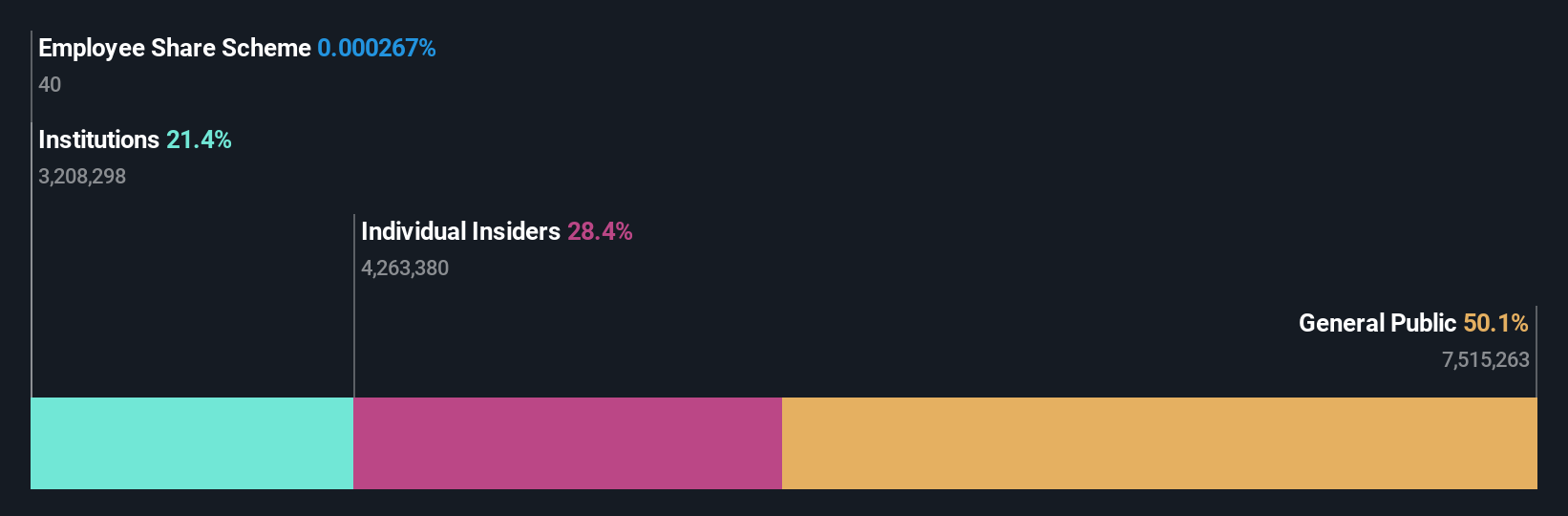

Insider Ownership: 28.3%

Daejoo Electronic Materials has demonstrated significant growth potential, with earnings forecasted to increase by 41% annually, outpacing the KR market's 27%. Recent third-quarter results show a remarkable net income rise to KRW 4.59 billion from KRW 102.6 million a year prior. Despite high share price volatility and debt concerns relative to operating cash flow, revenue is expected to grow at 36.1% annually, surpassing the market average of 9.1%.

- Unlock comprehensive insights into our analysis of Daejoo Electronic Materials stock in this growth report.

- Our valuation report here indicates Daejoo Electronic Materials may be overvalued.

Jilin OLED Material Tech (SHSE:688378)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jilin OLED Material Tech Co., Ltd. focuses on the research, development, production, and sale of organic electroluminescent materials and equipment for China's new display industry, with a market cap of CN¥4.99 billion.

Operations: Jilin OLED Material Tech Co., Ltd. generates revenue through its core activities in the development, manufacturing, and sales of organic electroluminescent materials and equipment tailored for China's new display sector.

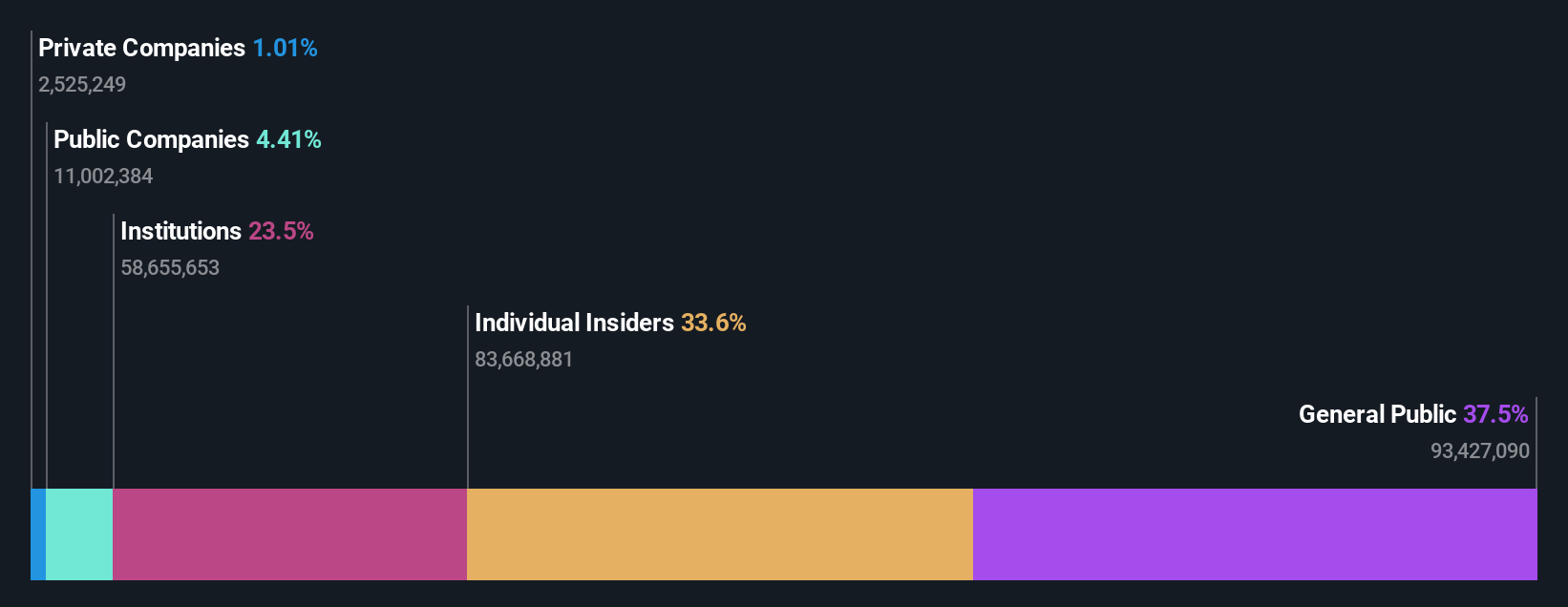

Insider Ownership: 33.5%

Jilin OLED Material Tech is set for robust growth, with earnings projected to rise 51% annually, outpacing the CN market's 25.4%. Revenue growth is also strong at 46.3% per year. Despite a low forecasted return on equity of 17.4%, its price-to-earnings ratio of 42.1x suggests good value compared to peers in the electronic industry average of 49.8x. Recently, a CNY 100 million share buyback program was announced, enhancing shareholder value and supporting employee incentives.

- Click to explore a detailed breakdown of our findings in Jilin OLED Material Tech's earnings growth report.

- Our valuation report unveils the possibility Jilin OLED Material Tech's shares may be trading at a discount.

Guangdong Zhongsheng Pharmaceutical (SZSE:002317)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangdong Zhongsheng Pharmaceutical Co., Ltd. operates in the pharmaceutical industry and has a market capitalization of approximately CN¥94.25 billion.

Operations: Unfortunately, the provided Business operations text does not contain specific revenue segment information for Guangdong Zhongsheng Pharmaceutical Co., Ltd.

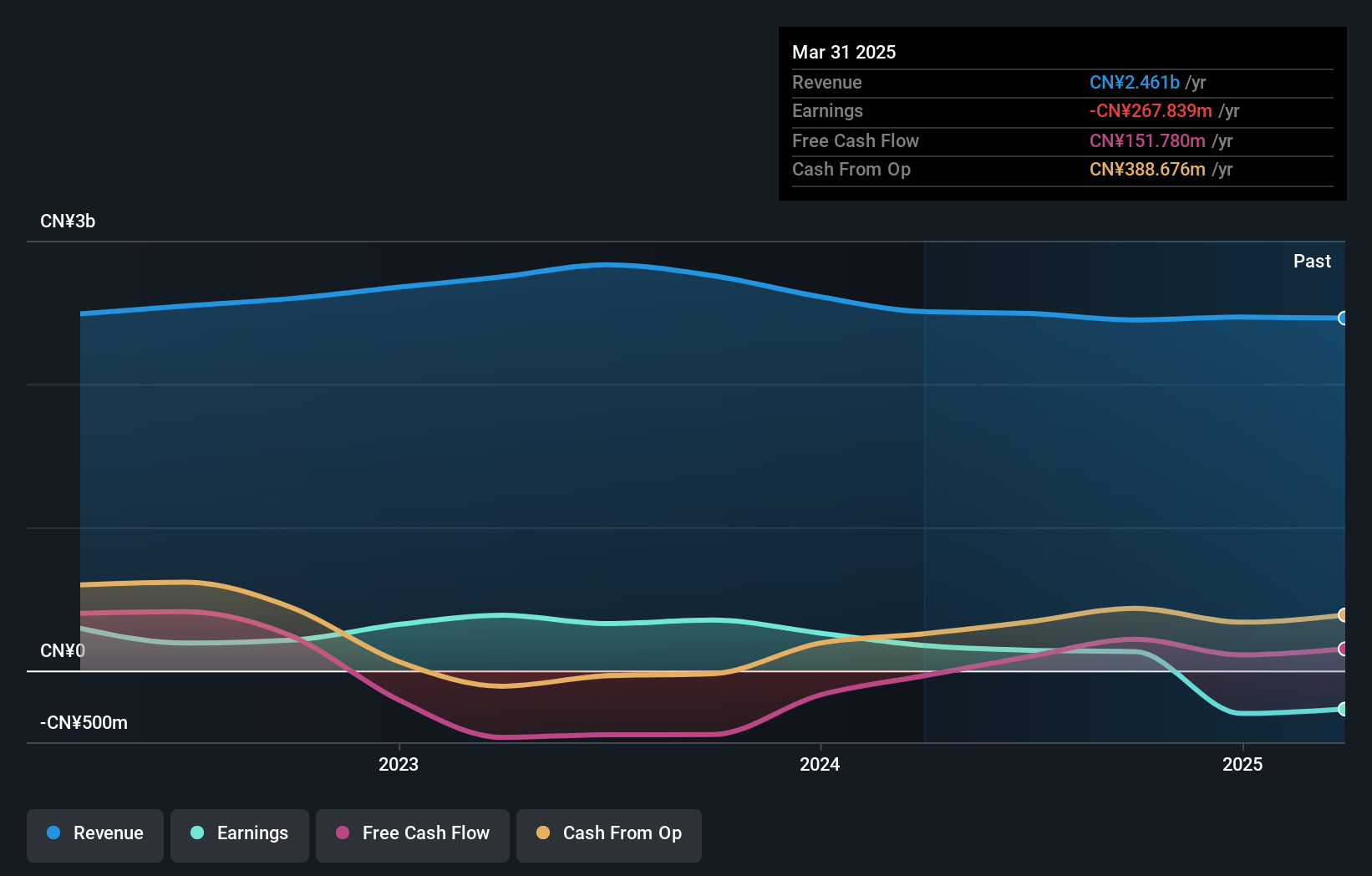

Insider Ownership: 27.8%

Guangdong Zhongsheng Pharmaceutical is poised for significant earnings growth at 41.7% annually, surpassing the CN market's 25.4%, although revenue is expected to grow at a slower pace of 16.3%. Despite this, its return on equity remains low at a forecasted 8.7%, and profit margins have decreased from last year’s figures. A recent extraordinary shareholders meeting discussed connected transactions related to equity redemption in a subsidiary, indicating strategic corporate restructuring efforts.

- Navigate through the intricacies of Guangdong Zhongsheng Pharmaceutical with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Guangdong Zhongsheng Pharmaceutical's shares may be trading at a premium.

Next Steps

- Investigate our full lineup of 1438 Fast Growing Companies With High Insider Ownership right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A078600

Daejoo Electronic Materials

Develops and sells electronic materials in South Korea, China, Taiwan, the United States, Europe, and Southeast Asia.

Solid track record and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)