- China

- /

- Electronic Equipment and Components

- /

- SHSE:603773

A Piece Of The Puzzle Missing From WG TECH (Jiang Xi) Co., Ltd.'s (SHSE:603773) 28% Share Price Climb

WG TECH (Jiang Xi) Co., Ltd. (SHSE:603773) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. The last 30 days bring the annual gain to a very sharp 28%.

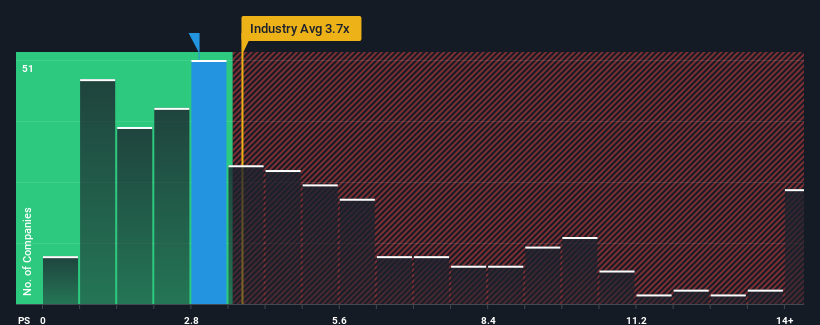

In spite of the firm bounce in price, WG TECH (Jiang Xi)'s price-to-sales (or "P/S") ratio of 2.9x might still make it look like a buy right now compared to the Electronic industry in China, where around half of the companies have P/S ratios above 3.7x and even P/S above 7x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for WG TECH (Jiang Xi)

How WG TECH (Jiang Xi) Has Been Performing

Recent times have been advantageous for WG TECH (Jiang Xi) as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on WG TECH (Jiang Xi).What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like WG TECH (Jiang Xi)'s to be considered reasonable.

Retrospectively, the last year delivered a decent 9.5% gain to the company's revenues. The latest three year period has also seen an excellent 183% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 39% during the coming year according to the lone analyst following the company. That's shaping up to be materially higher than the 26% growth forecast for the broader industry.

In light of this, it's peculiar that WG TECH (Jiang Xi)'s P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

The latest share price surge wasn't enough to lift WG TECH (Jiang Xi)'s P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

WG TECH (Jiang Xi)'s analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for WG TECH (Jiang Xi) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if WG TECH (Jiang Xi) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603773

WG TECH (Jiang Xi)

Provides glass-based circuit boards and related electronic devices in China.

Exceptional growth potential and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success