- China

- /

- Electronic Equipment and Components

- /

- SHSE:603236

High Growth Companies Insiders Are Backing In February 2025

Reviewed by Simply Wall St

As global markets grapple with tariff uncertainties and mixed economic signals, investors are keenly observing the impact on major indices, which have seen declines amid trade tensions and labor market shifts. Despite these challenges, companies with strong insider ownership can offer a compelling investment narrative, as insiders often have unique insights into their firms' potential for growth and resilience in fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.9% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.1% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Quectel Wireless Solutions (SHSE:603236)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Quectel Wireless Solutions Co., Ltd. is involved in the research, development, design, production, and sales of wireless communication modules and solutions globally, with a market cap of CN¥23.66 billion.

Operations: Quectel Wireless Solutions Co., Ltd. generates revenue through its global operations in the research, development, design, production, and sales of wireless communication modules and solutions.

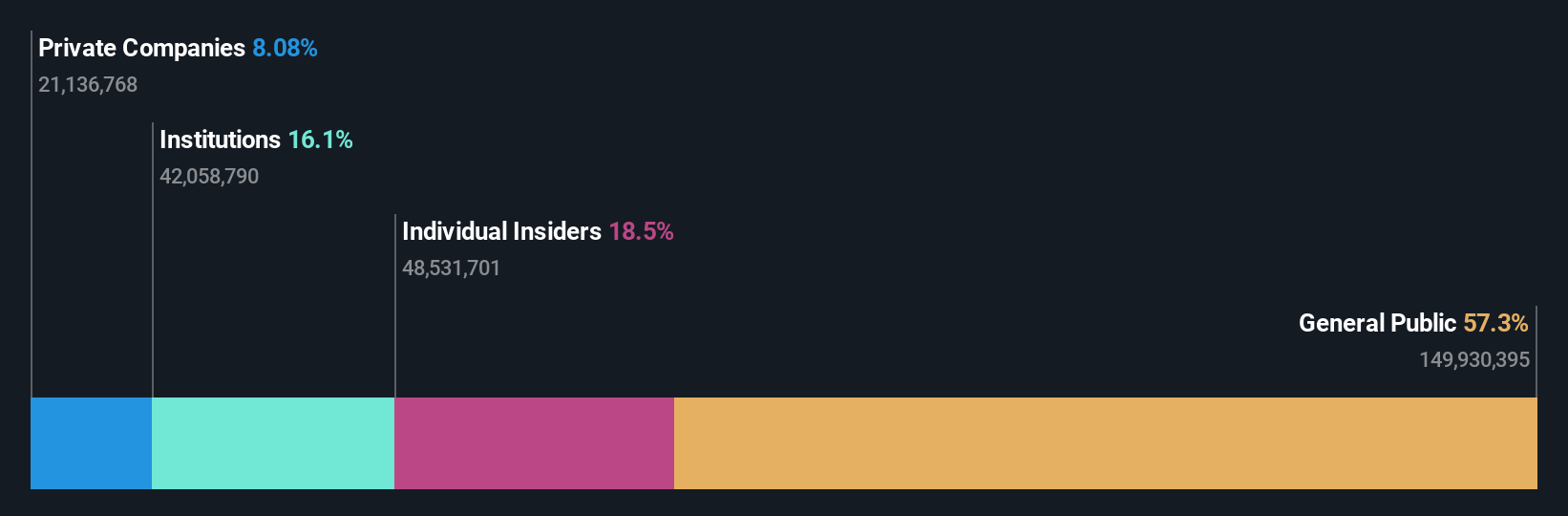

Insider Ownership: 23.3%

Earnings Growth Forecast: 31.6% p.a.

Quectel Wireless Solutions, with significant insider ownership, is poised for growth. The company recently introduced innovative products like the LS550G GNSS module and expanded its portfolio at CES 2025, enhancing its market presence. Despite a highly volatile share price recently, Quectel's earnings are forecast to grow significantly faster than the Chinese market average over the next three years. However, it trades below estimated fair value and has a relatively low expected return on equity in three years.

- Navigate through the intricacies of Quectel Wireless Solutions with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Quectel Wireless Solutions' share price might be on the expensive side.

Eaglerise Electric & Electronic (China) (SZSE:002922)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Eaglerise Electric & Electronic (China) Co., Ltd. operates in the electrical and electronic manufacturing industry, with a market cap of CN¥7.07 billion.

Operations: Eaglerise Electric & Electronic (China) Co., Ltd. is involved in the electrical and electronic manufacturing sector, boasting a market cap of CN¥7.07 billion.

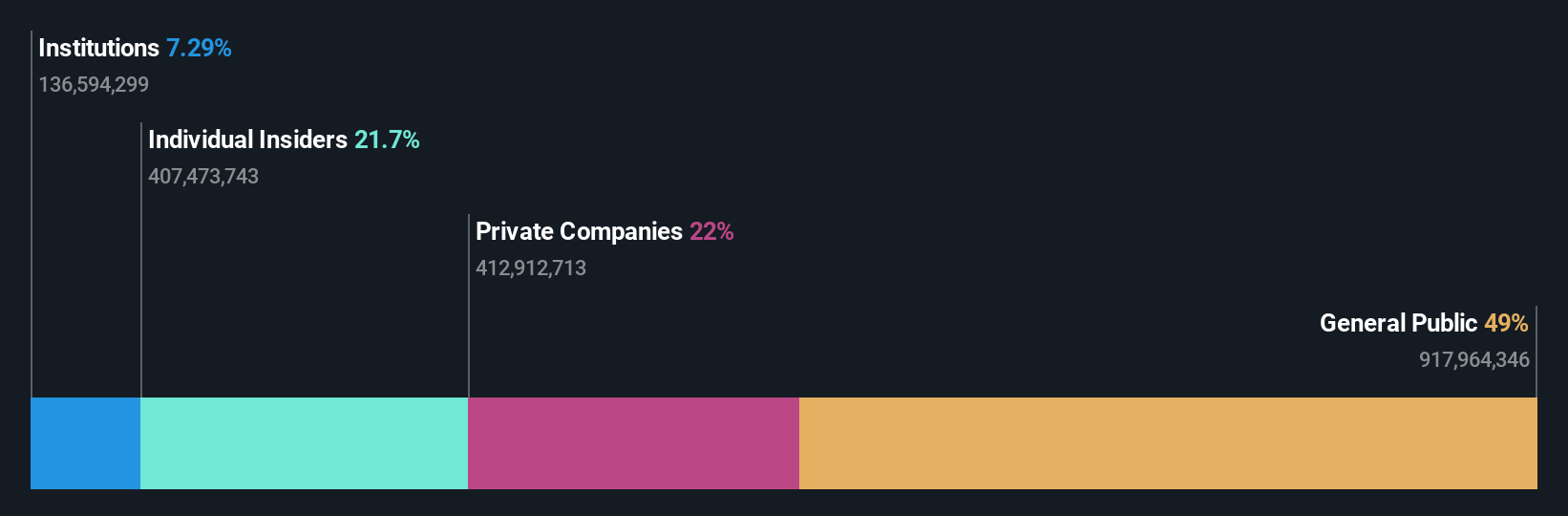

Insider Ownership: 31.8%

Earnings Growth Forecast: 35.7% p.a.

Eaglerise Electric & Electronic (China) demonstrates growth potential with significant insider ownership. The company completed a share buyback totaling CNY 92.68 million, reflecting confidence in its valuation, and plans a private placement to raise up to CNY 500 million, involving strategic investors like Foshan Maigesi Investment Co., Ltd. Earnings are expected to grow significantly faster than the Chinese market average over the next three years, although return on equity remains modestly low at 15.8%.

- Click here and access our complete growth analysis report to understand the dynamics of Eaglerise Electric & Electronic (China).

- Our expertly prepared valuation report Eaglerise Electric & Electronic (China) implies its share price may be lower than expected.

Zhejiang Huace Film & TV (SZSE:300133)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Huace Film & TV Co., Ltd. is involved in the production, distribution, and derivative of film and television dramas both in China and internationally, with a market cap of CN¥14.83 billion.

Operations: The company generates revenue from the production, distribution, and derivative activities related to film and television dramas both domestically and abroad.

Insider Ownership: 22.5%

Earnings Growth Forecast: 30.7% p.a.

Zhejiang Huace Film & TV is poised for growth, with earnings forecast to increase at 30.7% annually, outpacing the Chinese market's 25.3%. Revenue is also expected to grow faster than the market average at 21% per year. Despite this, return on equity remains low at a projected 6.7%. Insider transactions show no substantial activity in recent months. The company announced a cash dividend of CNY 0.20 per share for Q3 2024, indicating steady profit distribution practices.

- Delve into the full analysis future growth report here for a deeper understanding of Zhejiang Huace Film & TV.

- Our valuation report unveils the possibility Zhejiang Huace Film & TV's shares may be trading at a premium.

Where To Now?

- Dive into all 1442 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Quectel Wireless Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603236

Quectel Wireless Solutions

Engages in the research and development, design, production, and sale of wireless communication modules and solutions worldwide.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives