- China

- /

- Electronic Equipment and Components

- /

- SHSE:688260

With A 39% Price Drop For Suzhou Gyz Electronic Technology Co.,Ltd (SHSE:688260) You'll Still Get What You Pay For

Suzhou Gyz Electronic Technology Co.,Ltd (SHSE:688260) shares have had a horrible month, losing 39% after a relatively good period beforehand. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 14%.

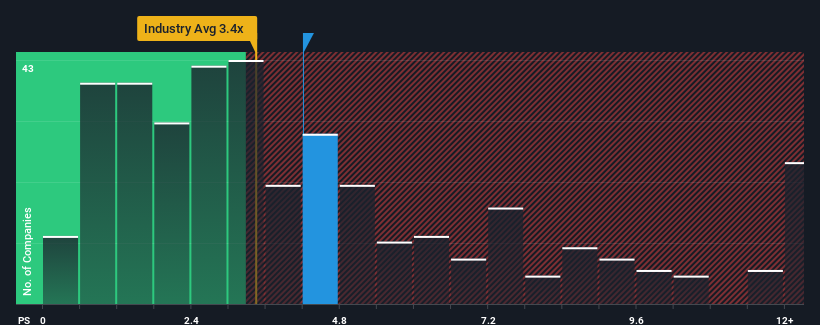

Even after such a large drop in price, when almost half of the companies in China's Electronic industry have price-to-sales ratios (or "P/S") below 3.4x, you may still consider Suzhou Gyz Electronic TechnologyLtd as a stock probably not worth researching with its 4.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Suzhou Gyz Electronic TechnologyLtd

What Does Suzhou Gyz Electronic TechnologyLtd's Recent Performance Look Like?

Suzhou Gyz Electronic TechnologyLtd certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Suzhou Gyz Electronic TechnologyLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Suzhou Gyz Electronic TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 5.2% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 34% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 23%, which is noticeably less attractive.

In light of this, it's understandable that Suzhou Gyz Electronic TechnologyLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Suzhou Gyz Electronic TechnologyLtd's P/S

Despite the recent share price weakness, Suzhou Gyz Electronic TechnologyLtd's P/S remains higher than most other companies in the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Suzhou Gyz Electronic TechnologyLtd shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Suzhou Gyz Electronic TechnologyLtd, and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688260

Suzhou Gyz Electronic TechnologyLtd

Designs and produces electronic components in China.

High growth potential with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success