- China

- /

- Electronic Equipment and Components

- /

- SHSE:603328

We Think Guangdong Ellington Electronics TechnologyLtd (SHSE:603328) Can Manage Its Debt With Ease

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Guangdong Ellington Electronics Technology Co.,Ltd (SHSE:603328) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Guangdong Ellington Electronics TechnologyLtd

What Is Guangdong Ellington Electronics TechnologyLtd's Debt?

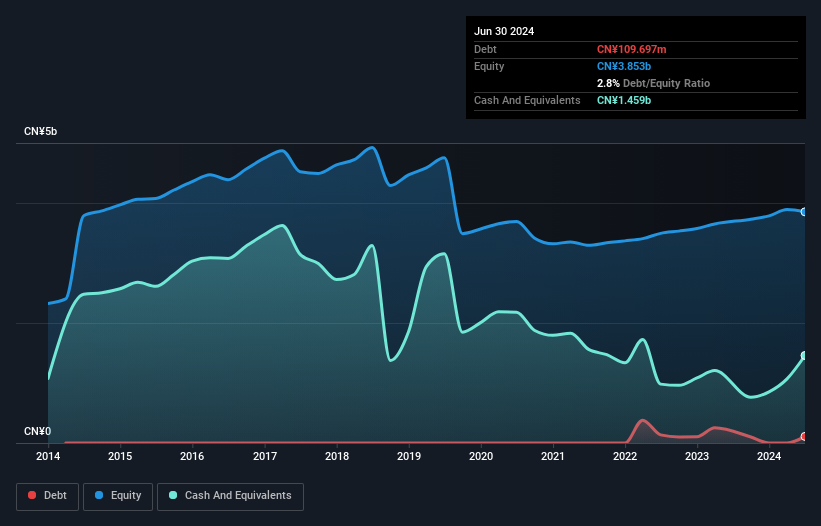

The image below, which you can click on for greater detail, shows that at June 2024 Guangdong Ellington Electronics TechnologyLtd had debt of CN¥109.7m, up from CN¥100.2m in one year. But on the other hand it also has CN¥1.46b in cash, leading to a CN¥1.35b net cash position.

How Healthy Is Guangdong Ellington Electronics TechnologyLtd's Balance Sheet?

According to the last reported balance sheet, Guangdong Ellington Electronics TechnologyLtd had liabilities of CN¥1.32b due within 12 months, and liabilities of CN¥91.4m due beyond 12 months. Offsetting this, it had CN¥1.46b in cash and CN¥1.20b in receivables that were due within 12 months. So it actually has CN¥1.24b more liquid assets than total liabilities.

It's good to see that Guangdong Ellington Electronics TechnologyLtd has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Succinctly put, Guangdong Ellington Electronics TechnologyLtd boasts net cash, so it's fair to say it does not have a heavy debt load!

On top of that, Guangdong Ellington Electronics TechnologyLtd grew its EBIT by 53% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But it is Guangdong Ellington Electronics TechnologyLtd's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Guangdong Ellington Electronics TechnologyLtd has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Guangdong Ellington Electronics TechnologyLtd generated free cash flow amounting to a very robust 91% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Summing Up

While it is always sensible to investigate a company's debt, in this case Guangdong Ellington Electronics TechnologyLtd has CN¥1.35b in net cash and a decent-looking balance sheet. And it impressed us with free cash flow of CN¥371m, being 91% of its EBIT. When it comes to Guangdong Ellington Electronics TechnologyLtd's debt, we sufficiently relaxed that our mind turns to the jacuzzi. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example Guangdong Ellington Electronics TechnologyLtd has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603328

Guangdong Ellington Electronics TechnologyLtd

Researches, develops, manufactures, and sells high-precision, high-density double-layer, and multi-layer printed circuit boards in China and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026