- China

- /

- Electronic Equipment and Components

- /

- SHSE:603380

High Growth Tech Stocks To Watch In December 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by dovish Federal Reserve signals and mixed economic indicators, small-cap stocks have notably outperformed their larger counterparts, with the Russell 2000 Index seeing a significant uptick. In this environment where technology stocks are rebounding from valuation concerns, identifying high-growth tech companies involves looking for those that can leverage innovation and adaptability to capitalize on evolving market dynamics.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Pharma Mar | 21.68% | 41.50% | ★★★★★★ |

| Gold Circuit Electronics | 28.44% | 34.07% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 35.76% | 50.22% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Suzhou Etron TechnologiesLtd (SHSE:603380)

Simply Wall St Growth Rating: ★★★★☆☆

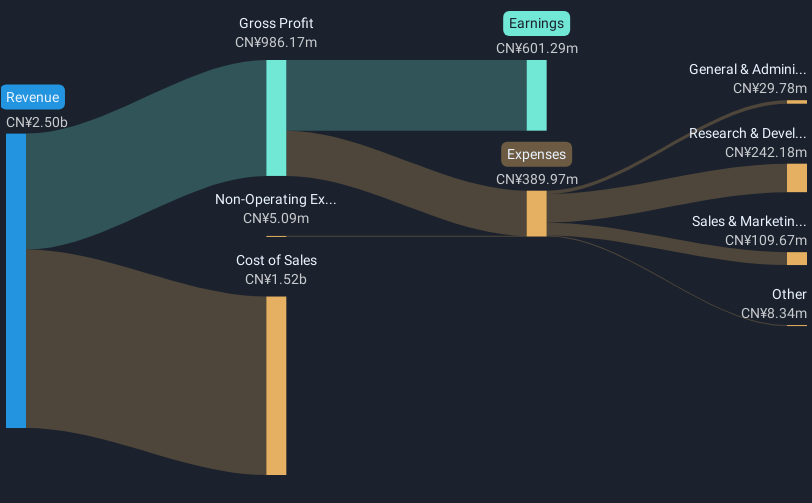

Overview: Suzhou Etron Technologies Co.,Ltd. offers electronics manufacturing services across various sectors including industrial control, medical, automotive, communications, new energy, and high-end consumer products with a market cap of CN¥5.68 billion.

Operations: The company generates revenue primarily from the production and sales of electronic components, totaling CN¥2.33 billion.

Suzhou Etron Technologies has demonstrated robust growth with a 31.1% increase in earnings over the past year, outpacing the electronic industry's average of 9%. This performance is underpinned by a significant annual revenue growth rate of 21.1%, which surpasses the broader Chinese market forecast of 14.6%. Moreover, the company's strategic focus on R&D is evident from its recent financials; however, specific figures on R&D spending were not disclosed. Looking ahead, while earnings are expected to grow at 23.2% annually—slightly below China’s market average—Suzhou Etron remains well-positioned with high-quality earnings and positive free cash flow, suggesting a sustainable trajectory amidst competitive pressures.

Willfar Information Technology (SHSE:688100)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Willfar Information Technology Co., Ltd. offers smart utility services and IoT solutions both in China and globally, with a market cap of CN¥17.08 billion.

Operations: Willfar Information Technology Co., Ltd. generates revenue through its smart utility services and IoT solutions, catering to both domestic and international markets. The company focuses on leveraging technology to enhance utility management and connectivity, contributing to its financial performance.

Willfar Information Technology has shown promising performance with a 24.2% annual revenue growth, outstripping the broader Chinese market's forecast of 14.6%. This growth is coupled with an earnings increase from CNY 422.47 million to CNY 474.19 million year-over-year, reflecting a solid upward trajectory in profitability. The company also emphasizes innovation, as seen in its commitment to R&D, though specific expenditure figures were not disclosed in the recent earnings call on November 24, 2025. With a projected earnings growth of 24% annually over the next three years and robust revenue gains, Willfar stands well-positioned within the tech sector despite competitive pressures and market dynamics.

Sansan (TSE:4443)

Simply Wall St Growth Rating: ★★★★★☆

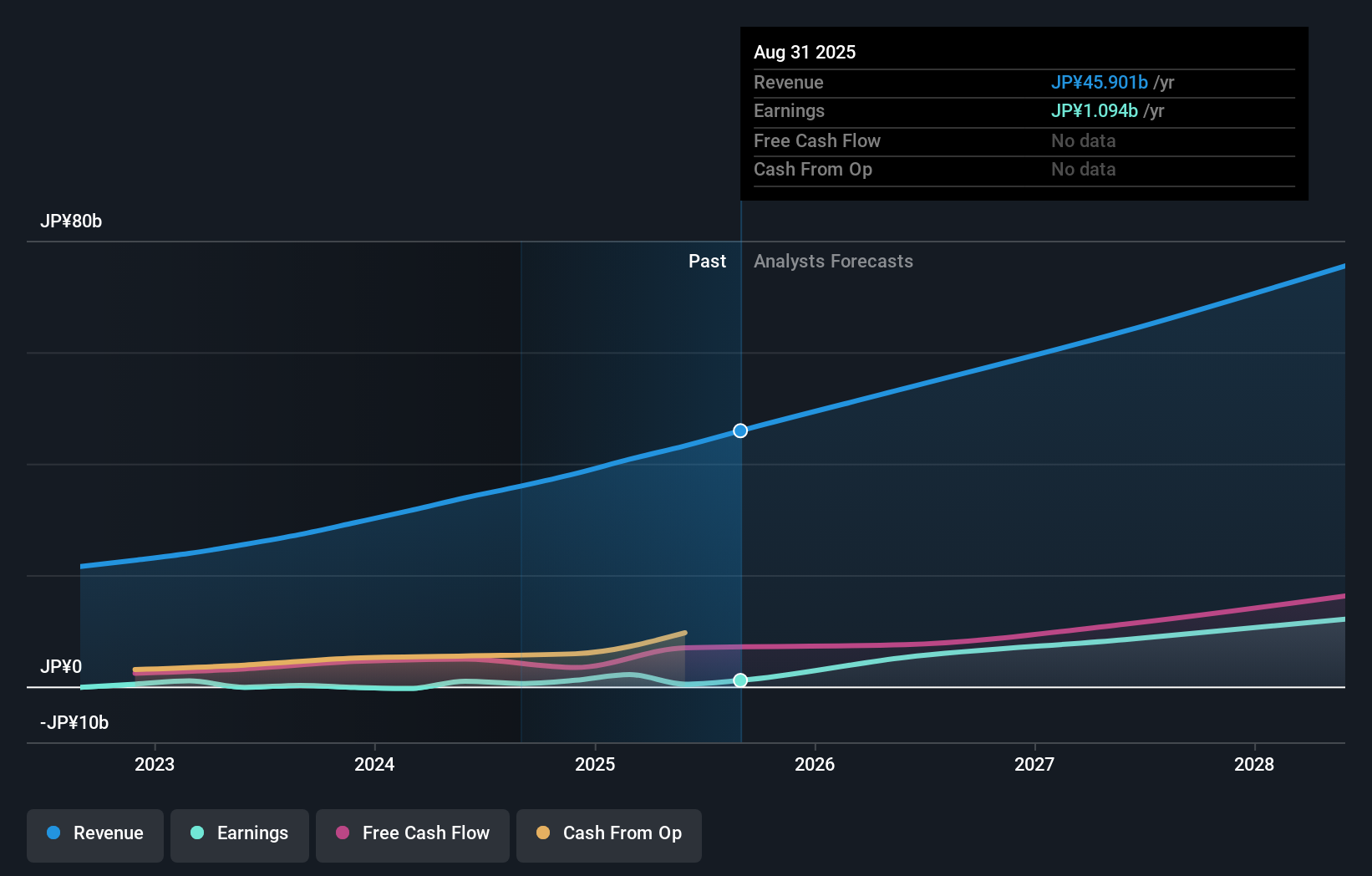

Overview: Sansan, Inc. is a Japanese company that specializes in the planning, development, and sale of cloud-based solutions with a market capitalization of ¥213.18 billion.

Operations: Sansan, Inc. generates revenue primarily from its Sansan/Bill One Business, contributing ¥40.07 billion, and its Eight Business segment, which adds ¥5.50 billion. The company focuses on cloud-based solutions within Japan's market.

Sansan, Inc. has demonstrated robust growth with a 16.2% increase in annual revenue, outpacing the broader Japanese market's growth of 4.5%. This performance is bolstered by an impressive 37.4% projected annual earnings growth, significantly higher than the market average of 8.3%. Notably, Sansan's commitment to innovation is evident in its R&D spending which aligns closely with its revenue gains, ensuring the company remains at the forefront of technological advancements within the software industry. Despite facing a substantial one-off loss of ¥2.3 billion last year, these strategic investments in technology and consistent financial performance highlight Sansan’s potential to maintain its trajectory in a competitive landscape.

Key Takeaways

- Embark on your investment journey to our 246 Global High Growth Tech and AI Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603380

Suzhou Etron TechnologiesLtd

Provides electronics manufacturing services for industrial control, medical, automotive, communications, new energy, and high-end consumer products.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026