- China

- /

- Communications

- /

- SHSE:688143

Investors Appear Satisfied With Yangtze Optical Electronic Co., Ltd.'s (SHSE:688143) Prospects As Shares Rocket 31%

The Yangtze Optical Electronic Co., Ltd. (SHSE:688143) share price has done very well over the last month, posting an excellent gain of 31%. The last 30 days bring the annual gain to a very sharp 42%.

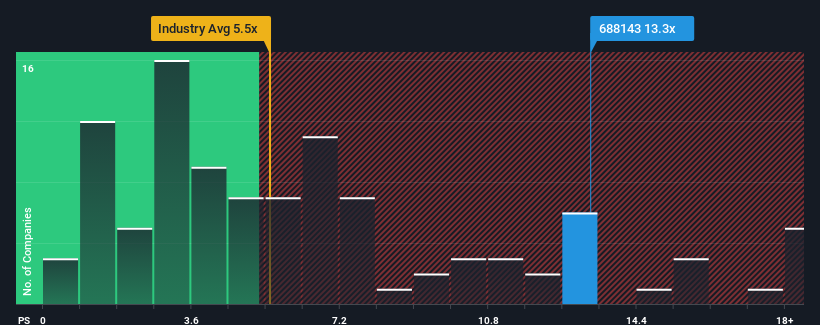

Since its price has surged higher, when almost half of the companies in China's Communications industry have price-to-sales ratios (or "P/S") below 5.5x, you may consider Yangtze Optical Electronic as a stock not worth researching with its 13.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Yangtze Optical Electronic

How Has Yangtze Optical Electronic Performed Recently?

Recent times haven't been great for Yangtze Optical Electronic as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Yangtze Optical Electronic's future stacks up against the industry? In that case, our free report is a great place to start.How Is Yangtze Optical Electronic's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Yangtze Optical Electronic's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 15% last year. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 76% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 35%, which is noticeably less attractive.

With this information, we can see why Yangtze Optical Electronic is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Shares in Yangtze Optical Electronic have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Yangtze Optical Electronic shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Yangtze Optical Electronic (at least 2 which don't sit too well with us), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Yangtze Optical Electronic, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688143

Yangtze Optical Electronic

Engages in the research and development, production, and sale of special optical fiber and cables, special optical devices, new materials, high-end equipment, and photoelectric systems in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026