- China

- /

- Communications

- /

- SHSE:603496

Why We're Not Concerned Yet About EmbedWay Technologies (Shanghai) Corporation's (SHSE:603496) 27% Share Price Plunge

EmbedWay Technologies (Shanghai) Corporation (SHSE:603496) shares have had a horrible month, losing 27% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 52%, which is great even in a bull market.

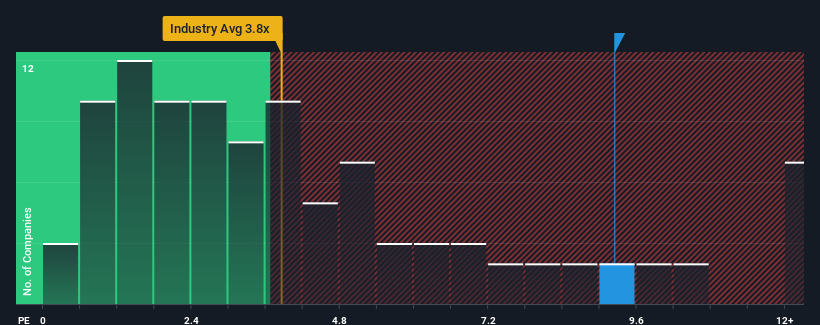

In spite of the heavy fall in price, when almost half of the companies in China's Communications industry have price-to-sales ratios (or "P/S") below 3.8x, you may still consider EmbedWay Technologies (Shanghai) as a stock not worth researching with its 9.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for EmbedWay Technologies (Shanghai)

How EmbedWay Technologies (Shanghai) Has Been Performing

EmbedWay Technologies (Shanghai) could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think EmbedWay Technologies (Shanghai)'s future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as EmbedWay Technologies (Shanghai)'s is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 45% overall rise in revenue, in spite of its uninspiring short-term performance. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 81% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 50%, which is noticeably less attractive.

In light of this, it's understandable that EmbedWay Technologies (Shanghai)'s P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From EmbedWay Technologies (Shanghai)'s P/S?

EmbedWay Technologies (Shanghai)'s shares may have suffered, but its P/S remains high. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into EmbedWay Technologies (Shanghai) shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware EmbedWay Technologies (Shanghai) is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if EmbedWay Technologies (Shanghai) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603496

EmbedWay Technologies (Shanghai)

Engages in the provision of network visibility, intelligent system platforms, and intelligent computing solutions and services in China.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026