- China

- /

- Electronic Equipment and Components

- /

- SHSE:603528

There's Reason For Concern Over DuoLun Technology Corporation Ltd.'s (SHSE:603528) Massive 26% Price Jump

DuoLun Technology Corporation Ltd. (SHSE:603528) shareholders have had their patience rewarded with a 26% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 52% in the last year.

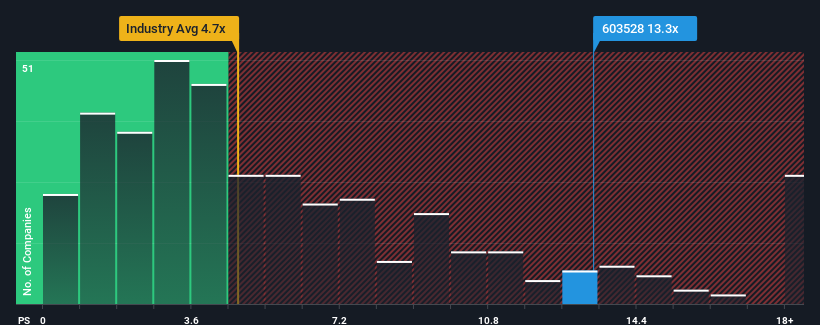

Following the firm bounce in price, DuoLun Technology's price-to-sales (or "P/S") ratio of 13.3x might make it look like a strong sell right now compared to other companies in the Electronic industry in China, where around half of the companies have P/S ratios below 4.7x and even P/S below 2x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for DuoLun Technology

How Has DuoLun Technology Performed Recently?

DuoLun Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think DuoLun Technology's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For DuoLun Technology?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like DuoLun Technology's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. The last three years don't look nice either as the company has shrunk revenue by 36% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 23% as estimated by the lone analyst watching the company. That's shaping up to be materially lower than the 26% growth forecast for the broader industry.

With this information, we find it concerning that DuoLun Technology is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

The strong share price surge has lead to DuoLun Technology's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for DuoLun Technology, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

You always need to take note of risks, for example - DuoLun Technology has 1 warning sign we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603528

DuoLun Technology

Develops motor vehicle driver intelligent training, testing, and application systems in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives