- China

- /

- Communications

- /

- SHSE:603703

Zhejiang Shengyang Science and TechnologyLtd (SHSE:603703) shareholders are still up 24% over 5 years despite pulling back 8.1% in the past week

When we invest, we're generally looking for stocks that outperform the market average. Buying under-rated businesses is one path to excess returns. For example, the Zhejiang Shengyang Science and Technology Co.,Ltd. (SHSE:603703) share price is up 24% in the last 5 years, clearly besting the market return of around 12% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 0.7%.

In light of the stock dropping 8.1% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

Check out our latest analysis for Zhejiang Shengyang Science and TechnologyLtd

We don't think that Zhejiang Shengyang Science and TechnologyLtd's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last half decade Zhejiang Shengyang Science and TechnologyLtd's revenue has actually been trending down at about 0.05% per year. Despite the lack of revenue growth, the stock has returned a respectable 4%, compound, over that time. To us that suggests that there probably isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

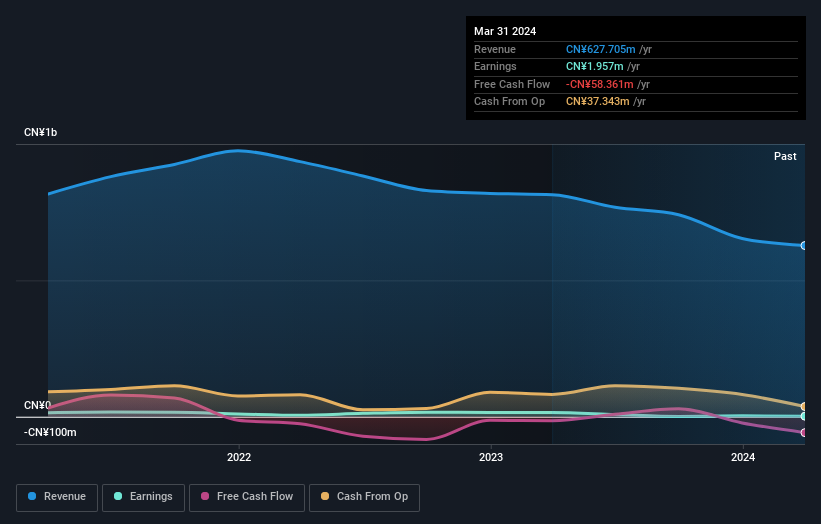

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Zhejiang Shengyang Science and TechnologyLtd's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Zhejiang Shengyang Science and TechnologyLtd shareholders have received a total shareholder return of 0.7% over the last year. Of course, that includes the dividend. Having said that, the five-year TSR of 4% a year, is even better. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Zhejiang Shengyang Science and TechnologyLtd has 3 warning signs (and 1 which is a bit concerning) we think you should know about.

We will like Zhejiang Shengyang Science and TechnologyLtd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Shengyang Science and TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603703

Zhejiang Shengyang Science and TechnologyLtd

Engages in the development, production, and sale of communication equipment for radio frequency cable industries and satellite communications operators primarily in China, Europe, and the United States.

Mediocre balance sheet low.