- China

- /

- Electronic Equipment and Components

- /

- SHSE:688112

Exploring Three High Growth Tech Stocks in Asia

Reviewed by Simply Wall St

As global markets experience shifts due to new trade deals and economic data releases, Asian tech stocks are capturing attention with their potential for high growth amid evolving U.S.-China relations and regional trade agreements. In this dynamic environment, a good stock often demonstrates resilience through innovation, strong market positioning, and the ability to capitalize on emerging technological trends.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.05% | 23.29% | ★★★★★★ |

| Gold Circuit Electronics | 20.97% | 26.54% | ★★★★★★ |

| Zhejiang Lante Optics | 21.61% | 23.73% | ★★★★★★ |

| PharmaEssentia | 31.60% | 57.71% | ★★★★★★ |

| Fositek | 30.51% | 37.34% | ★★★★★★ |

| Eoptolink Technology | 32.53% | 32.58% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.71% | 35.89% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

DuoLun Technology (SHSE:603528)

Simply Wall St Growth Rating: ★★★★★☆

Overview: DuoLun Technology Corporation Ltd. specializes in developing intelligent systems for motor vehicle driver training, testing, and applications in China, with a market cap of CN¥6.06 billion.

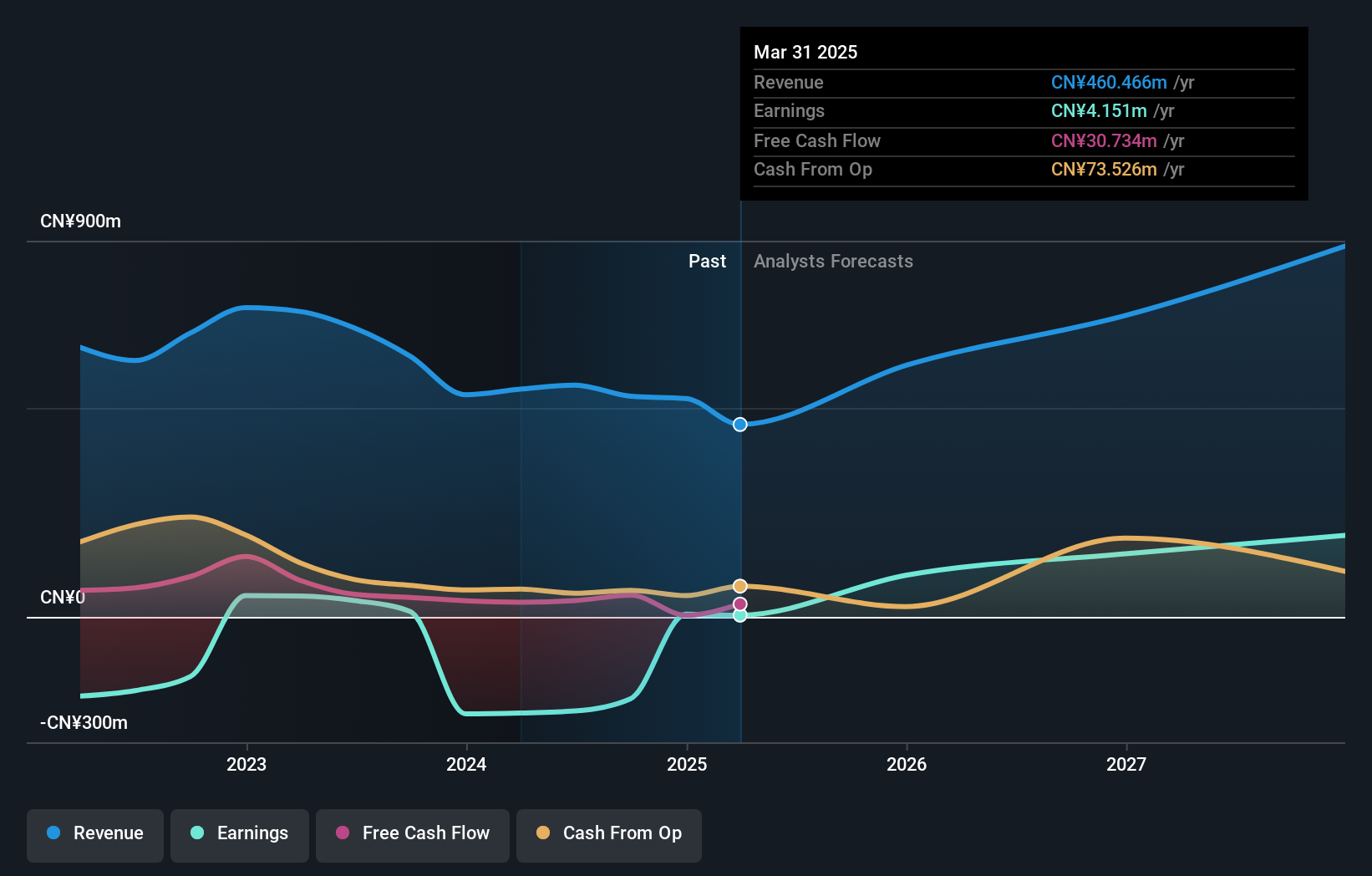

Operations: The company generates revenue primarily from electronic security devices, amounting to CN¥460.47 million.

DuoLun Technology, amidst a robust tech landscape in Asia, exemplifies significant growth with an annual revenue increase of 22.6% and earnings surging by nearly 59%. This performance starkly outpaces the broader Chinese market's growth rates of 12.5% for revenue and 23.6% for earnings, highlighting its competitive edge in a fierce market. With R&D expenses marking a substantial part of its budget, DuoLun is not just keeping pace but actively shaping future tech trends. The company's strategic focus on innovative technologies has also led to positive free cash flow, reinforcing its financial health amid rapid expansion. While challenges remain in boosting return on equity, currently forecasted at a modest 7.6%, the firm’s trajectory suggests robust potential for sustaining high growth momentum.

- Click here and access our complete health analysis report to understand the dynamics of DuoLun Technology.

Evaluate DuoLun Technology's historical performance by accessing our past performance report.

Siglent TechnologiesLtd (SHSE:688112)

Simply Wall St Growth Rating: ★★★★★☆

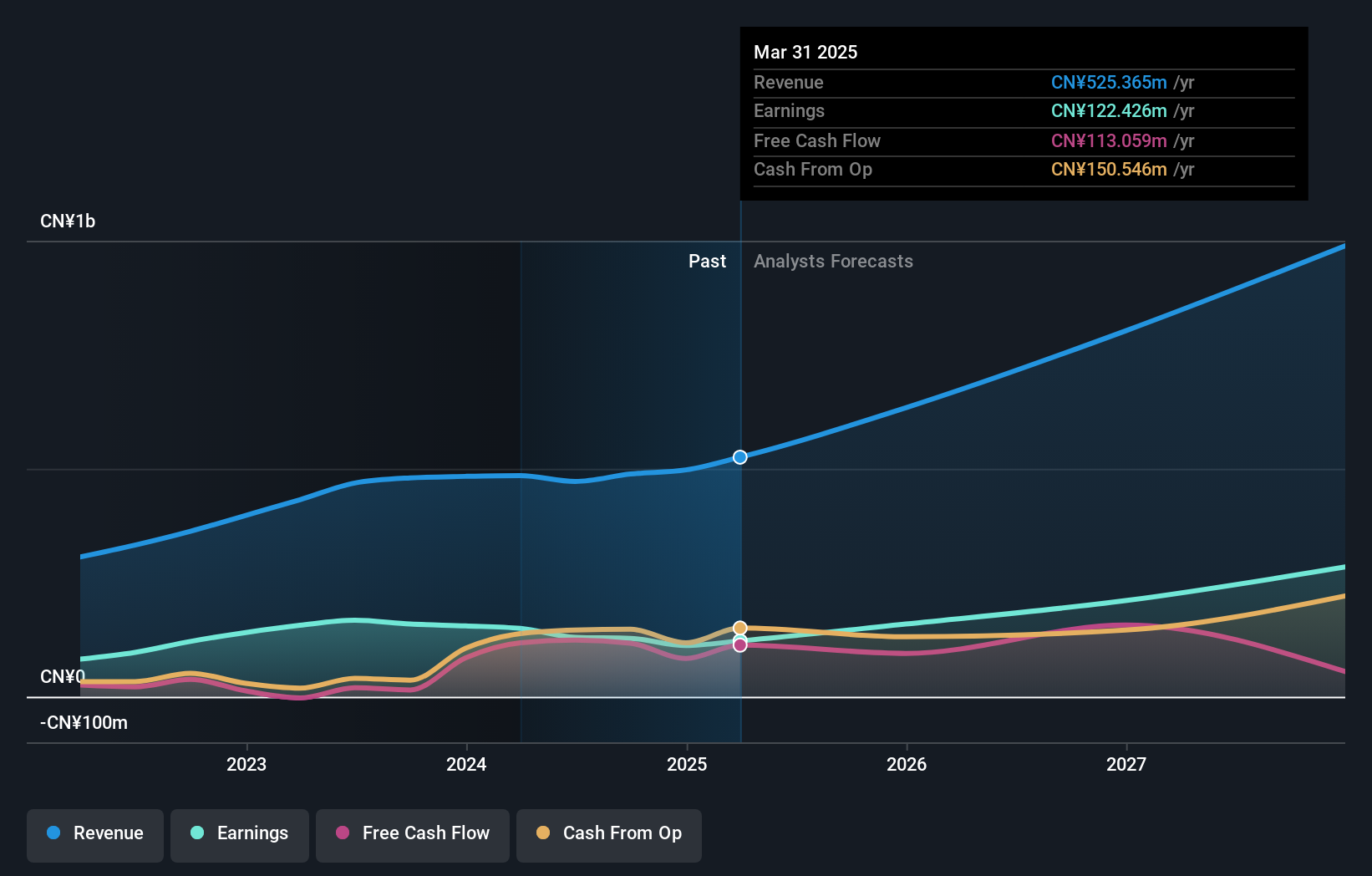

Overview: Siglent Technologies CO.,Ltd. is engaged in the research, development, production, sale, and servicing of electronic test and measurement equipment both in China and internationally, with a market capitalization of CN¥5.91 billion.

Operations: Siglent Technologies focuses on the electronic test and measurement equipment sector, generating revenue through the development, production, and sale of these products across domestic and international markets. The company is involved in various stages from research to servicing, contributing to its overall business model.

Siglent TechnologiesLtd, thriving in Asia's dynamic tech sector, has showcased robust growth with a notable 22.8% increase in annual revenue and an impressive 29.6% surge in earnings. This performance significantly outstrips the broader market trends, emphasizing its competitive stance. Particularly striking is the company's commitment to innovation, as evidenced by substantial investments in R&D which stand at 15% of total revenue. These strategic expenditures not only fuel current advancements but also lay groundwork for future technologies, positioning Siglent at the forefront of industry evolution despite some challenges in earnings consistency over the past year.

- Click to explore a detailed breakdown of our findings in Siglent TechnologiesLtd's health report.

Gain insights into Siglent TechnologiesLtd's past trends and performance with our Past report.

Zhejiang Lante Optics (SHSE:688127)

Simply Wall St Growth Rating: ★★★★★★

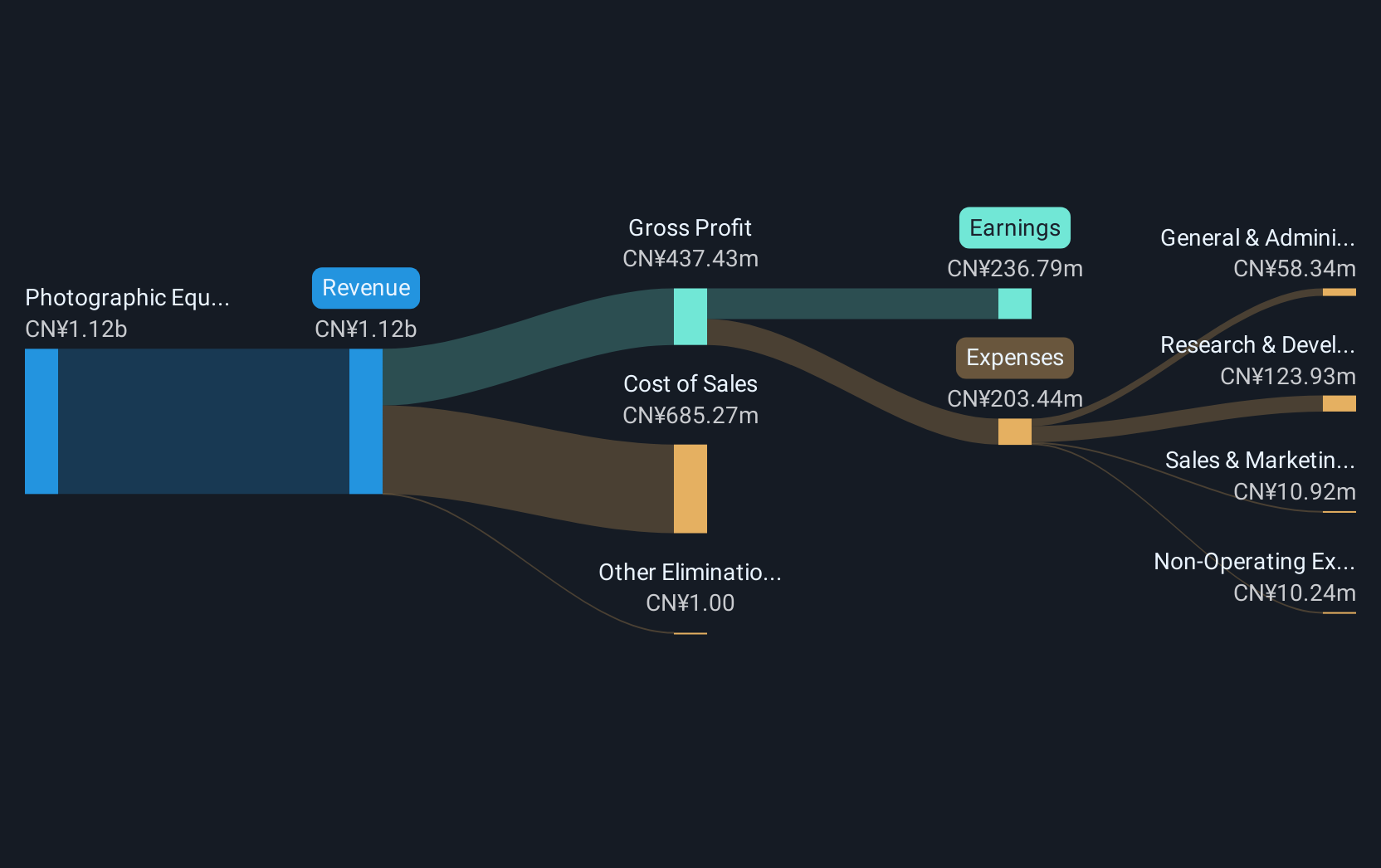

Overview: Zhejiang Lante Optics Co., Ltd. is a company that manufactures and sells optical products in China, with a market capitalization of CN¥11.24 billion.

Operations: Lante Optics focuses on the production and sale of optical products, generating revenue primarily from its Photographic Equipment & Supplies segment, which amounts to CN¥1.12 billion.

Zhejiang Lante Optics capitalizes on Asia's burgeoning tech market, with a commendable 21.6% annual revenue growth and an even more robust 23.7% surge in earnings growth per year. This financial trajectory is bolstered by significant R&D investments, which currently stand at 15% of total revenue, underscoring the company's commitment to innovation and future readiness in optical technologies. Despite facing stiff competition, these strategic moves could position Zhejiang Lante for sustained growth, leveraging trends like increased demand for advanced optical solutions across various industries.

Summing It All Up

- Dive into all 164 of the Asian High Growth Tech and AI Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688112

Siglent TechnologiesLtd

Researches, develops, produces, sells, and services electronic test and measurement equipment in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives