- China

- /

- Electronic Equipment and Components

- /

- SHSE:603528

More Unpleasant Surprises Could Be In Store For DuoLun Technology Corporation Ltd.'s (SHSE:603528) Shares After Tumbling 29%

DuoLun Technology Corporation Ltd. (SHSE:603528) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 18% in that time.

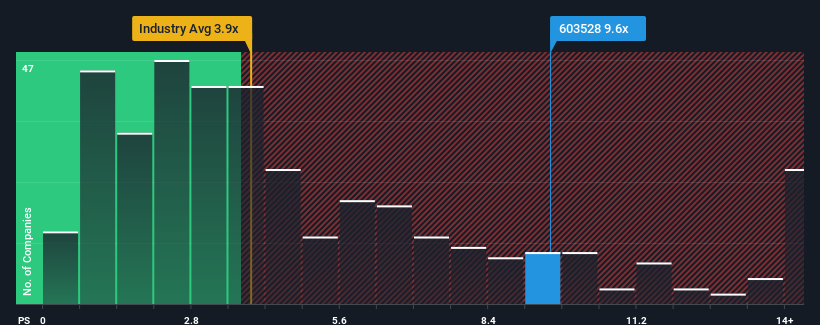

Even after such a large drop in price, you could still be forgiven for thinking DuoLun Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 9.6x, considering almost half the companies in China's Electronic industry have P/S ratios below 3.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for DuoLun Technology

What Does DuoLun Technology's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, DuoLun Technology's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on DuoLun Technology.How Is DuoLun Technology's Revenue Growth Trending?

DuoLun Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. The last three years don't look nice either as the company has shrunk revenue by 36% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 23% as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 26%, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that DuoLun Technology's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

Even after such a strong price drop, DuoLun Technology's P/S still exceeds the industry median significantly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for DuoLun Technology, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for DuoLun Technology with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603528

DuoLun Technology

Develops motor vehicle driver intelligent training, testing, and application systems in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives