- China

- /

- Electronic Equipment and Components

- /

- SHSE:688320

Zhejiang Hechuan Technology Co., Ltd.'s (SHSE:688320) 29% Share Price Surge Not Quite Adding Up

Zhejiang Hechuan Technology Co., Ltd. (SHSE:688320) shares have continued their recent momentum with a 29% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 95%.

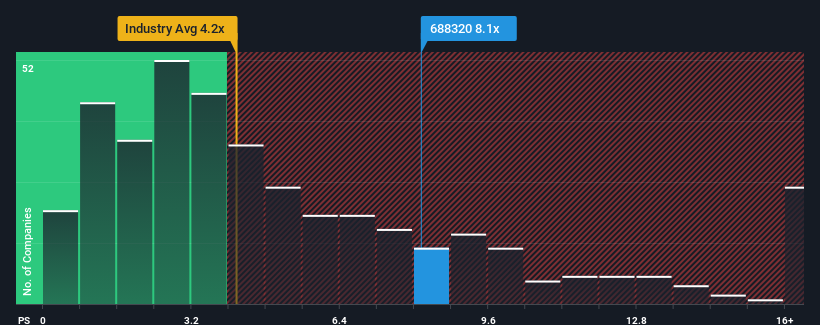

Since its price has surged higher, Zhejiang Hechuan Technology may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 8.1x, when you consider almost half of the companies in the Electronic industry in China have P/S ratios under 4.2x and even P/S lower than 2x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Zhejiang Hechuan Technology

How Zhejiang Hechuan Technology Has Been Performing

While the industry has experienced revenue growth lately, Zhejiang Hechuan Technology's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Zhejiang Hechuan Technology's future stacks up against the industry? In that case, our free report is a great place to start.How Is Zhejiang Hechuan Technology's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Zhejiang Hechuan Technology's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 22%. Regardless, revenue has managed to lift by a handy 16% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should generate growth of 24% as estimated by the dual analysts watching the company. With the industry predicted to deliver 26% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Zhejiang Hechuan Technology's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Zhejiang Hechuan Technology's P/S Mean For Investors?

Shares in Zhejiang Hechuan Technology have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Zhejiang Hechuan Technology currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 1 warning sign for Zhejiang Hechuan Technology you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zhejiang Hechuan Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688320

Zhejiang Hechuan Technology

Engages in the research and development, manufacturing, sale, and application integration of industrial automation products.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)