- China

- /

- Communications

- /

- SHSE:603703

Is The Market Rewarding Zhejiang Shengyang Science and Technology Co.,Ltd. (SHSE:603703) With A Negative Sentiment As A Result Of Its Mixed Fundamentals?

It is hard to get excited after looking at Zhejiang Shengyang Science and TechnologyLtd's (SHSE:603703) recent performance, when its stock has declined 16% over the past month. It is possible that the markets have ignored the company's differing financials and decided to lean-in to the negative sentiment. Fundamentals usually dictate market outcomes so it makes sense to study the company's financials. Specifically, we decided to study Zhejiang Shengyang Science and TechnologyLtd's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

View our latest analysis for Zhejiang Shengyang Science and TechnologyLtd

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Zhejiang Shengyang Science and TechnologyLtd is:

0.5% = CN¥4.5m ÷ CN¥884m (Based on the trailing twelve months to September 2024).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each CN¥1 of shareholders' capital it has, the company made CN¥0.01 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Zhejiang Shengyang Science and TechnologyLtd's Earnings Growth And 0.5% ROE

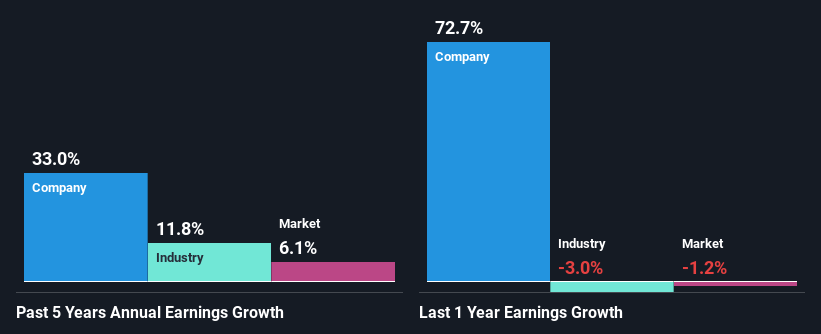

It is hard to argue that Zhejiang Shengyang Science and TechnologyLtd's ROE is much good in and of itself. Even compared to the average industry ROE of 5.6%, the company's ROE is quite dismal. However, we we're pleasantly surprised to see that Zhejiang Shengyang Science and TechnologyLtd grew its net income at a significant rate of 33% in the last five years. We reckon that there could be other factors at play here. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

As a next step, we compared Zhejiang Shengyang Science and TechnologyLtd's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 12%.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Zhejiang Shengyang Science and TechnologyLtd fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Zhejiang Shengyang Science and TechnologyLtd Making Efficient Use Of Its Profits?

Zhejiang Shengyang Science and TechnologyLtd's very high three-year median payout ratio of 164% suggests that the company is paying more to its shareholders than what it is earning. However, this hasn't hampered its ability to grow as we saw earlier. Having said that, the high payout ratio is definitely risky and something to keep an eye on. You can see the 2 risks we have identified for Zhejiang Shengyang Science and TechnologyLtd by visiting our risks dashboard for free on our platform here.

Additionally, Zhejiang Shengyang Science and TechnologyLtd has paid dividends over a period of nine years which means that the company is pretty serious about sharing its profits with shareholders.

Conclusion

On the whole, we feel that the performance shown by Zhejiang Shengyang Science and TechnologyLtd can be open to many interpretations. While the company has posted impressive earnings growth, its poor ROE and low earnings retention makes us doubtful if that growth could continue, if by any chance the business is faced with any sort of risk. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. To gain further insights into Zhejiang Shengyang Science and TechnologyLtd's past profit growth, check out this visualization of past earnings, revenue and cash flows.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zhejiang Shengyang Science and TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603703

Zhejiang Shengyang Science and TechnologyLtd

Engages in the development, production, and sale of communication equipment in China, and internationally.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion