Amidst a backdrop of mixed economic signals in the global markets, Asia's stock indices have shown resilience, with China's recent GDP growth and Japan's modest stock market gains capturing investor attention. In this environment, stocks characterized by high insider ownership often attract interest as they may indicate confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 25.8% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 26.5% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| Laopu Gold (SEHK:6181) | 35.5% | 42.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 25.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

Let's dive into some prime choices out of the screener.

EmbedWay Technologies (Shanghai) (SHSE:603496)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EmbedWay Technologies (Shanghai) Corporation operates as a network visibility infrastructure and intelligent system platform vendor in China, with a market cap of CN¥9.38 billion.

Operations: The company's revenue primarily comes from its Computer, Communication and Other Electronic Equipment Manufacturing segment, totaling CN¥982.58 million.

Insider Ownership: 32%

EmbedWay Technologies (Shanghai) is forecast to experience robust revenue growth of 27.2% annually, outpacing the broader Chinese market. Despite a current net loss, it is expected to become profitable within three years, surpassing average market growth rates. However, recent earnings show a decline in sales and profitability compared to the previous year, highlighting potential volatility. No significant insider trading activity has been reported over the past three months.

- Get an in-depth perspective on EmbedWay Technologies (Shanghai)'s performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of EmbedWay Technologies (Shanghai) shares in the market.

Shenzhen H&T Intelligent ControlLtd (SZSE:002402)

Simply Wall St Growth Rating: ★★★★★☆

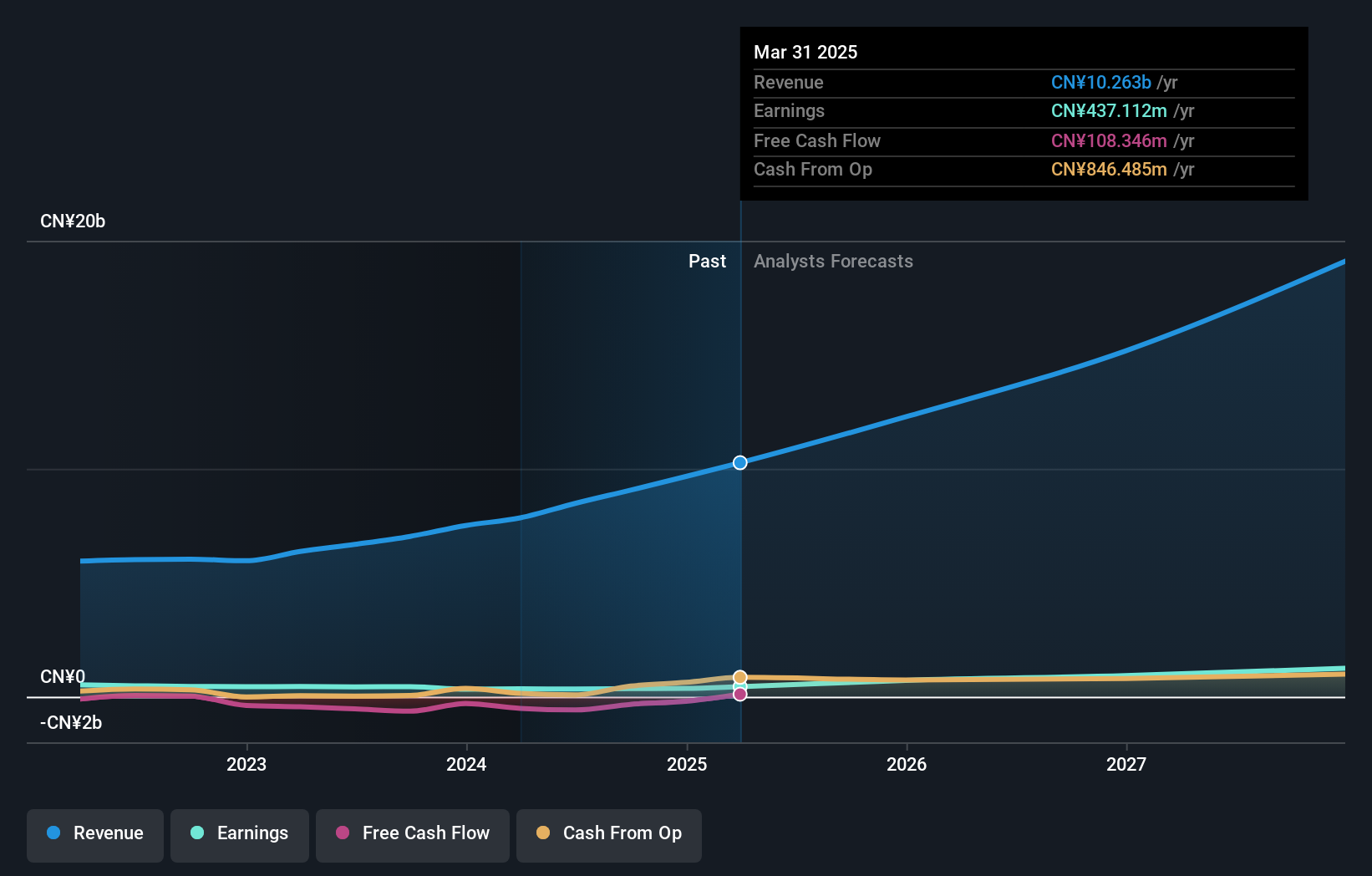

Overview: Shenzhen H&T Intelligent Control Co.Ltd, with a market cap of CN¥21.65 billion, is engaged in the research, development, manufacturing, sales, and marketing of intelligent controller products both in China and internationally.

Operations: The company's revenue segments include intelligent controller products catering to various industries both domestically and internationally.

Insider Ownership: 15.3%

Shenzhen H&T Intelligent Control is poised for strong growth, with earnings projected to rise significantly at 33.9% annually, outpacing the Chinese market. Its revenue is also expected to grow faster than the market average at 21.6% per year. The company maintains a competitive valuation with a Price-To-Earnings ratio below the industry average and has not experienced substantial insider trading activity recently. Recent AGM decisions include changes in registered capital and dividend adjustments.

- Unlock comprehensive insights into our analysis of Shenzhen H&T Intelligent ControlLtd stock in this growth report.

- The valuation report we've compiled suggests that Shenzhen H&T Intelligent ControlLtd's current price could be inflated.

Beijing SuperMap Software (SZSE:300036)

Simply Wall St Growth Rating: ★★★★☆☆

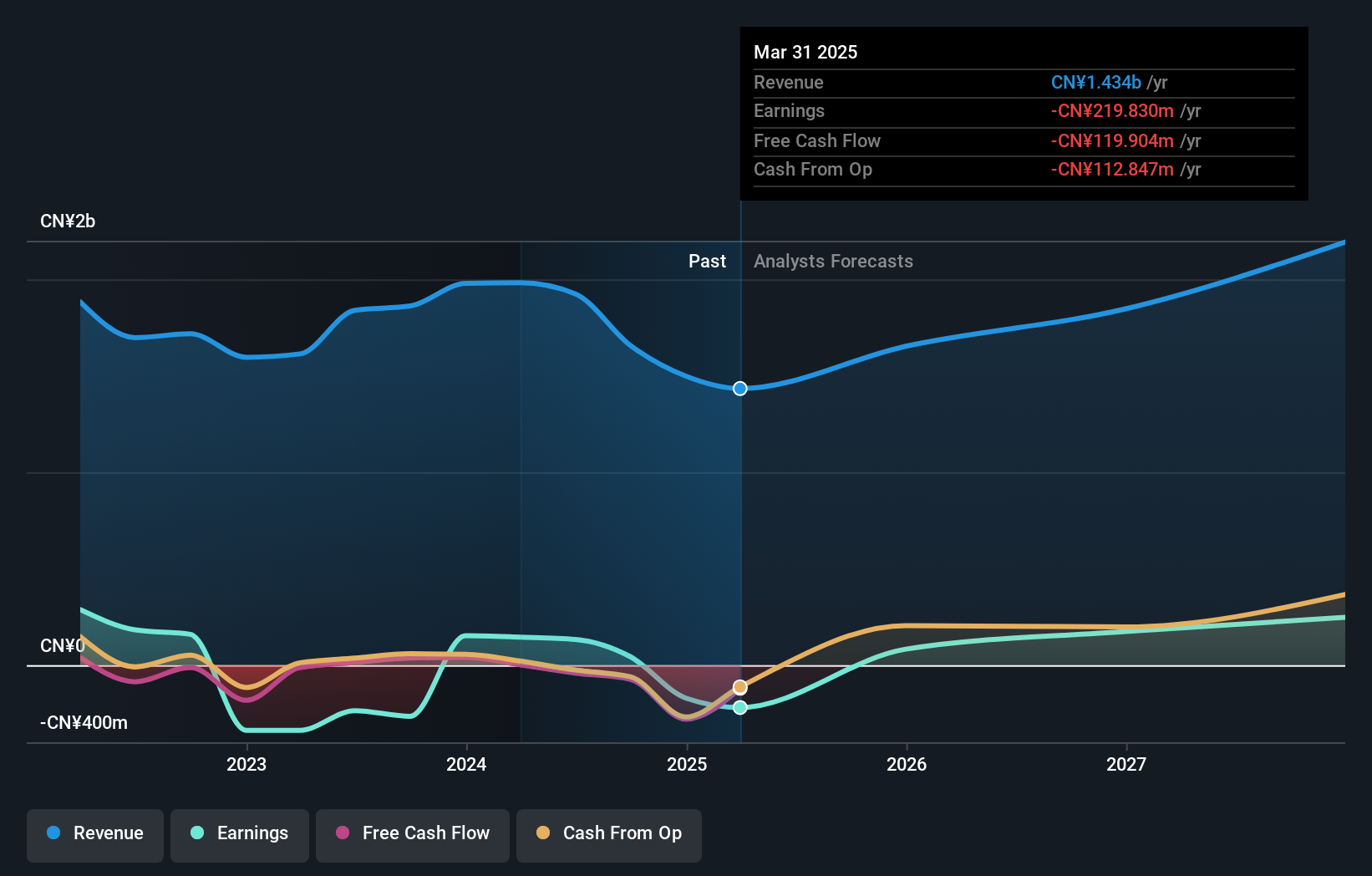

Overview: Beijing SuperMap Software Co., Ltd. develops geographic information system and spatial intelligence software products and services for both domestic and international markets, with a market cap of CN¥8.41 billion.

Operations: Beijing SuperMap Software Co., Ltd. generates revenue through its geographic information system and spatial intelligence software offerings, catering to both the Chinese and global markets.

Insider Ownership: 17.3%

Beijing SuperMap Software is forecasted to experience significant earnings growth of 90.68% annually, with revenue expected to increase by 14.8% per year, surpassing the Chinese market average. Despite a recent net loss of CNY 43.54 million in Q1 2025, the company is projected to become profitable within three years. Insider trading activity has been minimal over the past three months, and its Return on Equity is anticipated to remain low at 6.5%.

- Click here to discover the nuances of Beijing SuperMap Software with our detailed analytical future growth report.

- The analysis detailed in our Beijing SuperMap Software valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Delve into our full catalog of 590 Fast Growing Asian Companies With High Insider Ownership here.

- Curious About Other Options? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Beijing SuperMap Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300036

Beijing SuperMap Software

Provides geographic information system and spatial intelligence software products and services in China and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives