- China

- /

- Electronic Equipment and Components

- /

- SHSE:603920

Olympic Circuit Technology Co., Ltd's (SHSE:603920) Popularity With Investors Under Threat As Stock Sinks 25%

Olympic Circuit Technology Co., Ltd (SHSE:603920) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. Looking at the bigger picture, even after this poor month the stock is up 64% in the last year.

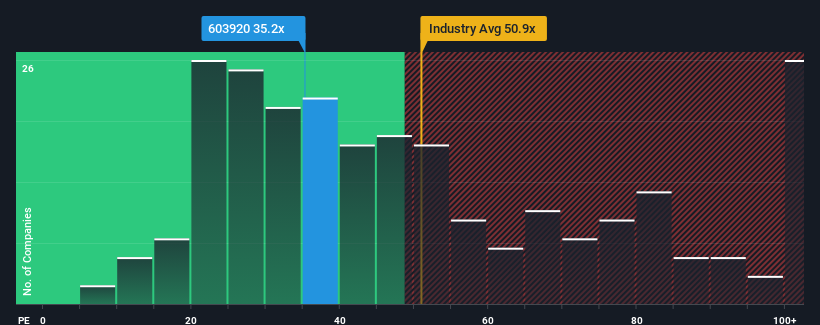

In spite of the heavy fall in price, it's still not a stretch to say that Olympic Circuit Technology's price-to-earnings (or "P/E") ratio of 35.2x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 38x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been pleasing for Olympic Circuit Technology as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Olympic Circuit Technology

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Olympic Circuit Technology would need to produce growth that's similar to the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 83% overall rise in EPS, in spite of its uninspiring short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 19% as estimated by the four analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 37%, which is noticeably more attractive.

In light of this, it's curious that Olympic Circuit Technology's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

With its share price falling into a hole, the P/E for Olympic Circuit Technology looks quite average now. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Olympic Circuit Technology's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 2 warning signs for Olympic Circuit Technology (1 shouldn't be ignored!) that you should be aware of.

You might be able to find a better investment than Olympic Circuit Technology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603920

Olympic Circuit Technology

Olympic Circuit Technology Co., Ltd is involved in the research and development, manufacture, and sales of various printed circuit boards (PCBs) in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success