- China

- /

- Electronic Equipment and Components

- /

- SHSE:688071

Shanghai W-Ibeda High Tech.Group Co.,Ltd. (SHSE:688071) Shares Slammed 30% But Getting In Cheap Might Be Difficult Regardless

Shanghai W-Ibeda High Tech.Group Co.,Ltd. (SHSE:688071) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 49% in that time.

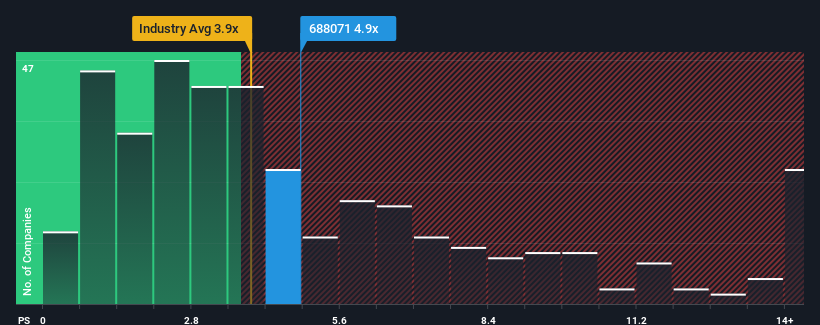

In spite of the heavy fall in price, when almost half of the companies in China's Electronic industry have price-to-sales ratios (or "P/S") below 3.9x, you may still consider Shanghai W-Ibeda High Tech.GroupLtd as a stock probably not worth researching with its 4.9x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Shanghai W-Ibeda High Tech.GroupLtd

What Does Shanghai W-Ibeda High Tech.GroupLtd's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Shanghai W-Ibeda High Tech.GroupLtd has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Shanghai W-Ibeda High Tech.GroupLtd's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Shanghai W-Ibeda High Tech.GroupLtd?

The only time you'd be truly comfortable seeing a P/S as high as Shanghai W-Ibeda High Tech.GroupLtd's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 32% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 48% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 26%, which is noticeably less attractive.

With this information, we can see why Shanghai W-Ibeda High Tech.GroupLtd is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Shanghai W-Ibeda High Tech.GroupLtd's P/S Mean For Investors?

Shanghai W-Ibeda High Tech.GroupLtd's P/S remain high even after its stock plunged. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Shanghai W-Ibeda High Tech.GroupLtd shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Shanghai W-Ibeda High Tech.GroupLtd that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688071

Shanghai W-Ibeda High Tech.GroupLtd

Shanghai W-Ibeda High Tech.Group Co.,Ltd.

High growth potential with very low risk.

Market Insights

Community Narratives