- China

- /

- Electronic Equipment and Components

- /

- SHSE:603773

WG TECH (Jiang Xi) Co., Ltd. (SHSE:603773) Stock Rockets 38% But Many Are Still Ignoring The Company

The WG TECH (Jiang Xi) Co., Ltd. (SHSE:603773) share price has done very well over the last month, posting an excellent gain of 38%. Taking a wider view, although not as strong as the last month, the full year gain of 19% is also fairly reasonable.

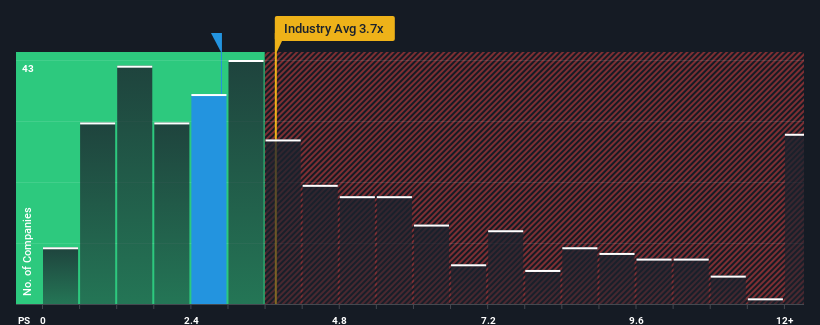

Even after such a large jump in price, WG TECH (Jiang Xi) may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 2.9x, considering almost half of all companies in the Electronic industry in China have P/S ratios greater than 3.7x and even P/S higher than 7x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for WG TECH (Jiang Xi)

How WG TECH (Jiang Xi) Has Been Performing

Recent times have been advantageous for WG TECH (Jiang Xi) as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think WG TECH (Jiang Xi)'s future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, WG TECH (Jiang Xi) would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 44% last year. The latest three year period has also seen an excellent 190% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 25% over the next year. With the industry predicted to deliver 26% growth , the company is positioned for a comparable revenue result.

In light of this, it's peculiar that WG TECH (Jiang Xi)'s P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does WG TECH (Jiang Xi)'s P/S Mean For Investors?

The latest share price surge wasn't enough to lift WG TECH (Jiang Xi)'s P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It looks to us like the P/S figures for WG TECH (Jiang Xi) remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with WG TECH (Jiang Xi), and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WG TECH (Jiang Xi) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603773

WG TECH (Jiang Xi)

Provides glass-based circuit boards and related electronic devices in China.

Exceptional growth potential and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion