- China

- /

- Electronic Equipment and Components

- /

- SHSE:603678

High Growth Tech Stocks To Watch This February 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by U.S. tariff uncertainties and mixed economic signals, major indices like the S&P 500 have experienced slight declines, while manufacturing activity in the U.S. shows signs of recovery for the first time in over two years. Amidst these fluctuations, identifying high growth tech stocks requires a keen understanding of how these companies can leverage innovation to thrive despite potential trade disruptions and evolving market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1216 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Fujian Torch Electron Technology (SHSE:603678)

Simply Wall St Growth Rating: ★★★★★☆

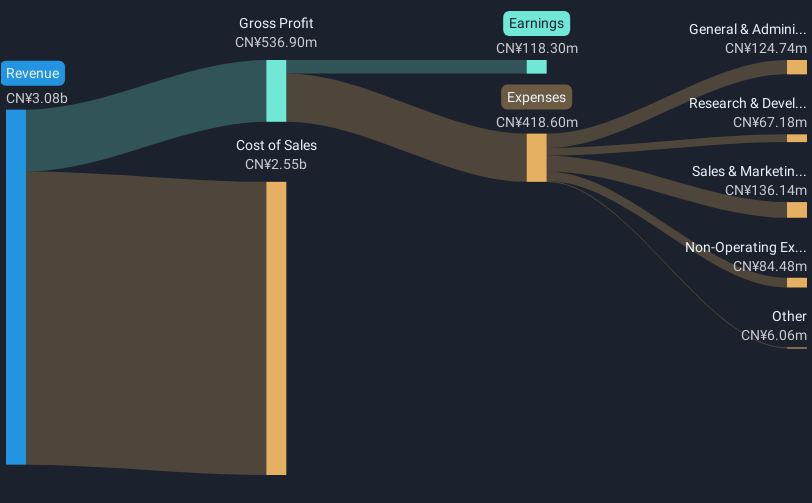

Overview: Fujian Torch Electron Technology Co., Ltd. operates in the electronic components industry with a market capitalization of CN¥12.78 billion.

Operations: The company generates revenue primarily from the production and sale of electronic components. It focuses on optimizing its cost structure to enhance profitability, with a notable trend observed in its net profit margin.

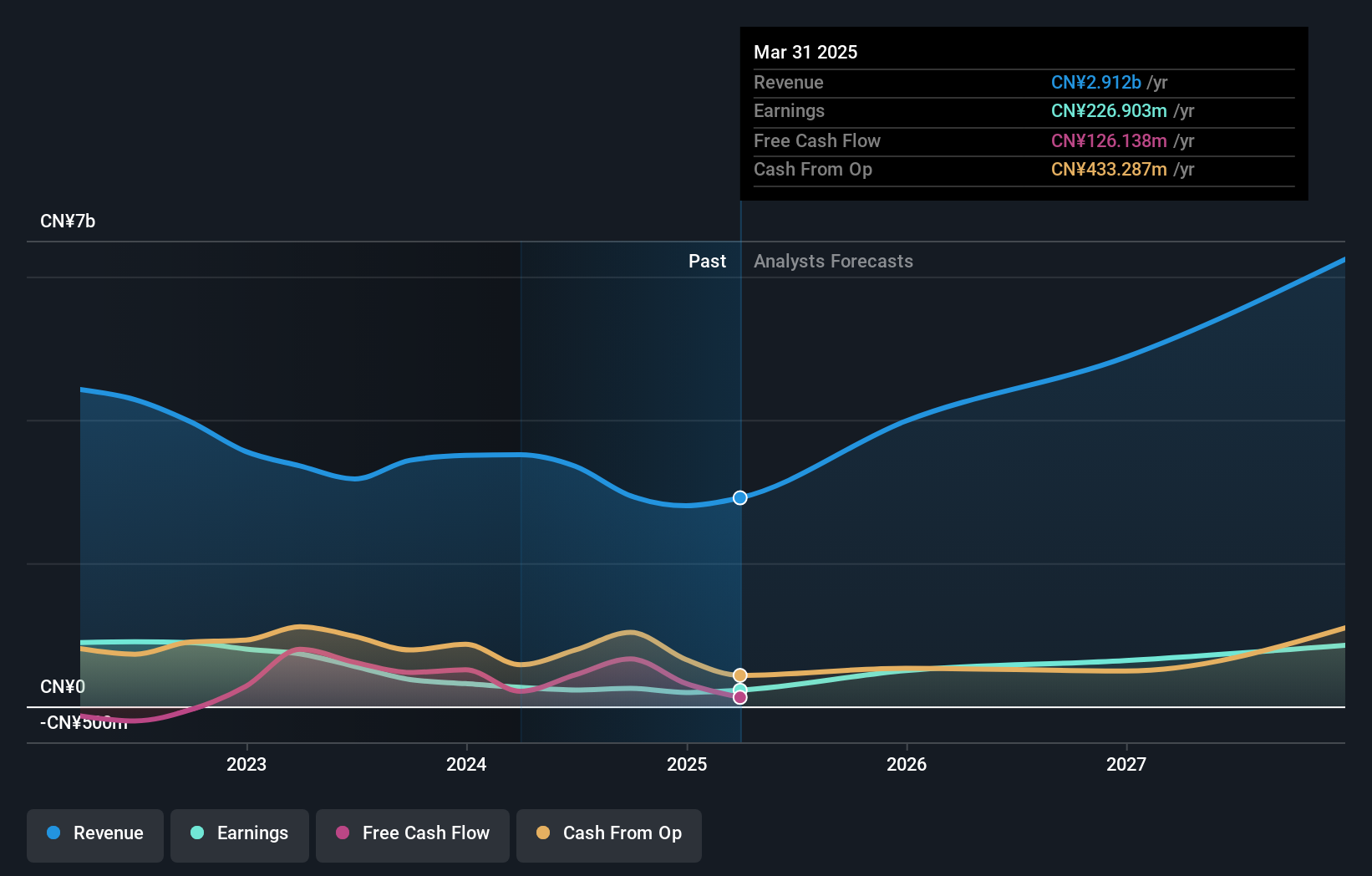

Fujian Torch Electron Technology, amidst a challenging market, showcases robust potential with a forecasted annual revenue growth of 21.9%, outpacing the Chinese market's average of 13.5%. This performance is bolstered by significant projected earnings growth at an annual rate of 36.5%, which also exceeds the broader market expectation of 25.4%. Despite past financial results being influenced by a one-off gain of CN¥46M, the company's strategic focus on innovation and development in electronic technology positions it well for sustained growth. Moreover, its ability to maintain positive free cash flow enhances its financial stability and supports ongoing investments in cutting-edge technologies, crucial for staying competitive in the fast-evolving tech landscape.

Shanghai Yct Electronics GroupLtd (SZSE:301099)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai YCT Electronics Group Co., Ltd specializes in providing electronic products within China and has a market capitalization of CN¥4.69 billion.

Operations: The company focuses on the production and sale of electronic products within China. It operates with a market capitalization of CN¥4.69 billion, indicating its significant presence in the domestic electronics sector.

Shanghai Yct Electronics GroupLtd demonstrates dynamic growth within the tech sector, with an impressive annual revenue increase of 36.4%, significantly outpacing the Chinese market average growth of 13.5%. This surge is supported by a robust earnings expansion of 41.5% per year, well above the broader market's 25.4%. The company's commitment to innovation is evident in its R&D spending trends, which have consistently aligned with or exceeded industry benchmarks, ensuring it remains at the forefront of technological advancements. With a strong focus on developing cutting-edge electronic solutions and maintaining a positive free cash flow, Shanghai Yct is strategically positioned to capitalize on future technology demands, despite facing challenges from occasional significant one-off financial impacts.

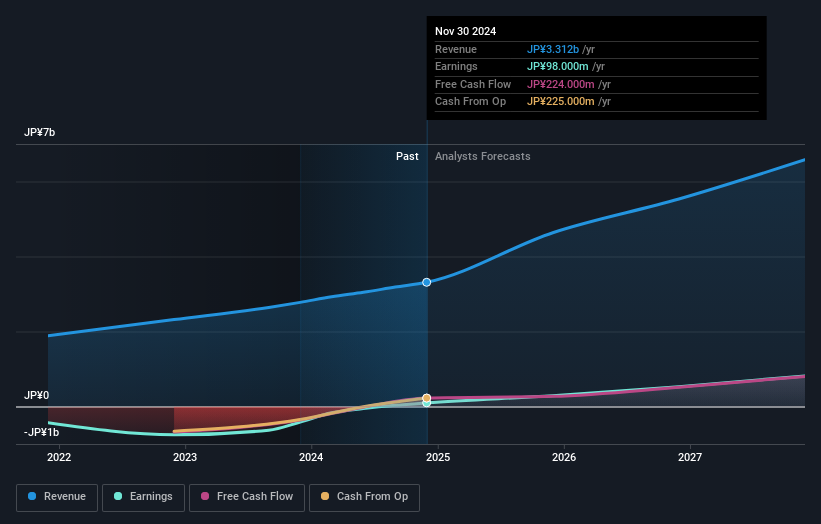

note (TSE:5243)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Note Inc. operates a media platform business in Japan with a market capitalization of ¥39.47 billion.

Operations: The company generates revenue primarily through its media platform operations in Japan. It focuses on leveraging digital content and user engagement to drive growth within the media sector.

Note Inc. is carving a niche in the tech landscape with its recent strategic moves, including a significant private placement that raised approximately ¥490 million net, indicating robust investor confidence and an infusion of capital to propel further innovations. This aligns with their impressive financial trajectory, marked by a revenue growth forecast at 17.5% annually and an even more striking earnings growth projection of 42.9% per year, outstripping the broader Japanese market's expectations significantly. The firm's dedication to research and development is not just a budget line but a cornerstone of its strategy, ensuring it stays ahead in the competitive tech arena despite its share price volatility over the past three months.

- Click here and access our complete health analysis report to understand the dynamics of note.

Understand note's track record by examining our Past report.

Next Steps

- Access the full spectrum of 1216 High Growth Tech and AI Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603678

Fujian Torch Electron Technology

Fujian Torch Electron Technology Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives