- China

- /

- Electronic Equipment and Components

- /

- SHSE:688056

High Growth Tech Stocks In Asia With Promising Potential

Reviewed by Simply Wall St

The Asian tech market is experiencing notable growth, with indices such as the Nasdaq Composite reaching new highs and Chinese exports showing resilience despite global trade tensions. In this dynamic environment, identifying promising tech stocks involves looking for companies that demonstrate strong innovation capabilities and adaptability to shifting economic conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.79% | 22.79% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 25.19% | 23.94% | ★★★★★★ |

| Zhejiang Lante Optics | 21.61% | 23.73% | ★★★★★★ |

| PharmaEssentia | 31.60% | 57.71% | ★★★★★★ |

| Fositek | 31.69% | 39.80% | ★★★★★★ |

| Eoptolink Technology | 32.53% | 32.58% | ★★★★★★ |

| Gold Circuit Electronics | 26.51% | 32.23% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.08% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Essex Bio-Technology (SEHK:1061)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Essex Bio-Technology Limited is an investment holding company that develops, manufactures, and sells biologic drugs in China, Hong Kong, and internationally with a market capitalization of approximately HK$3.16 billion.

Operations: Essex Bio-Technology generates revenue primarily from its surgical and ophthalmology segments, with HK$879.90 million and HK$771.49 million respectively. The company also provides services contributing HK$18.42 million to its revenue stream.

Essex Bio-Technology has demonstrated a robust trajectory in the biotech sector, with its revenue and earnings growth outpacing the broader Hong Kong market. The company's annual revenue is expected to increase by 10.2%, surpassing the market's 8.1% growth rate, while its earnings are forecasted to climb at an impressive rate of 12% annually, compared to the market's 10.8%. Despite not outperforming the biotech industry’s average last year, Essex maintains a promising outlook with a projected Return on Equity of 22.5%. Additionally, recent corporate developments include a dividend increase and amendments to its bylaws which could enhance governance structures and shareholder returns moving forward.

- Get an in-depth perspective on Essex Bio-Technology's performance by reading our health report here.

Assess Essex Bio-Technology's past performance with our detailed historical performance reports.

WuXi Xinje ElectricLtd (SHSE:603416)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: WuXi Xinje Electric Co., Ltd. focuses on developing, producing, and selling industrial automation products both in China and internationally, with a market cap of CN¥8.81 billion.

Operations: The company generates revenue primarily from the instrument industry, with reported sales of CN¥1.76 billion.

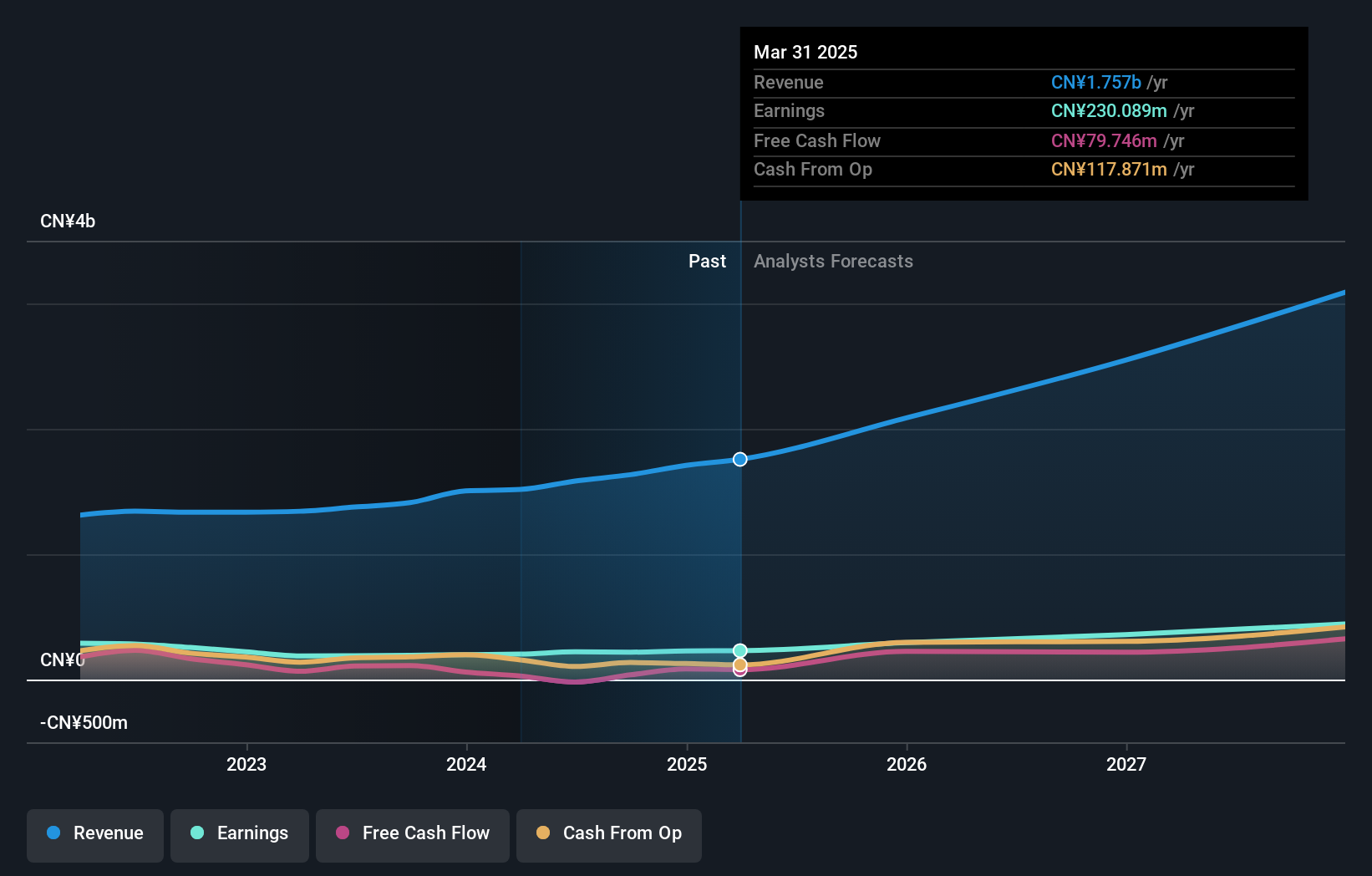

WuXi Xinje Electric has carved a niche in the high-growth tech sector in Asia, demonstrating robust financial health with earnings growth of 22.8% annually and revenue surging by 20.3% each year, outpacing the broader Chinese market's growth of 12.6%. Despite a forecasted Return on Equity of 12.9%, which lags behind some industry benchmarks, the company's strategic focus on innovation is evident from its significant R&D investment, aligning with its impressive earnings trajectory. Recent developments from their Q1 2025 Earnings Call highlight continued expansion efforts and operational enhancements that could bolster future performance in an increasingly competitive electronic industry landscape.

- Delve into the full analysis health report here for a deeper understanding of WuXi Xinje ElectricLtd.

Understand WuXi Xinje ElectricLtd's track record by examining our Past report.

Beijing Labtech Instruments (SHSE:688056)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Labtech Instruments Co., Ltd. manufactures and supplies laboratorial products and solutions to the laboratory industry worldwide, with a market capitalization of CN¥2.67 billion.

Operations: The company focuses on producing and delivering laboratory products and solutions globally.

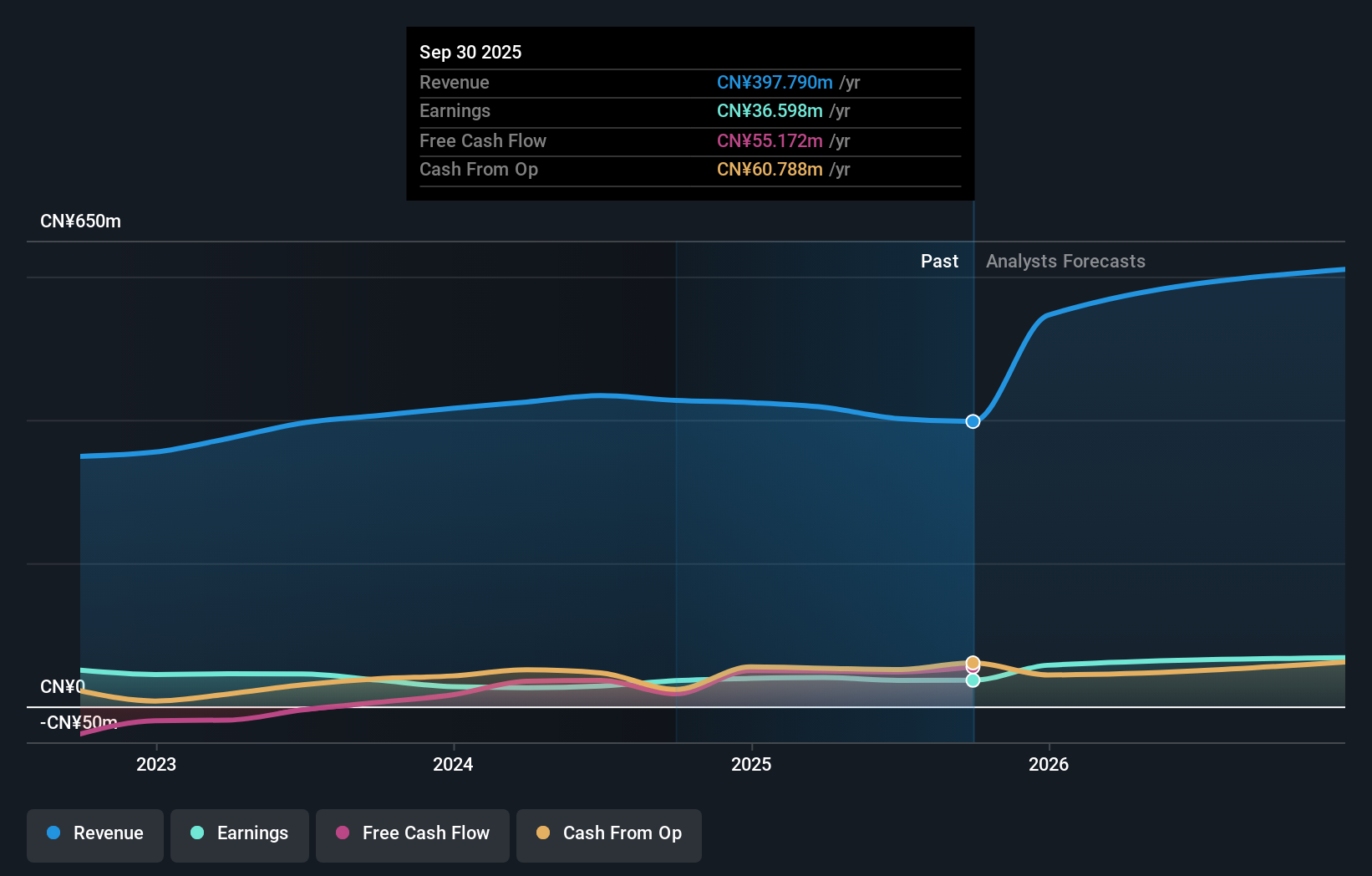

Beijing Labtech Instruments is distinguishing itself in the high-growth tech landscape of Asia, with a notable annual revenue increase of 20.5%, outstripping the broader Chinese market's expansion rate of 12.6%. The firm's commitment to innovation is underscored by an impressive R&D expenditure, which fuels an earnings growth forecast at a vigorous rate of 28.3% per year. Recent strategic acquisitions, including a CNY 60 million investment by major financial players for a 3% stake, underscore confidence in its trajectory and potential to scale operations further within the competitive tech sector.

- Click here to discover the nuances of Beijing Labtech Instruments with our detailed analytical health report.

Gain insights into Beijing Labtech Instruments' past trends and performance with our Past report.

Key Takeaways

- Click this link to deep-dive into the 174 companies within our Asian High Growth Tech and AI Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Labtech Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688056

Beijing Labtech Instruments

Manufactures and supplies laboratorial products and solutions to laboratory industry worldwide.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion