- China

- /

- Electronic Equipment and Components

- /

- SHSE:688011

There's Reason For Concern Over Harbin Xinguang Optic-Electronics Technology Co.,Ltd.'s (SHSE:688011) Massive 55% Price Jump

Harbin Xinguang Optic-Electronics Technology Co.,Ltd. (SHSE:688011) shareholders would be excited to see that the share price has had a great month, posting a 55% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 23% in the last twelve months.

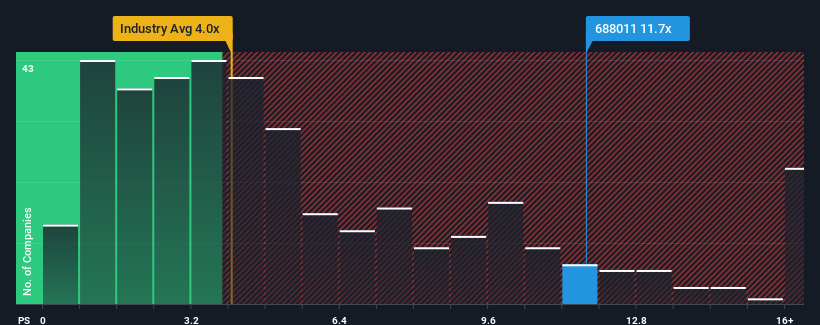

Since its price has surged higher, Harbin Xinguang Optic-Electronics TechnologyLtd's price-to-sales (or "P/S") ratio of 11.7x might make it look like a strong sell right now compared to other companies in the Electronic industry in China, where around half of the companies have P/S ratios below 4x and even P/S below 2x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Harbin Xinguang Optic-Electronics TechnologyLtd

How Has Harbin Xinguang Optic-Electronics TechnologyLtd Performed Recently?

We'd have to say that with no tangible growth over the last year, Harbin Xinguang Optic-Electronics TechnologyLtd's revenue has been unimpressive. One possibility is that the P/S is high because investors think the benign revenue growth will improve to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Harbin Xinguang Optic-Electronics TechnologyLtd will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Harbin Xinguang Optic-Electronics TechnologyLtd?

The only time you'd be truly comfortable seeing a P/S as steep as Harbin Xinguang Optic-Electronics TechnologyLtd's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 8.4% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 26% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that Harbin Xinguang Optic-Electronics TechnologyLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Harbin Xinguang Optic-Electronics TechnologyLtd's P/S Mean For Investors?

Harbin Xinguang Optic-Electronics TechnologyLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Harbin Xinguang Optic-Electronics TechnologyLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Harbin Xinguang Optic-Electronics TechnologyLtd (at least 1 which doesn't sit too well with us), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Harbin Xinguang Optic-Electronics TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688011

Harbin Xinguang Optic-Electronics TechnologyLtd

Harbin Xinguang Optic-Electronics Technology Co.,Ltd.

Flawless balance sheet with very low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion