Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SHSE:603583

The three-year loss for Zhejiang Jiecang Linear Motion TechnologyLtd (SHSE:603583) shareholders likely driven by its shrinking earnings

Zhejiang Jiecang Linear Motion Technology Co.,Ltd. (SHSE:603583) shareholders should be happy to see the share price up 13% in the last quarter. But over the last three years we've seen a quite serious decline. Tragically, the share price declined 58% in that time. So it's good to see it climbing back up. While many would remain nervous, there could be further gains if the business can put its best foot forward.

On a more encouraging note the company has added CN¥469m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Check out our latest analysis for Zhejiang Jiecang Linear Motion TechnologyLtd

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

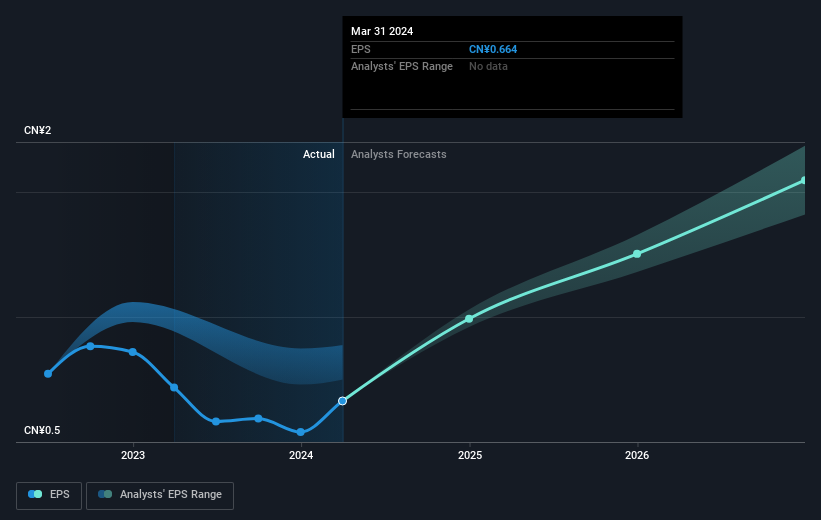

Zhejiang Jiecang Linear Motion TechnologyLtd saw its EPS decline at a compound rate of 16% per year, over the last three years. The share price decline of 25% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Zhejiang Jiecang Linear Motion TechnologyLtd's earnings, revenue and cash flow.

A Different Perspective

While it's never nice to take a loss, Zhejiang Jiecang Linear Motion TechnologyLtd shareholders can take comfort that , including dividends,their trailing twelve month loss of 3.6% wasn't as bad as the market loss of around 16%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 4% for each year. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for Zhejiang Jiecang Linear Motion TechnologyLtd that you should be aware of before investing here.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Zhejiang Jiecang Linear Motion TechnologyLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Zhejiang Jiecang Linear Motion TechnologyLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603583

Zhejiang Jiecang Linear Motion TechnologyLtd

Zhejiang Jiecang Linear Motion Technology Co.,Ltd.

Undervalued with excellent balance sheet.