- South Korea

- /

- Entertainment

- /

- KOSDAQ:A041510

High Growth Tech And 2 Other Innovative Stocks With Potential For Expansion

Reviewed by Simply Wall St

As global markets experience a mixed end to the year, with U.S. consumer confidence declining and major stock indexes showing moderate gains, investors are closely watching the performance of technology-heavy indices like the Nasdaq Composite. In such a dynamic environment, identifying stocks with robust growth potential often involves looking at companies that not only innovate but also adapt effectively to changing economic conditions and market trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1261 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

SM Entertainment (KOSDAQ:A041510)

Simply Wall St Growth Rating: ★★★★☆☆

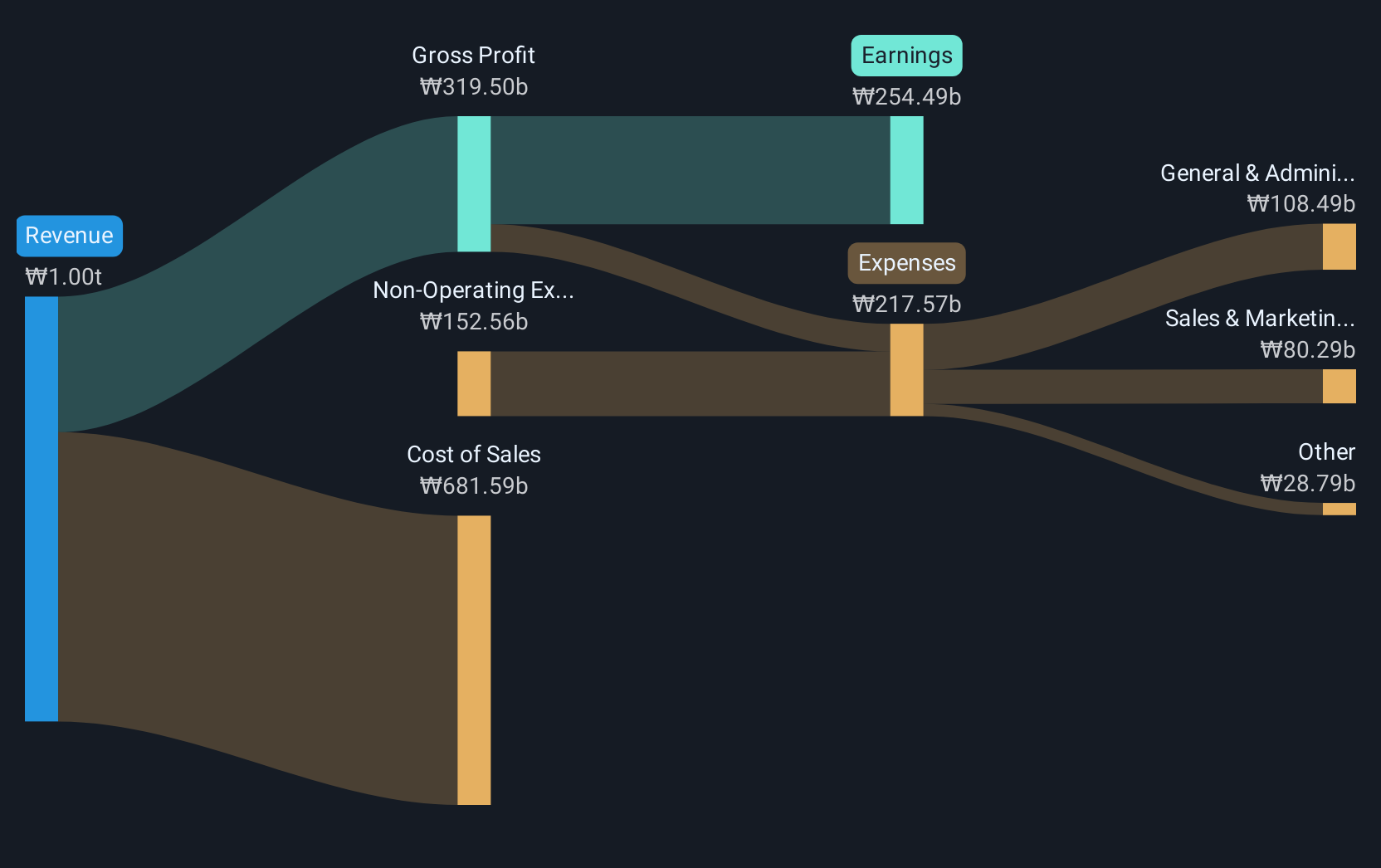

Overview: SM Entertainment Co., Ltd. operates in music and sound production, talent management, and music/audio content publication both in South Korea and internationally, with a market cap of ₩1.73 trillion.

Operations: SM Entertainment generates revenue primarily from its entertainment segment, excluding advertising agency activities, which accounts for ₩871.42 billion. The company also earns from its advertising agency operations, contributing ₩80.94 billion to the overall revenue stream.

SM Entertainment, navigating the dynamic entertainment landscape, is poised for significant transformations with expected profitability within three years and a robust annual earnings growth rate of 78.4%. Despite its current unprofitability, the company's revenue growth at 11.7% annually outpaces South Korea's market average of 9%, signaling potential resilience and strategic adaptability in a competitive industry. With R&D investments tailored to innovate in music and media production, SM Entertainment is strategically positioning itself to capitalize on evolving consumer preferences and technological advancements. Recent dividends and an upcoming earnings call underscore active financial management amidst these promising growth projections.

- Click here and access our complete health analysis report to understand the dynamics of SM Entertainment.

Gain insights into SM Entertainment's past trends and performance with our Past report.

Optowide Technologies (SHSE:688195)

Simply Wall St Growth Rating: ★★★★★☆

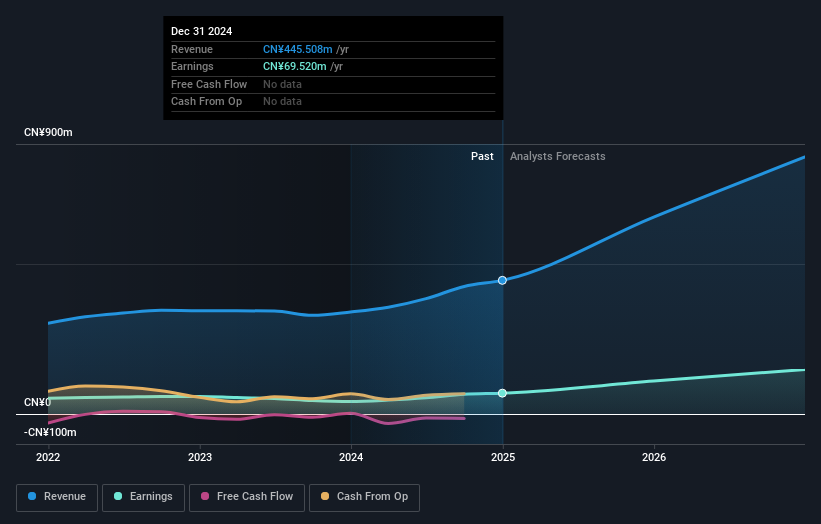

Overview: Optowide Technologies Co., Ltd. is involved in the research, development, production, and sale of precision optics and fiber components both in China and internationally, with a market cap of CN¥5.20 billion.

Operations: Optowide Technologies focuses on precision optics and fiber components, catering to both domestic and international markets. The company generates revenue through the sale of these specialized products, which are integral to various technological applications.

Optowide Technologies has demonstrated a robust financial performance, with earnings surging by 47.3% over the past year, outpacing the electronic industry's growth of 1.9%. This growth trajectory is supported by significant R&D investments, aligning with an annual revenue increase of 31.1%, which notably exceeds the Chinese market average of 13.7%. The company's proactive approach in share repurchasing, including a recent adjustment to CNY 38.90 per share, underscores its strategic financial management and commitment to enhancing shareholder value. These moves not only reflect Optowide’s agility in navigating market dynamics but also its potential to sustain high growth amidst evolving industry demands.

- Dive into the specifics of Optowide Technologies here with our thorough health report.

Evaluate Optowide Technologies' historical performance by accessing our past performance report.

PLAIDInc (TSE:4165)

Simply Wall St Growth Rating: ★★★★★☆

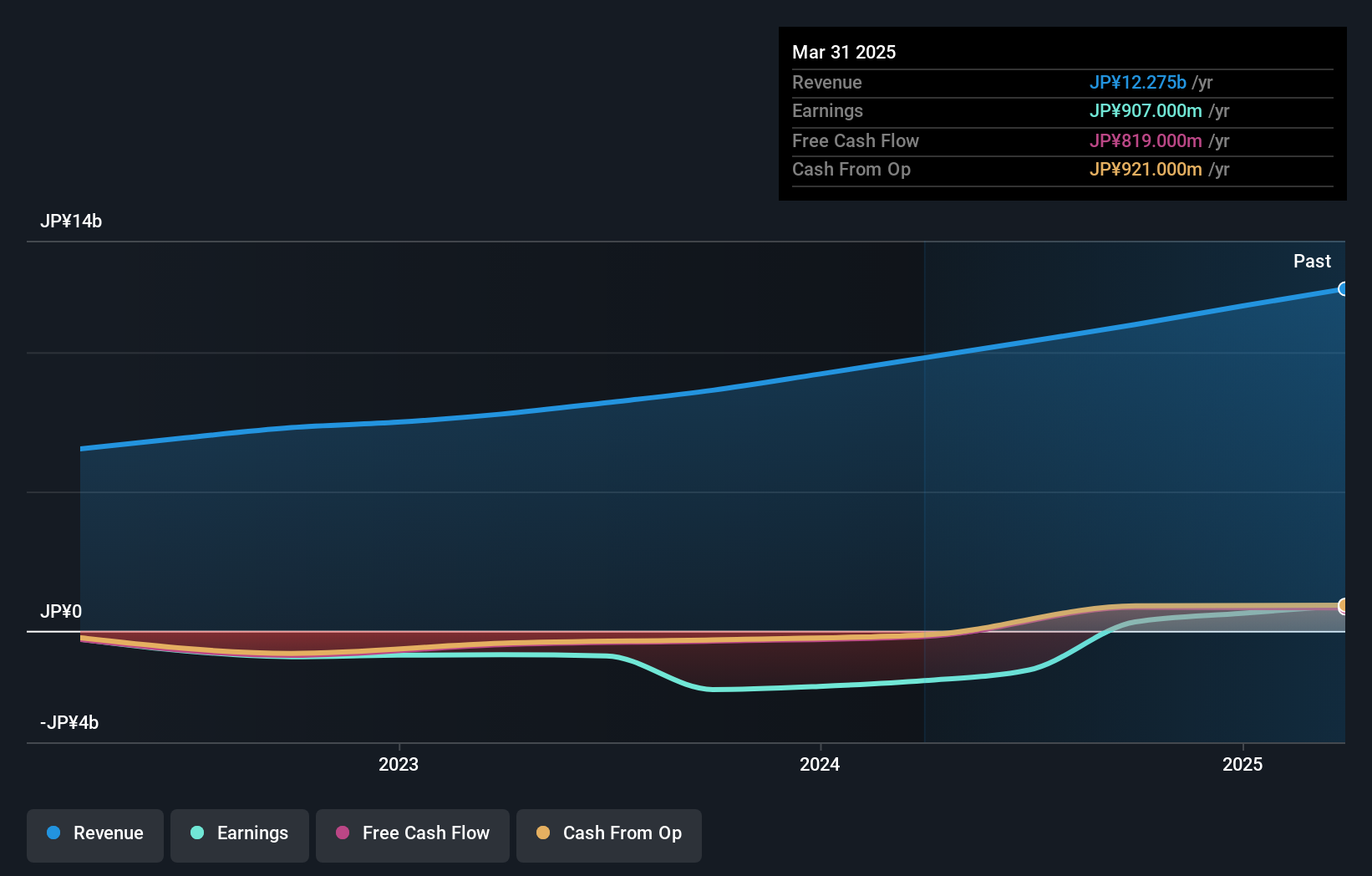

Overview: PLAID, Inc. operates in Japan by developing and managing KARTE, a customer experience SaaS platform, with a market cap of ¥41.23 billion.

Operations: KARTE, developed by PLAID, Inc., is a SaaS platform focused on enhancing customer experiences in Japan. The company's primary revenue stream comes from subscription fees for its software services. Operating costs are mainly driven by technology development and customer support expenses. Gross profit margin trends indicate a focus on efficient cost management relative to revenue growth.

PLAIDInc, amidst the competitive tech landscape, has shown promising financial agility with an expected annual profit growth of 53.8%, significantly outpacing the Japanese market's forecast of 7.9%. This robust growth trajectory is reinforced by a strategic focus on R&D, aligning with its revenue projections to grow at 18% annually, which exceeds Japan's market average by nearly fourfold. Furthermore, the company's recent corporate guidance anticipates net sales reaching ¥13.575 billion and operating income at ¥678 million for FY2025, reflecting strong operational efficiency and market adaptability despite a highly volatile share price in recent months.

- Get an in-depth perspective on PLAIDInc's performance by reading our health report here.

Assess PLAIDInc's past performance with our detailed historical performance reports.

Taking Advantage

- Delve into our full catalog of 1261 High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A041510

SM Entertainment

Engages in music/sound production, talent management, and music/audio content publication activities in South Korea and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives