- China

- /

- Electronic Equipment and Components

- /

- SHSE:603267

High Growth Tech Stocks to Watch in May 2025

Reviewed by Simply Wall St

Amid a mixed performance in global markets, small- and mid-cap indexes have shown resilience, posting gains for the fifth consecutive week against a backdrop of potential trade de-escalation between major economies like the U.S. and China. As investors navigate an uncertain economic outlook with steady interest rates from the Federal Reserve and improving services activity, identifying high growth tech stocks involves looking for companies that can adapt to evolving market conditions and leverage technological advancements to drive sustained performance.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 28.00% | 28.07% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 28.34% | 29.48% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| KebNi | 21.29% | 66.10% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Yubico | 20.12% | 25.70% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 77.62% | ★★★★★★ |

| CD Projekt | 33.48% | 39.45% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Beijing Yuanliu Hongyuan Electronic Technology (SHSE:603267)

Simply Wall St Growth Rating: ★★★★★☆

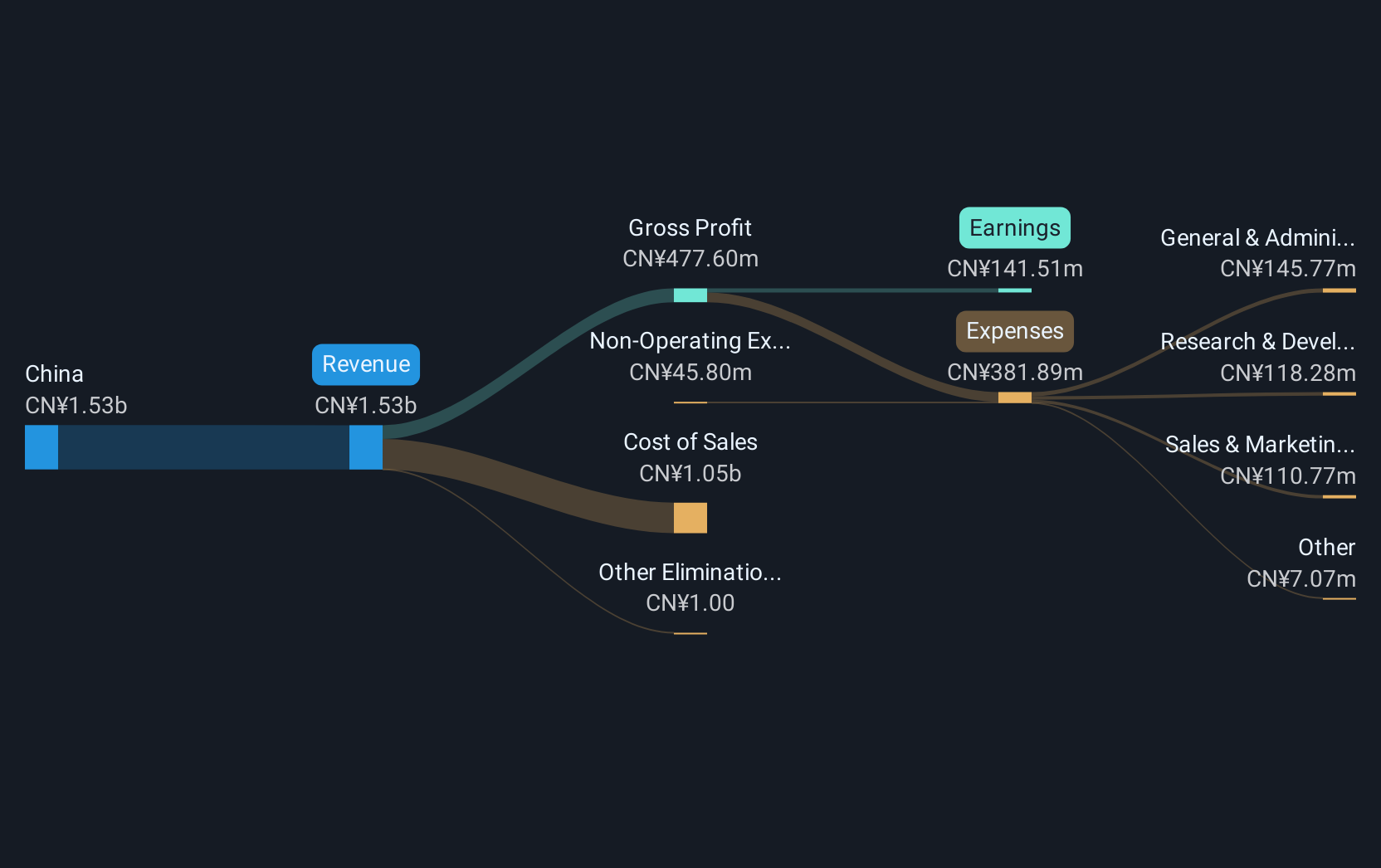

Overview: Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd. operates in the electronic technology sector with a market capitalization of CN¥11.75 billion.

Operations: The company generates revenue primarily from its electronic technology products and services. It has a market capitalization of CN¥11.75 billion, reflecting its significant presence in the sector.

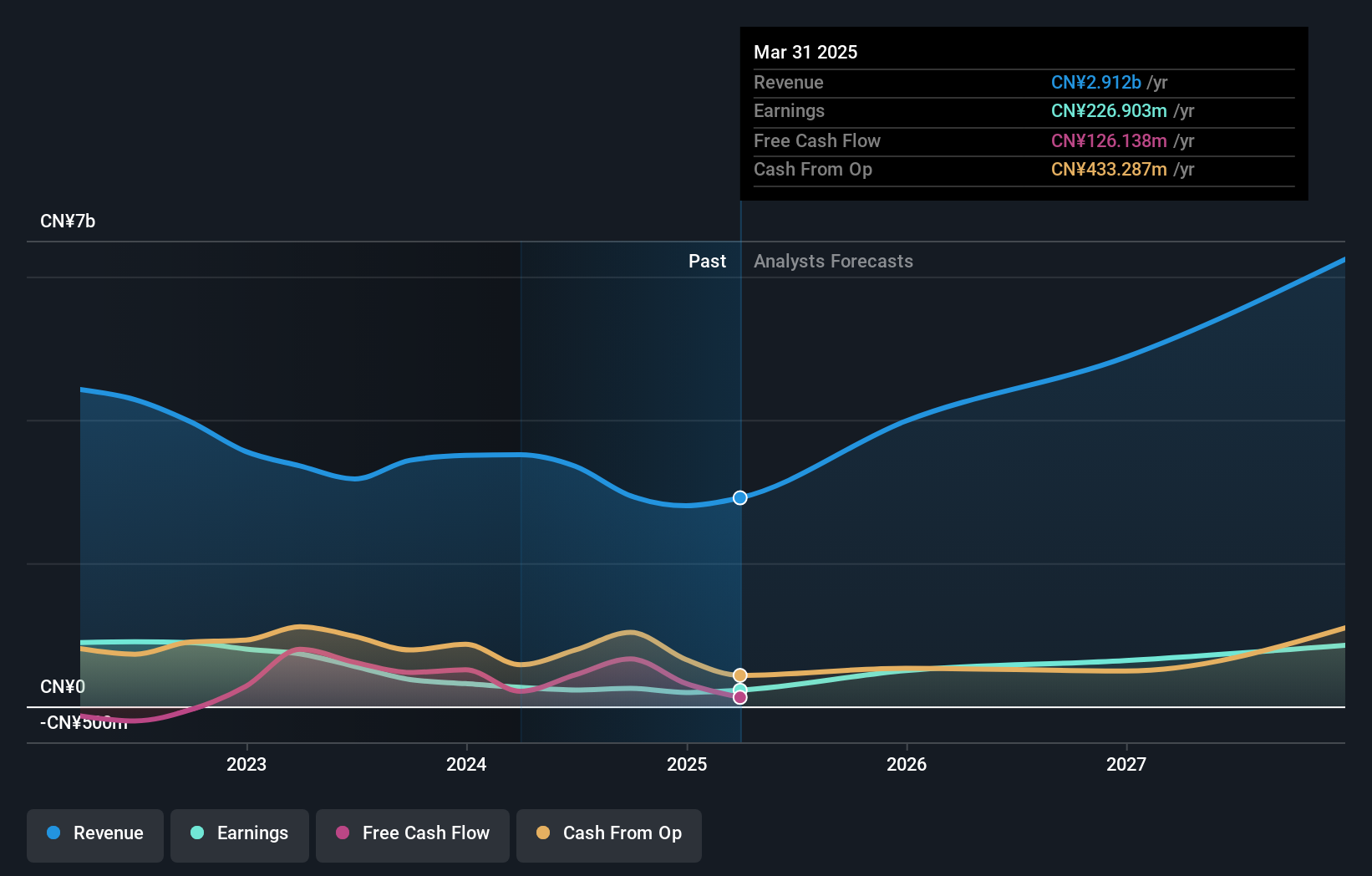

Beijing Yuanliu Hongyuan Electronic Technology has demonstrated robust financial dynamics, with an annual revenue growth rate of 26.7%, outpacing the Chinese market's average of 12.5%. This growth is complemented by a significant expected increase in earnings, projected at 42.8% annually over the next three years. Despite recent volatility in share price and a dip in profit margins from 14.6% to 9.3%, the company's aggressive R&D investment, which remains undisclosed but is central to its strategy, underscores its commitment to innovation and market competitiveness. The firm recently engaged in a private placement aiming to raise CNY 300 million, indicating proactive capital management and potential for future expansions or technological advancements.

Beijing Wantai Biological Pharmacy Enterprise (SHSE:603392)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Wantai Biological Pharmacy Enterprise Co., Ltd. is a company operating in the biotechnology and pharmaceutical industry, with a market cap of CN¥81.89 billion.

Operations: Beijing Wantai Biological Pharmacy Enterprise focuses on biotechnology and pharmaceuticals, generating revenue through product sales in these sectors.

Beijing Wantai Biological Pharmacy Enterprise, amid a challenging year, reported a significant revenue drop to CNY 2.25 billion from last year's CNY 5.51 billion, reflecting broader market pressures yet underscoring resilience with a net income of CNY 106.24 million despite tough conditions. The firm's R&D commitment is evident as it navigates through industry-specific hurdles, positioning itself strategically for recovery and growth in the biotech sector’s rapidly evolving landscape. This approach suggests potential for rebound and innovation-driven performance in upcoming years.

Fujian Torch Electron Technology (SHSE:603678)

Simply Wall St Growth Rating: ★★★★★☆

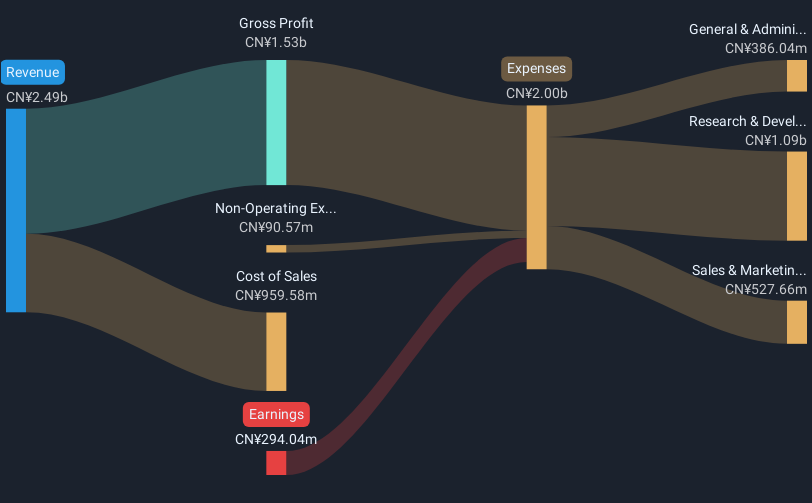

Overview: Fujian Torch Electron Technology Co., Ltd. operates in the electronic components industry with a market capitalization of CN¥17.75 billion.

Operations: The company generates revenue primarily from the production and sale of electronic components. Its financial performance is reflected in its market capitalization of CN¥17.75 billion.

Fujian Torch Electron Technology has demonstrated resilience amidst challenges, with a notable revenue growth forecast of 24.9% annually, outpacing the Chinese market average of 12.5%. Despite a recent downturn in earnings for the year ending December 31, 2024—where net income fell to CNY 194.52 million from CNY 318.38 million—the company is poised for recovery with expected annual earnings growth at an impressive rate of 39.3%. This potential is underpinned by significant investment in R&D, crucial for maintaining competitive edge and driving future innovations in the high-tech electronics sector. The company's strategic focus on enhancing its technological capabilities could well position it as a key player in addressing evolving market demands and trends.

- Take a closer look at Fujian Torch Electron Technology's potential here in our health report.

Understand Fujian Torch Electron Technology's track record by examining our Past report.

Where To Now?

- Click here to access our complete index of 735 Global High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Yuanliu Hongyuan Electronic Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603267

Beijing Yuanliu Hongyuan Electronic Technology

Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives