- China

- /

- Electronic Equipment and Components

- /

- SHSE:603677

Some Confidence Is Lacking In Qijing Machinery Co., Ltd.'s (SHSE:603677) P/E

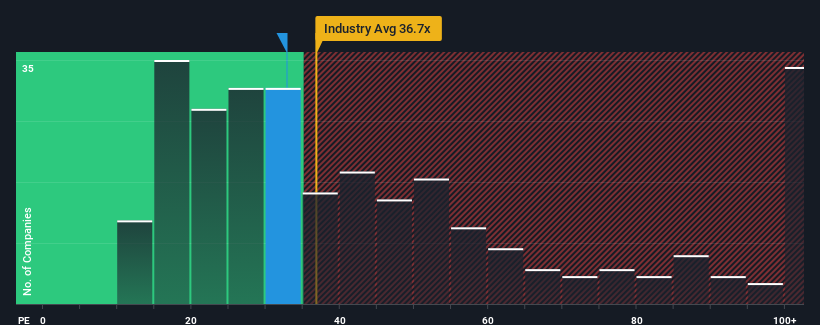

There wouldn't be many who think Qijing Machinery Co., Ltd.'s (SHSE:603677) price-to-earnings (or "P/E") ratio of 32.8x is worth a mention when the median P/E in China is similar at about 30x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

We'd have to say that with no tangible growth over the last year, Qijing Machinery's earnings have been unimpressive. One possibility is that the P/E is moderate because investors think this benign earnings growth rate might not be enough to outperform the broader market in the near future. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

See our latest analysis for Qijing Machinery

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Qijing Machinery's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with earnings down 4.3% overall from three years ago. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 41% shows it's an unpleasant look.

With this information, we find it concerning that Qijing Machinery is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Qijing Machinery revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Qijing Machinery (1 is concerning!) that you should be aware of before investing here.

If you're unsure about the strength of Qijing Machinery's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Qijing Machinery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603677

Qijing Machinery

Researches and develops, produces, and sells electric tool parts in China.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success