- China

- /

- Communications

- /

- SHSE:688283

After Leaping 40% Chengdu KSW Technologies Co.,Ltd. (SHSE:688283) Shares Are Not Flying Under The Radar

Chengdu KSW Technologies Co.,Ltd. (SHSE:688283) shareholders have had their patience rewarded with a 40% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 37% over that time.

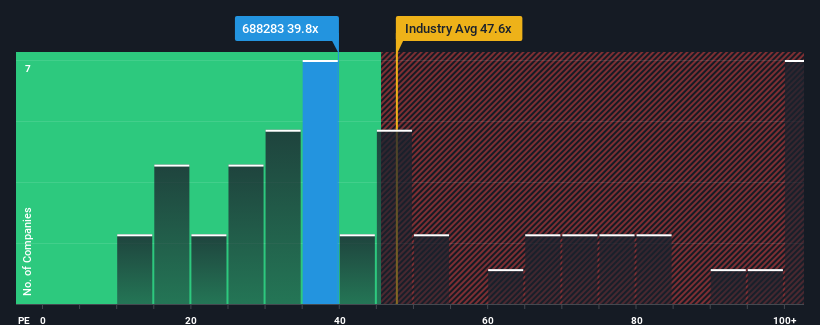

Since its price has surged higher, Chengdu KSW TechnologiesLtd's price-to-earnings (or "P/E") ratio of 39.8x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 32x and even P/E's below 19x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times haven't been advantageous for Chengdu KSW TechnologiesLtd as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for Chengdu KSW TechnologiesLtd

How Is Chengdu KSW TechnologiesLtd's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Chengdu KSW TechnologiesLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 20% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the one analyst covering the company suggest earnings should grow by 35% per year over the next three years. That's shaping up to be materially higher than the 19% each year growth forecast for the broader market.

In light of this, it's understandable that Chengdu KSW TechnologiesLtd's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Chengdu KSW TechnologiesLtd's P/E

Chengdu KSW TechnologiesLtd's P/E is getting right up there since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Chengdu KSW TechnologiesLtd maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Chengdu KSW TechnologiesLtd (1 makes us a bit uncomfortable!) that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688283

Chengdu KSW TechnologiesLtd

Engages in the research and development, manufacture, and sale of wireless channel emulators and radio frequency microwave signal generator products in China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives