- China

- /

- Tech Hardware

- /

- SZSE:001339

3 Asian Stocks Estimated To Be Up To 38.3% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets continue to navigate interest rate expectations and inflation concerns, Asian stock markets have shown resilience with notable gains in major indices like Japan's Nikkei 225 and China's CSI 300. In this environment, identifying undervalued stocks becomes crucial for investors seeking opportunities, as these stocks may offer potential value when they trade below their intrinsic worth amidst evolving economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Suzhou Alton Electrical & Mechanical Industry (SZSE:301187) | CN¥29.37 | CN¥58.31 | 49.6% |

| Q & M Dental Group (Singapore) (SGX:QC7) | SGD0.485 | SGD0.97 | 49.8% |

| Nanjing COSMOS Chemical (SZSE:300856) | CN¥14.23 | CN¥28.39 | 49.9% |

| Jiangxi Rimag Group (SEHK:2522) | HK$17.44 | HK$34.42 | 49.3% |

| Inspur Digital Enterprise Technology (SEHK:596) | HK$9.77 | HK$19.34 | 49.5% |

| FP Partner (TSE:7388) | ¥2238.00 | ¥4425.25 | 49.4% |

| Food Empire Holdings (SGX:F03) | SGD2.59 | SGD5.13 | 49.6% |

| Finger (KOSDAQ:A163730) | ₩13600.00 | ₩26826.03 | 49.3% |

| Faraday Technology (TWSE:3035) | NT$150.50 | NT$300.05 | 49.8% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥49.18 | CN¥97.18 | 49.4% |

Let's review some notable picks from our screened stocks.

EmbedWay Technologies (Shanghai) (SHSE:603496)

Overview: EmbedWay Technologies (Shanghai) Corporation operates as a network visibility infrastructure and intelligent system platform vendor in China with a market cap of CN¥10.33 billion.

Operations: The company's revenue segment is primarily derived from the Computer, Communication and Other Electronic Equipment Manufacturing sector, totaling CN¥969.72 million.

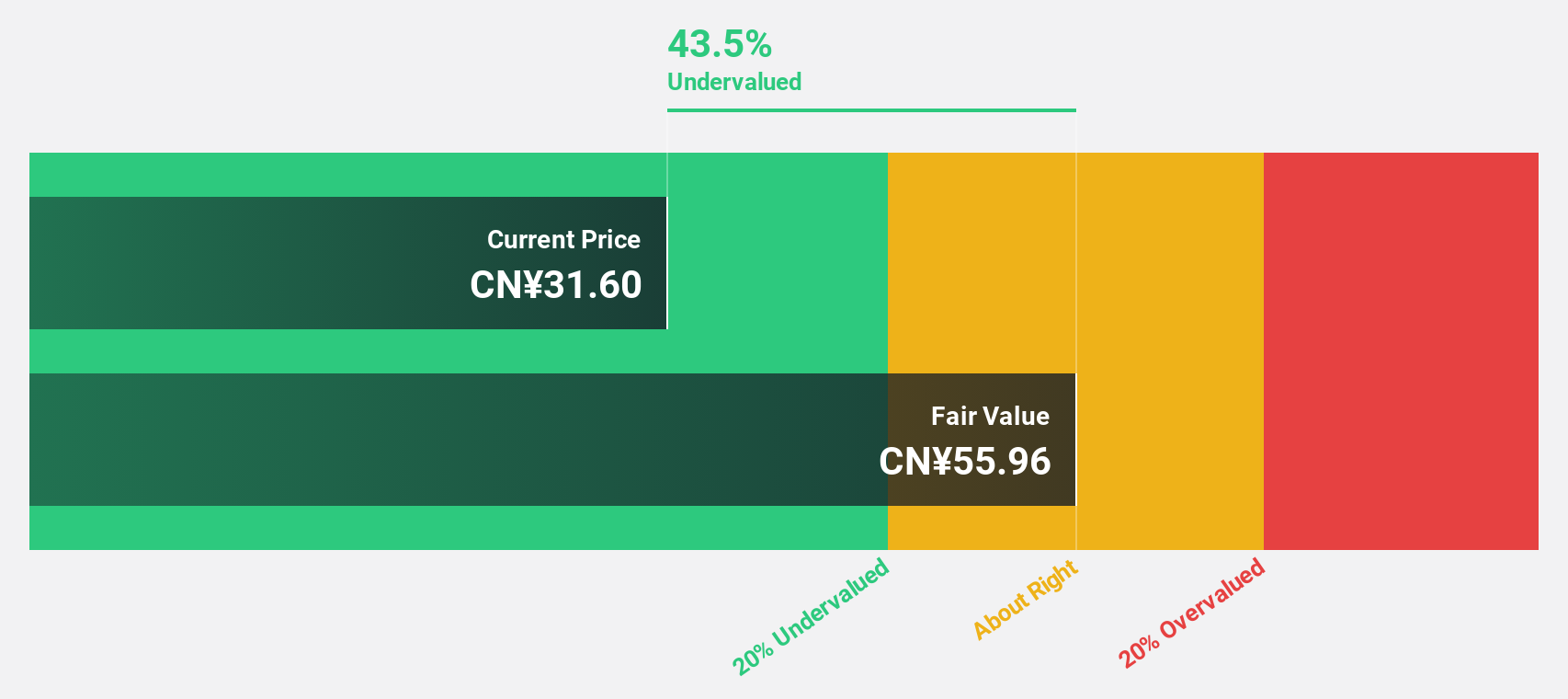

Estimated Discount To Fair Value: 38.3%

EmbedWay Technologies (Shanghai) is trading at CN¥32.25, significantly below its estimated fair value of CN¥52.31, suggesting it is undervalued based on cash flows. Despite recent declines in sales and net income for the first half of 2025, the company’s revenue is forecast to grow at 30.2% annually, outpacing the Chinese market average. However, its return on equity is expected to be relatively low at 12.7% in three years.

- Upon reviewing our latest growth report, EmbedWay Technologies (Shanghai)'s projected financial performance appears quite optimistic.

- Dive into the specifics of EmbedWay Technologies (Shanghai) here with our thorough financial health report.

JWIPC Technology (SZSE:001339)

Overview: JWIPC Technology Co., Ltd. focuses on researching, developing, and manufacturing IoT hardware solutions, with a market cap of CN¥14.58 billion.

Operations: The company's revenue segments include Industry Terminal at CN¥2.59 billion, ICT Infrastructure at CN¥637.74 million, Industrial Internet of Things at CN¥232.23 million, and Intelligent Computing Business at CN¥477.98 million.

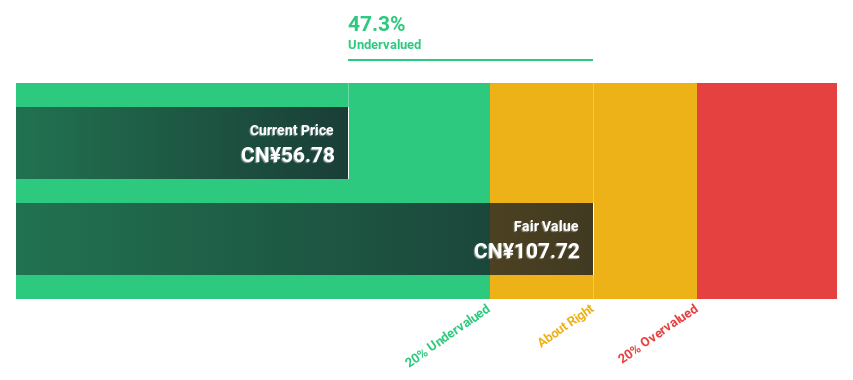

Estimated Discount To Fair Value: 26.8%

JWIPC Technology, with a current trading price of CN¥60.99, is undervalued compared to its estimated fair value of CN¥83.33, based on cash flow analysis. The company reported significant growth in net income for the first half of 2025 and forecasts earnings growth at 34.4% annually, surpassing the Chinese market average. However, its return on equity is projected to be modest at 15.2% over three years amidst high share price volatility recently observed.

- Our expertly prepared growth report on JWIPC Technology implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of JWIPC Technology.

Lucky Harvest (SZSE:002965)

Overview: Lucky Harvest Co., Ltd. operates in China, focusing on the research, development, production, and sale of precision stamping dies and structural metal parts with a market cap of CN¥12.07 billion.

Operations: The company's revenue primarily comes from the automotive manufacturing sector, generating CN¥5.14 billion, followed by the metal products industry at CN¥1.62 billion and the computer, communications, and other electronic equipment manufacturing sector contributing CN¥283.28 million.

Estimated Discount To Fair Value: 34.3%

Lucky Harvest, trading at CN¥45.48, is priced below its fair value estimate of CN¥69.26, indicating it is undervalued based on cash flows. Despite a decline in net profit margin from 6.5% to 4.1%, earnings are projected to grow significantly over the next three years, outpacing the Chinese market's growth rate of 26.4%. Recent results show increased sales and revenue but a drop in net income compared to last year, highlighting potential challenges ahead.

- The analysis detailed in our Lucky Harvest growth report hints at robust future financial performance.

- Get an in-depth perspective on Lucky Harvest's balance sheet by reading our health report here.

Where To Now?

- Click through to start exploring the rest of the 286 Undervalued Asian Stocks Based On Cash Flows now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001339

JWIPC Technology

Researches, develops, and manufactures IoT hardware solutions.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success