- China

- /

- Electronic Equipment and Components

- /

- SHSE:688160

There's Reason For Concern Over Kinco Automation (Shanghai) Co.,Ltd's (SHSE:688160) Massive 28% Price Jump

Kinco Automation (Shanghai) Co.,Ltd (SHSE:688160) shares have continued their recent momentum with a 28% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 79%.

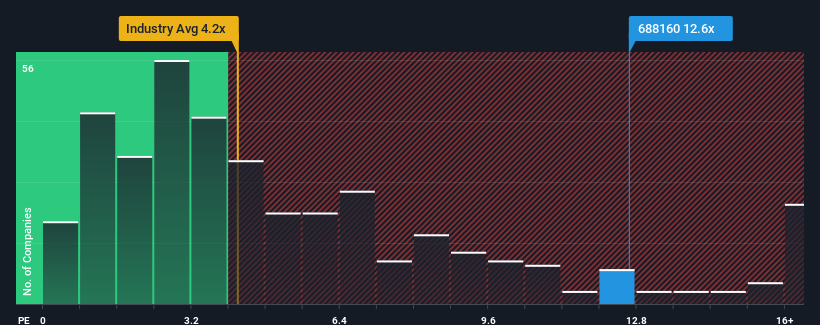

Since its price has surged higher, Kinco Automation (Shanghai)Ltd may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 12.6x, when you consider almost half of the companies in the Electronic industry in China have P/S ratios under 4.2x and even P/S lower than 2x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Kinco Automation (Shanghai)Ltd

How Has Kinco Automation (Shanghai)Ltd Performed Recently?

The recent revenue growth at Kinco Automation (Shanghai)Ltd would have to be considered satisfactory if not spectacular. It might be that many expect the reasonable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Kinco Automation (Shanghai)Ltd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Kinco Automation (Shanghai)Ltd's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 4.6% gain to the company's revenues. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 26% shows it's noticeably less attractive.

In light of this, it's alarming that Kinco Automation (Shanghai)Ltd's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Kinco Automation (Shanghai)Ltd's P/S

The strong share price surge has lead to Kinco Automation (Shanghai)Ltd's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Kinco Automation (Shanghai)Ltd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Kinco Automation (Shanghai)Ltd (2 are concerning!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Kinco Automation (Shanghai)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688160

Kinco Automation (Shanghai)Ltd

Develops, produces, and sells industrial automation standards and intelligent hardware products in China.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026