- China

- /

- Electronic Equipment and Components

- /

- SHSE:688205

Wuxi Taclink Optoelectronics Technology Co., Ltd.'s (SHSE:688205) Stock Retreats 30% But Revenues Haven't Escaped The Attention Of Investors

The Wuxi Taclink Optoelectronics Technology Co., Ltd. (SHSE:688205) share price has softened a substantial 30% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 76%, which is great even in a bull market.

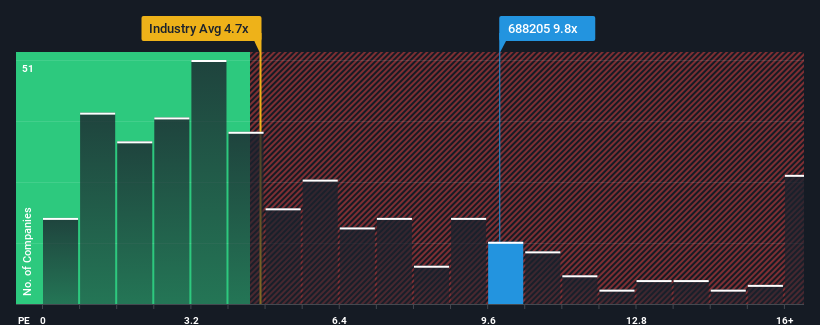

Even after such a large drop in price, Wuxi Taclink Optoelectronics Technology may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 9.8x, when you consider almost half of the companies in the Electronic industry in China have P/S ratios under 4.7x and even P/S lower than 2x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Wuxi Taclink Optoelectronics Technology

How Has Wuxi Taclink Optoelectronics Technology Performed Recently?

Recent times have been advantageous for Wuxi Taclink Optoelectronics Technology as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Wuxi Taclink Optoelectronics Technology.Is There Enough Revenue Growth Forecasted For Wuxi Taclink Optoelectronics Technology?

Wuxi Taclink Optoelectronics Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. As a result, it also grew revenue by 19% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 37% over the next year. With the industry only predicted to deliver 26%, the company is positioned for a stronger revenue result.

With this information, we can see why Wuxi Taclink Optoelectronics Technology is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Wuxi Taclink Optoelectronics Technology's P/S?

Wuxi Taclink Optoelectronics Technology's shares may have suffered, but its P/S remains high. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Wuxi Taclink Optoelectronics Technology's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Wuxi Taclink Optoelectronics Technology (1 shouldn't be ignored) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Taclink Optoelectronics Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688205

Wuxi Taclink Optoelectronics Technology

Wuxi Taclink Optoelectronics Technology Co., Ltd.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives