- China

- /

- Electronic Equipment and Components

- /

- SHSE:688337

Rigol Technologies Co., Ltd. (SHSE:688337) Looks Just Right With A 28% Price Jump

Rigol Technologies Co., Ltd. (SHSE:688337) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 43% in the last twelve months.

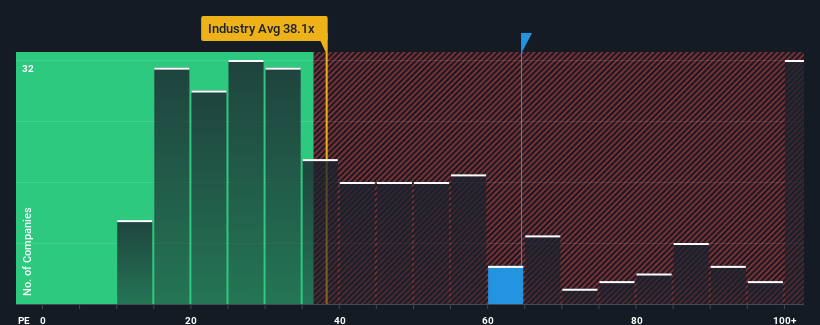

After such a large jump in price, Rigol Technologies may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 64.4x, since almost half of all companies in China have P/E ratios under 30x and even P/E's lower than 18x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Rigol Technologies has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Rigol Technologies

How Is Rigol Technologies' Growth Trending?

In order to justify its P/E ratio, Rigol Technologies would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a decent 7.0% gain to the company's bottom line. However, due to its less than impressive performance prior to this period, EPS growth is practically non-existent over the last three years overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 88% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

In light of this, it's understandable that Rigol Technologies' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Shares in Rigol Technologies have built up some good momentum lately, which has really inflated its P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Rigol Technologies maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Rigol Technologies that you should be aware of.

If these risks are making you reconsider your opinion on Rigol Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688337

Rigol Technologies

Engages in the research, development, manufacturing, and sale of electronic testing and measuring instruments and accessories in China and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives