- China

- /

- Electronic Equipment and Components

- /

- SHSE:603236

Quectel Wireless Solutions Co., Ltd. (SHSE:603236) Looks Just Right With A 37% Price Jump

Those holding Quectel Wireless Solutions Co., Ltd. (SHSE:603236) shares would be relieved that the share price has rebounded 37% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 49% in the last twelve months.

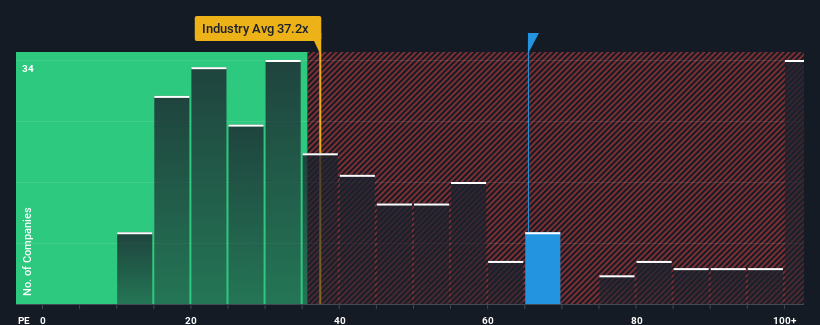

Since its price has surged higher, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may consider Quectel Wireless Solutions as a stock to avoid entirely with its 65.4x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings that are retreating more than the market's of late, Quectel Wireless Solutions has been very sluggish. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Quectel Wireless Solutions

What Are Growth Metrics Telling Us About The High P/E?

Quectel Wireless Solutions' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 69% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 21% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 174% as estimated by the eight analysts watching the company. With the market only predicted to deliver 41%, the company is positioned for a stronger earnings result.

With this information, we can see why Quectel Wireless Solutions is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Quectel Wireless Solutions' P/E

The strong share price surge has got Quectel Wireless Solutions' P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Quectel Wireless Solutions maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Quectel Wireless Solutions that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Quectel Wireless Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603236

Quectel Wireless Solutions

Engages in the research and development, design, production, and sale of wireless communication modules and solutions worldwide.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026