- China

- /

- Electronic Equipment and Components

- /

- SHSE:688286

Investors Appear Satisfied With MEMSensing Microsystems (Suzhou, China) Co., Ltd.'s (SHSE:688286) Prospects As Shares Rocket 36%

MEMSensing Microsystems (Suzhou, China) Co., Ltd. (SHSE:688286) shares have had a really impressive month, gaining 36% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.4% in the last twelve months.

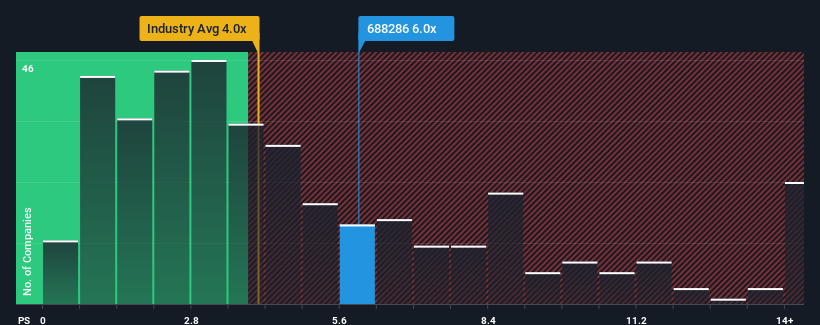

Following the firm bounce in price, MEMSensing Microsystems (Suzhou China) may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 6x, since almost half of all companies in the Electronic in China have P/S ratios under 4x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for MEMSensing Microsystems (Suzhou China)

How Has MEMSensing Microsystems (Suzhou China) Performed Recently?

MEMSensing Microsystems (Suzhou China) certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on MEMSensing Microsystems (Suzhou China).How Is MEMSensing Microsystems (Suzhou China)'s Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as MEMSensing Microsystems (Suzhou China)'s is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 38% gain to the company's top line. As a result, it also grew revenue by 10% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next year should generate growth of 32% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 26% growth forecast for the broader industry.

With this in mind, it's not hard to understand why MEMSensing Microsystems (Suzhou China)'s P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The large bounce in MEMSensing Microsystems (Suzhou China)'s shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that MEMSensing Microsystems (Suzhou China) maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electronic industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - MEMSensing Microsystems (Suzhou China) has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688286

MEMSensing Microsystems (Suzhou China)

MEMSensing Microsystems (Suzhou, China) Co., Ltd.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion