- China

- /

- Electronic Equipment and Components

- /

- SHSE:688002

Why We're Not Concerned About Raytron Technology Co.,Ltd.'s (SHSE:688002) Share Price

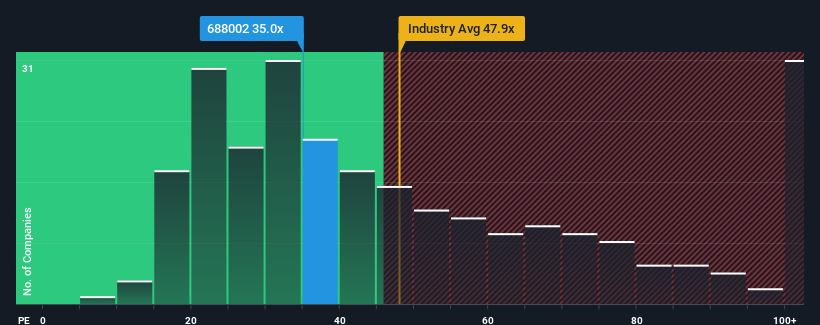

It's not a stretch to say that Raytron Technology Co.,Ltd.'s (SHSE:688002) price-to-earnings (or "P/E") ratio of 35x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 36x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Raytron TechnologyLtd has been doing quite well of late. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Raytron TechnologyLtd

How Is Raytron TechnologyLtd's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Raytron TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 15% gain to the company's bottom line. The solid recent performance means it was also able to grow EPS by 29% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Turning to the outlook, the next year should generate growth of 37% as estimated by the five analysts watching the company. With the market predicted to deliver 38% growth , the company is positioned for a comparable earnings result.

In light of this, it's understandable that Raytron TechnologyLtd's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Raytron TechnologyLtd's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Raytron TechnologyLtd with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Raytron TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688002

Raytron TechnologyLtd

Engages in the research and development, design, manufacturing, and sales of uncooled infrared imagining, MEMS sensor, and image processing algorithms technology in China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives