Asian Growth Companies With High Insider Ownership In August 2025

Reviewed by Simply Wall St

As of August 2025, Asian markets have experienced a boost in investor confidence, driven by improved U.S.-China trade relations and robust performances in Chinese stock indices. In this environment, companies with high insider ownership can be particularly appealing to investors seeking growth opportunities, as they often indicate strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Techwing (KOSDAQ:A089030) | 19.1% | 64.4% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 25.8% |

| Samyang Foods (KOSE:A003230) | 14.9% | 28.0% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| M31 Technology (TPEX:6643) | 30.7% | 96.8% |

| Laopu Gold (SEHK:6181) | 35.5% | 34.3% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 43.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.7% | 91.9% |

Let's uncover some gems from our specialized screener.

Shanghai Putailai New Energy TechnologyLtd (SHSE:603659)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Putailai New Energy Technology Co., Ltd. develops and sells lithium-ion battery materials and automation equipment in China, with a market cap of CN¥40.53 billion.

Operations: Shanghai Putailai New Energy Technology Co., Ltd. generates revenue through its lithium-ion battery materials and automation equipment segments in China.

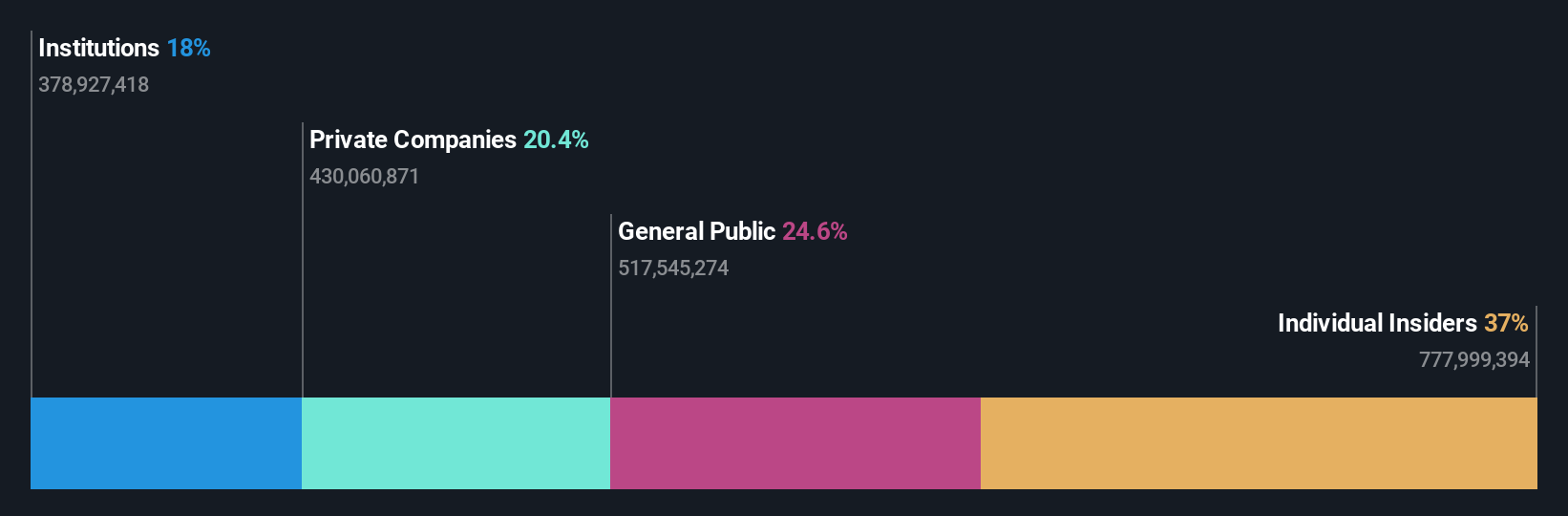

Insider Ownership: 37%

Revenue Growth Forecast: 15.4% p.a.

Shanghai Putailai New Energy Technology Ltd. is experiencing significant earnings growth, forecasted at 28.8% annually over the next three years, outpacing the Chinese market's expected growth. Despite being removed from key indices like the SSE 180 Index in June 2025, it remains a good value investment, trading below its estimated fair value and showing strong revenue growth relative to the market. However, its return on equity is expected to be low at 12.3%.

- Get an in-depth perspective on Shanghai Putailai New Energy TechnologyLtd's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Shanghai Putailai New Energy TechnologyLtd's share price might be too pessimistic.

QuantumCTek (SHSE:688027)

Simply Wall St Growth Rating: ★★★★★☆

Overview: QuantumCTek Co., Ltd. specializes in manufacturing and selling quantum information technology-enabled security products and services for information and communication technology in China, with a market cap of CN¥33.31 billion.

Operations: QuantumCTek Co., Ltd.'s revenue is primarily derived from its quantum information technology-enabled security products and services for the information and communication technology sector in China.

Insider Ownership: 12%

Revenue Growth Forecast: 40.1% p.a.

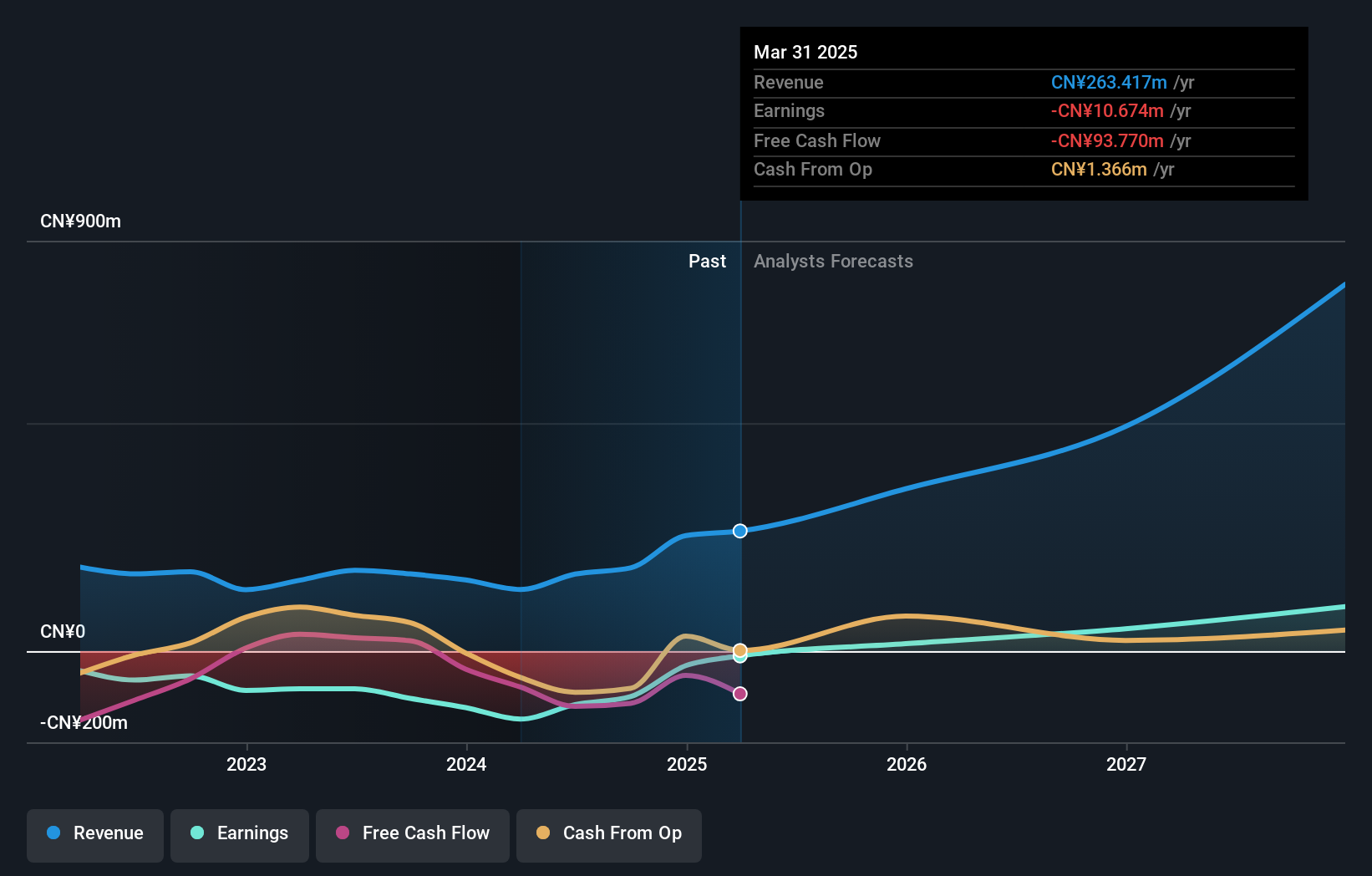

QuantumCTek's revenue is forecast to grow significantly at 40.1% annually, outpacing the Chinese market, with earnings expected to rise by 97.85% per year and profitability anticipated within three years. Recent half-year results showed improved sales of CNY 116.26 million but a net loss of CNY 23.79 million, indicating progress despite past shareholder dilution. No substantial insider trading activity was reported over the past three months, highlighting stability in insider sentiment.

- Take a closer look at QuantumCTek's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of QuantumCTek shares in the market.

Ingenic SemiconductorLtd (SZSE:300223)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ingenic Semiconductor Co., Ltd. focuses on the research, development, design, and sale of integrated circuit chip products both in China and internationally, with a market capitalization of CN¥37.25 billion.

Operations: Ingenic Semiconductor Co., Ltd. derives its revenue from the research, development, design, and sale of integrated circuit chip products across domestic and international markets.

Insider Ownership: 16.6%

Revenue Growth Forecast: 19.2% p.a.

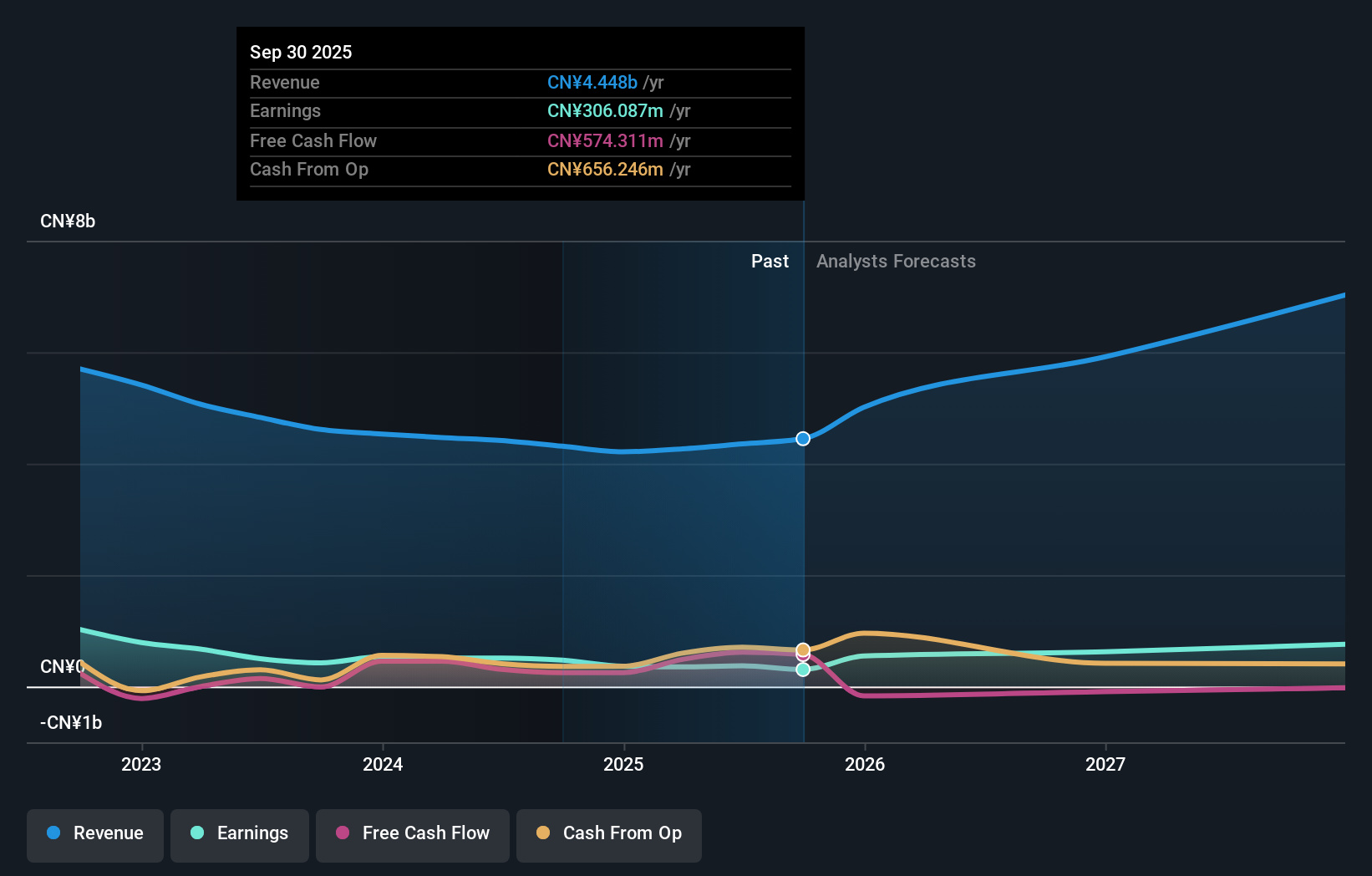

Ingenic Semiconductor's revenue is projected to grow at 19.2% annually, surpassing the Chinese market average. Earnings are expected to increase significantly by 26.8% per year, outpacing market growth rates. Recent half-year results show sales of CNY 2.25 billion and a net income of CNY 203.12 million, indicating steady performance despite low forecasted return on equity at 5.2%. No significant insider trading activity has been reported recently, suggesting stable insider confidence.

- Click here to discover the nuances of Ingenic SemiconductorLtd with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Ingenic SemiconductorLtd's share price might be too optimistic.

Taking Advantage

- Access the full spectrum of 597 Fast Growing Asian Companies With High Insider Ownership by clicking on this link.

- Interested In Other Possibilities? Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603659

Shanghai Putailai New Energy Technology GroupLtd

Engages in the development and sale of materials of lithium-ion batteries and automation equipment in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives