- China

- /

- Electronic Equipment and Components

- /

- SHSE:603773

WG TECH (Jiang Xi) Co., Ltd.'s (SHSE:603773) Shares Not Telling The Full Story

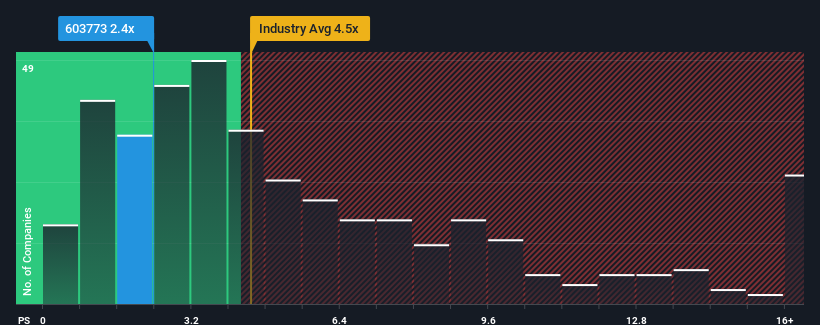

You may think that with a price-to-sales (or "P/S") ratio of 2.4x WG TECH (Jiang Xi) Co., Ltd. (SHSE:603773) is a stock worth checking out, seeing as almost half of all the Electronic companies in China have P/S ratios greater than 4.5x and even P/S higher than 9x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for WG TECH (Jiang Xi)

How WG TECH (Jiang Xi) Has Been Performing

WG TECH (Jiang Xi) certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on WG TECH (Jiang Xi) will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For WG TECH (Jiang Xi)?

WG TECH (Jiang Xi)'s P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 40% gain to the company's top line. Pleasingly, revenue has also lifted 160% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 28% over the next year. Meanwhile, the rest of the industry is forecast to expand by 25%, which is not materially different.

With this in consideration, we find it intriguing that WG TECH (Jiang Xi)'s P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does WG TECH (Jiang Xi)'s P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that WG TECH (Jiang Xi) currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for WG TECH (Jiang Xi) that you should be aware of.

If these risks are making you reconsider your opinion on WG TECH (Jiang Xi), explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if WG TECH (Jiang Xi) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603773

WG TECH (Jiang Xi)

Provides glass-based circuit boards and related electronic devices in China.

Exceptional growth potential and fair value.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026